DaVita Inc (DVA) Reports Solid Financial Performance Amid Operational Challenges

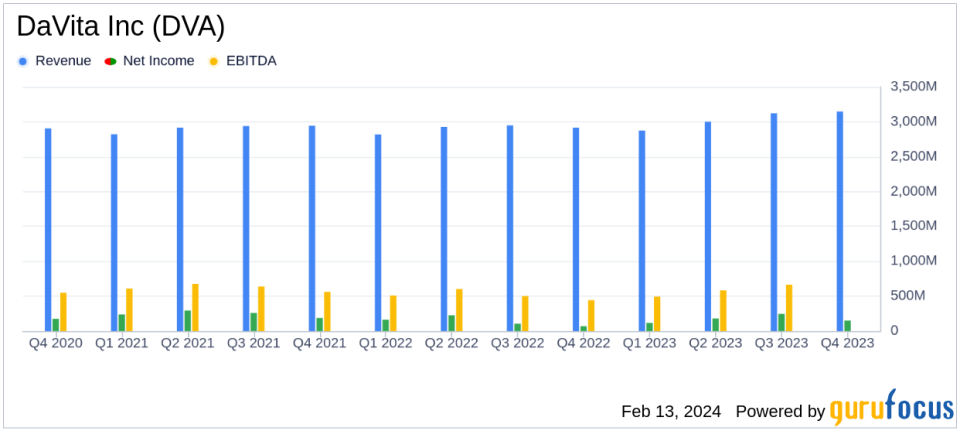

Revenue: Consolidated revenues reached $3.146 billion for Q4 and $12.140 billion for the full year.

Net Income: Net income from continuing operations was $151 million for Q4 and $692 million for the full year.

Earnings Per Share: Diluted EPS from continuing operations stood at $1.62 for Q4 and $7.42 for the full year.

Cash Flow: Operating cash flow was robust at $485 million for Q4, with free cash flow of $258 million.

Share Repurchases: DaVita repurchased 2.9 million shares at an average price of $97.82 per share during Q4.

Treatment Growth: U.S. dialysis treatments increased slightly by 0.04% compared to the previous quarter.

On February 13, 2024, DaVita Inc (NYSE:DVA) released its 8-K filing, disclosing its financial and operating results for the fourth quarter and full year ended December 31, 2023. DaVita, a leading provider of dialysis services, operates over 3,000 facilities worldwide and treats over 240,000 patients annually. The company's financial resilience is underscored by its significant market share and reliance on government reimbursement programs, with commercial insurers contributing substantially to U.S. profits despite representing a smaller patient percentage.

Financial Performance and Challenges

DaVita's CEO, Javier Rodriguez, reflected on the company's financial resilience amidst external challenges, emphasizing the strength gained through continued investment in their team, systems, and capabilities. The company's performance is crucial as it operates in the highly regulated Healthcare Providers & Services industry, where consistent revenue and controlled costs are vital for sustaining operations and funding future investments.

Despite operational challenges, including the impact of the COVID-19 pandemic on patient census and the strategic review of outpatient clinic capacity, DaVita reported solid financial achievements. The company's ability to maintain a steady increase in revenue and manage patient care costs effectively is significant in an industry where margins can be tight due to heavy reliance on government reimbursement rates.

Key Financial Metrics

DaVita's financial stability is reflected in its income statement, balance sheet, and cash flow statement. The company's operating income for Q4 was $390 million, with an adjusted operating income of $415 million. For the full year, operating income reached $1,603 million, and adjusted operating income was $1,734 million. These figures are important as they demonstrate DaVita's ability to generate profit from its core operations.

The company's balance sheet remains strong, with substantial operating cash flow and free cash flow, which are critical for funding operations, repaying debt, and returning value to shareholders through share repurchases. DaVita's disciplined capital management is evident in its strategic share repurchase program, which enhances shareholder value.

"As we reflect on the past year, our 2023 financial performance highlighted the resilience of our business," said Javier Rodriguez, CEO of DaVita Inc. "The external challenges of recent years ultimately made us stronger, and with continued investment in our teammates, systems, and capabilities, we believe that we are well positioned for the years ahead. We enter 2024 with more confidence than we have had since the start of COVID in 2020."

Analysis of Company's Performance

DaVita's performance in 2023 indicates a company that has navigated the complexities of the healthcare industry successfully. The slight increase in U.S. dialysis treatments suggests stability in the company's core service area, while the management of patient care costs reflects effective operational control. The company's strategic decisions, such as clinic closures and investments in home dialysis, align with industry trends towards more cost-effective and patient-preferred treatment modalities.

The company's financial health is further evidenced by its solid free cash flow, which provides the liquidity needed for strategic initiatives and shareholder returns. DaVita's share repurchase activity not only reflects confidence in the company's future but also a commitment to delivering shareholder value.

In conclusion, DaVita Inc (NYSE:DVA) has demonstrated financial and operational resilience in its latest earnings report. The company's ability to adapt to industry challenges while maintaining financial stability positions it well for future growth and continued success in the healthcare sector. For more detailed information and analysis, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from DaVita Inc for further details.

This article first appeared on GuruFocus.