DCP Midstream (DCP) Gains Marginally Since Q3 Earnings Beat

DCP Midstream, LP DCP stock jumped 1.2% since it reported strong third-quarter 2022 results on Nov 02, thanks to increased NGL pipeline throughput.

The partnership reported third-quarter adjusted earnings of $1.50 per unit, beating the Zacks Consensus Estimate of $1.05. The bottom line improved from the year-ago quarter’s earnings of 18 cents per unit.

Total quarterly revenues of $4,319 million beat the Zacks Consensus Estimate of $3,937 million. The top line increased from $2,827 million in the year-ago quarter.

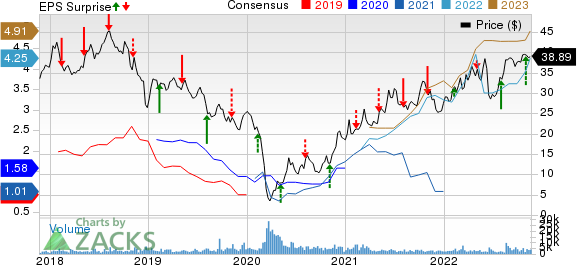

DCP Midstream Partners, LP Price, Consensus and EPS Surprise

DCP Midstream Partners, LP price-consensus-eps-surprise-chart | DCP Midstream Partners, LP Quote

Operations

Logistics and Marketing

The segment of DCP Midstream recorded adjusted EBITDA of $224 million in the third quarter, up from the year-ago period’s $184 million. Higher NGL pipeline throughput volumes and tariffs aided the segment.

The average NGL pipeline throughput in the quarter was 731 thousand barrels per day (Mbpd), higher than the year-ago quarter’s 668 Mbpd. Fractionator throughputs were recorded at 62 Mbpd, increasing from the year-ago quarter of 58 Mbpd.

Gathering and Processing

The segment reported adjusted EBITDA of $306 million in the third quarter, up from $227 million in the year-ago quarter. Increased wellhead volumes aided the segment.

Average natural gas wellhead volumes in the quarter rose to 4,492 million cubic feet per day (MMcf/d) from the year-ago period’s 4,221 MMcf/d. NGL gross production totaled 436 Mbpd, up from 406 Mbpd.

Total Expenses

Purchases and related costs significantly increased year over year in the quarter under review. Operating and maintenance expenses rose to $193 million from $168 million in the third quarter of 2021.

Total operating costs and expenses were $4,072 million, up from the year-ago quarter’s figure of $2,833 million.

Financials

In third-quarter 2022, total growth capital expenditures, acquisition and equity investments were $184 million. Sustaining capital in the quarter was $30 million. DCP generated an excess free cash flow of $52 million in the reported quarter.

At the end of the third quarter, DCP Midstream reported long-term debt of $4,317 million. Cash and cash equivalents were $93 million. It had current debt of $506 million.

Zacks Rank & Stocks to Consider

DCP Midstream currently sports a Zacks Rank #1 (Strong Buy). Other prospective players in the same space include Magellan Midstream Partners MMP, Oil States International, Inc. OIS and BP plc BP. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Being a midstream energy player, Magellan Midstream’s business model is less exposed to volatility in oil and gas prices. In fact, contributions from core fee-based transportation and terminals activities have aided MMP’s results in the third quarter of this year.

Oil States International has a constant focus on capital and cost discipline. Owing to this discipline amid improving industry fundamentals, Oil States International is witnessing increasing revenues and EBITDA. The company is also experiencing improvement in its Well Site Services segment, thanks to increased land-based completion and production activity.

The sizable refining and marketing operations of BP provide significant protection to the company from low commodity prices. The company is also focused on the reduction of net debt load. For 2022, BP is likely to witness earnings growth of 138.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

Oil States International, Inc. (OIS) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research