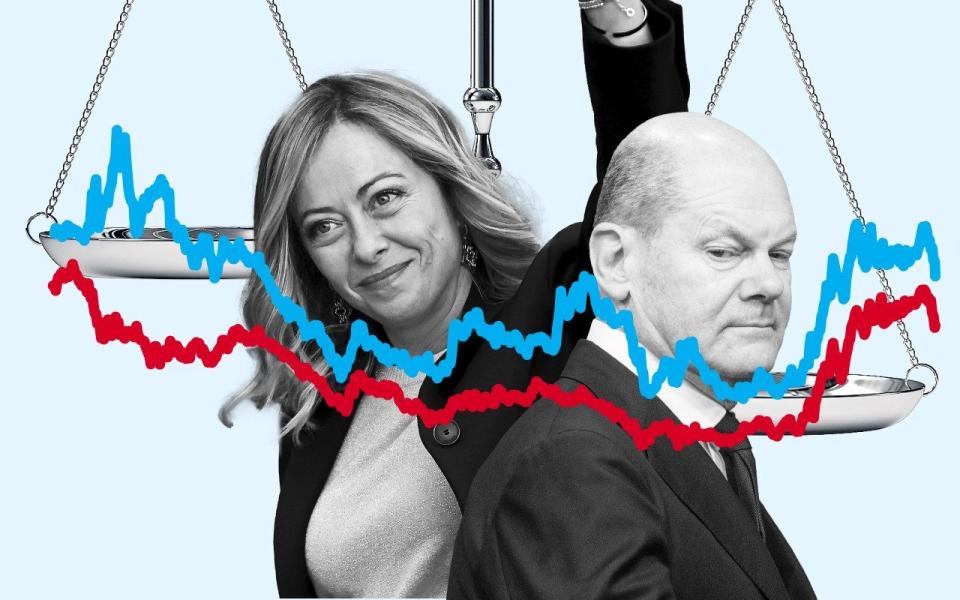

How debt-laden Germany put ‘the periphery’ in Europe’s economic driving seat

Germany’s decline as the economic engine of the eurozone has been nothing short of staggering.

The country’s economic preeminence for much of the past 20 years was so consistent that it came to be seen as both natural and obvious.

Berlin, largely under Angela Merkel’s administration, ran a supposedly tight ship while happily dishing out advice to the perceived profligate laggards of the southern European states. As the debts of nations such as Greece caused ructions for the currency area a decade ago, it was Merkel who held all the power.

Yet the combination of the pandemic, China’s slowdown and the energy crisis have brutally exposed the flaws in Germany’s economic model. Its reliance on dictatorships has proven its undoing and the latest business indicators suggest recession looms.

Behind the scenes, an economic transformation of equal scale has been quietly taking place in Portugal, Italy, Greece and Spain.

The countries that came to be most politely described as the eurozone’s “periphery”, and more rudely mocked as the Pigs, have used the past decade wisely.

As Germany tumbles into a seemingly inescapable quagmire of stagnation, the former basket cases of the eurozone’s southern fringe have emerged as bastions of strength.

Italy is wiping the floor with Germany this year in terms of GDP growth and is set to outpace it again in 2024, on OECD forecasts.

Spain is expected to grow more than twice as fast as Germany next year, with Greek GDP set to expand at more than three-times Germany’s pace.

It is a far cry from the sovereign debt crisis of a decade ago when, at the worst moments, it looked as though the indebted Mediterranean nations might lead a breakup of the eurozone.

Sandra Horsfield, economist at Investec, says the energy crunch and China’s weak recovery have been particularly painful for Germany.

“Places like Germany are suffering as a result of their particular industrial setup. If you have an economy that is heavily manufacturing-driven, that is a weakness at this particular point,” she says.

Conversely, Holger Schmieding, chief economist at Hamburg-based Berenberg Bank, admits: “The periphery has shaped up.”

However, Schmieding is quick to point to what he sees as German fingerprints on the economic success in southern Europe.

