DBV Technologies SA Reports Decrease in Net Loss and Advances Clinical Programs in Full Year ...

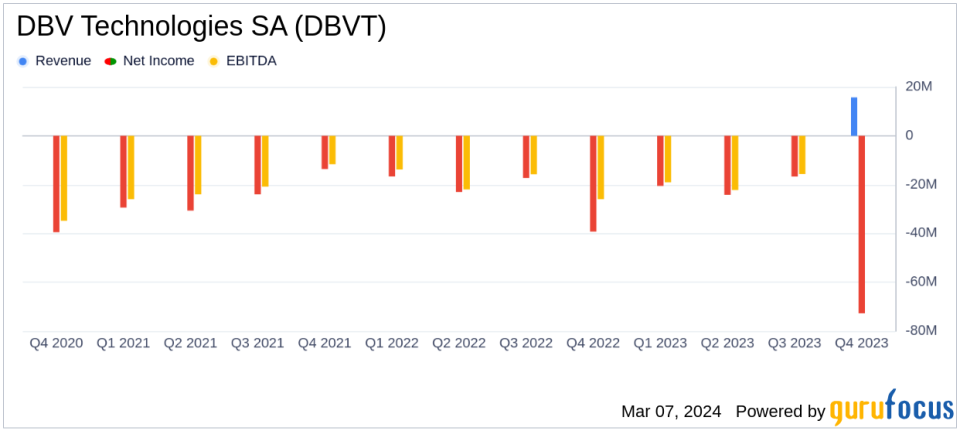

Cash Position: Cash and cash equivalents stood at $141.4 million as of December 31, 2023, a decrease from the previous year's $209.2 million.

Operating Income: Operating income increased to $15.7 million, up from $4.8 million in the previous year.

Operating Expenses: Operating expenses decreased to $92.2 million, down from $101.5 million in the prior year.

Net Loss: Net loss narrowed to $72.7 million, improving from a net loss of $96.3 million in the previous year.

Net Loss per Share: Net loss per share was $0.76, better than the $1.24 loss per share reported in the prior year.

Going Concern: The company expressed substantial doubt about its ability to continue as a going concern, with cash expected to fund operations until December 31, 2024.

On March 7, 2024, DBV Technologies SA (NASDAQ:DBVT) released its 8-K filing, detailing its financial results for the full year 2023. The company, a clinical-stage biopharmaceutical entity, is known for its innovative approach to treating food allergies and other immunologic conditions through its proprietary technology platform, Viaskin.

DBV Technologies reported a net decrease in cash and cash equivalents of $67.8 million for the year ended December 31, 2023, with a year-end balance of $141.4 million. The company's operating income saw a significant increase to $15.7 million, up from $4.8 million in the previous year, primarily due to the revenues from the Nestle Collaboration Agreement. Excluding these revenues, operating income would have been $8.8 million.

Operating expenses decreased by $9.3 million to $92.2 million, compared to $101.5 million in the previous year. This reduction in expenses was partially offset by the loss on completion accrual reversal from the Nestle Collaboration Agreement. When excluding this factor, operating expenses would have totaled $107.3 million.

The company recorded a net loss of $72.7 million for the year, which is an improvement from the $96.3 million net loss reported in the previous year. On a per-share basis, the net loss was $0.76, compared to a net loss of $1.24 per share in the prior year. Without the impact of the Nestle Collaboration Agreement termination, the net loss would have been $94.7 million.

Despite the progress in reducing net loss and managing operating expenses, DBV Technologies highlighted the substantial doubt regarding its ability to continue as a going concern. The company's cash reserves are projected to support its operations only until the end of 2024. DBV Technologies plans to seek additional capital through debt and equity offerings as it continues its research and development efforts and prepares for the potential launch of Viaskin Peanut, pending approval.

Advancements in Clinical Development

DBV Technologies made significant strides in its clinical development programs, particularly with Viaskin Peanut, which targets peanut allergies in different pediatric age groups. The company is focused on completing enrollment in VITESSE, a Phase 3 efficacy and safety trial for children, and initiating two supplemental six-month safety trials, COMFORT Toddlers and COMFORT Children. These trials are crucial for the preparation of Biologics License Applications to the FDA.

CEO Daniel Tasse emphasized the company's commitment to bringing this novel treatment to market, addressing the daily burdens faced by families dealing with peanut allergies. The company expects to see good momentum in Vitesse recruitment in the coming months, with the last subject expected to be screened by Q3 2024.

Financial Stability and Future Outlook

While DBV Technologies has made commendable progress in its clinical trials and financial metrics, the company's future depends on its ability to secure additional funding and successfully launch its products. The financial results and business updates presented in the 8-K filing reflect a company at a critical juncture, balancing promising clinical advancements with the pressing need for financial sustainability.

Investors and stakeholders will be closely monitoring DBV Technologies' efforts to navigate these challenges as it aims to transform the care of food allergic individuals. The company will host a conference call and webcast to discuss the full year 2023 financial results and provide further business updates.

For more detailed information on DBV Technologies' financial performance and strategic initiatives, interested parties are encouraged to access the full 8-K filing and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from DBV Technologies SA for further details.

This article first appeared on GuruFocus.