“The euro crisis did serve its purpose. The countries down there have reformed their supply side, they are now better places for businesses and they are reaping the rewards, which is exactly what the euro is about.

“The euro is about instilling discipline: if you want to be in the euro, you have to obey discipline, because you cannot devalue. The countries in the south have swallowed the medicine and are thriving as a result.”

Reforms include making hiring and firing easier. This is often unpopular at first but typically results in a rise in employment and stronger economic dynamism, as companies feel safer taking a chance on staff and people find it easier to move jobs.

Joshua Farber at BNP Paribas attributes much of the strength of countries such as Spain to the enthusiasm of tourists who have flooded back to the Mediterranean after being cut off from sunny holidays during the pandemic.

“The periphery is services-heavy and manufacturing-light – they do not export as much to China and they have been a greater beneficiary of the Covid so-called revenge spending,” he says.

At the same time, households and businesses in the south rebuilt their finances after the battering of the credit crunch, while those in the north borrowed more heavily when interest rates were at record lows.

Since the start of 2013, ECB figures show mortgage lending in Germany has surged by almost 60pc. In France, the number is up 56pc.

By contrast, households in Italy have been rather more restrained with borrowing up just one-sixth. In Spain, which suffered a mighty property crash, lending for home purchase is down more than one-fifth.

As a share of household incomes, Greek, Spanish and Portuguese debts have tumbled to the same level or in some cases below those in Germany. French families have taken on a significantly bigger debt burden over the same period.

A similar picture is true with business lending. While loans to companies are up by around one-third over the past decade in Italy, Spain and Portugal, in Germany lending is up by more than 50pc, and in France it has more than doubled.

As a result, southern European states are suffering less from higher borrowing costs now.

“The periphery is the new core,” says Farber. “The peripheral banks have less commercial real estate exposure and are making more money than the cold weather banks.

“Banks’ asset bases have eroded earlier in the northern core than in Italy and Spain and places like Greece.”

Any economies that rely on lending to fuel growth are now in trouble: ECB surveys point to a collapse in borrowing as households and businesses are put off by high interest rates.

When it comes to government finances, Italy remains exposed as a heavy borrower but has at least improved its trajectory in recent years.

Financial markets appear unflustered: Italy pays an interest rate of 3.2pc on its 10-year bonds, compared to just over 2pc in Germany. That is a far cry from the height of the sovereign debt crisis when Rome’s debt traded at a yield of around 7pc, while Germany’s was below 3.5pc.

Greece has locked in cheap debt from Europe in return for its reforms, while Spain and Portugal are on a much more secure footing than they were a decade ago.

The periphery’s ability to maintain and build on its newfound economic success will depend on whether the political will to keep reforming can be sustained in the face of higher interest rates, which are hurting populations and prompting calls for more state support.

“Greece is on a track just like the UK after Thatcher,” says Schmieding, praising its economic reforms.

“Portugal is a similar story, though not quite as pronounced.

“Spain is a similar story, although with their current Left government it is not clear whether the supply side will remain strong, or whether they will reverse the labour market reforms and impede Spain.

“But at the moment, the periphery is reaping the rewards.”

Schmieding adds: “Italy is a question mark long term, but at the moment, while it is pursuing reforms under Meloni, Italy is being given the benefit of the doubt both by the ECB and by markets.”

It is a different story in Germany, where collapsing manufacturing activity is forcing a nation long obsessed with zero borrowing to confront difficult questions around debt.

The country’s constitutional court recently shot down Chancellor Olaf Scholz’s scheme to take emergency Covid funds and redirect them to green spending. The plan was aimed at boosting growth but was deemed to break the country’s strict debt rules.

This “has taken away a key plank supporting growth”, says Schmieding.

Tight limits on public debt mean the government has little room for manoeuvre. With the private sector stalling and key sectors such as car manufacturing facing costly transitions to net zero, Schmieding says the outlook for Germany is bleak.

“The direction is relatively clear: it is going to be negative for the German growth outlook once again.”

A decade after the eurozone crisis, the balance of economic power in the bloc has shifted.