December Best Dividend Paying Stocks

A great investment for income investors with a long time horizon is in dividend-paying companies like Canadian Real Estate Investment Trust. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

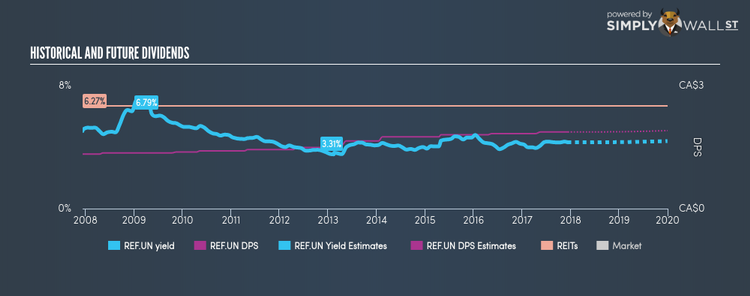

Canadian Real Estate Investment Trust (TSX:REF.UN)

CREIT is a real estate investment trust focused on accumulating and aggressively managing a portfolio of high-quality real estate assets and delivering the benefits of real estate ownership to Unitholders. Formed in 1984, and headed by CEO Stephen Johnson, the company provides employment to 153 people and with the stock’s market cap sitting at CAD CA$3.39B, it comes under the mid-cap stocks category.

REF.UN has an alluring dividend yield of 4.04% and distributes 75.44% of its earnings to shareholders as dividends . In the case of REF.UN, they have increased their dividend per share from $1.33 to $1.8696 so in the past 10 years. They have been consistent too, not missing a payment during this 10 year period.

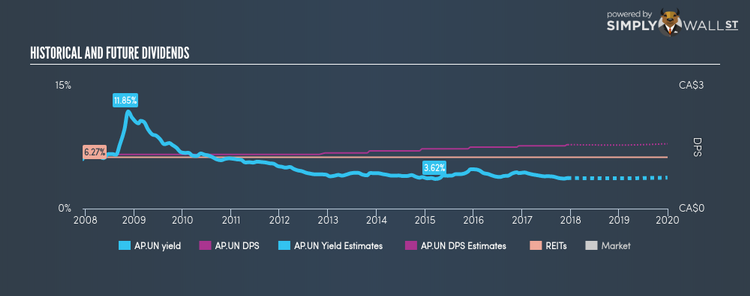

Allied Properties Real Estate Investment Trust (TSX:AP.UN)

Allied is a leading owner, manager and developer of distinctive urban workspace in Canada’s major cities. Started in 2002, and currently headed by CEO Michael Emory, the company size now stands at 247 people and with the company’s market cap sitting at CAD CA$3.89B, it falls under the mid-cap group.

AP.UN has a good dividend yield of 3.72% and pays out 28.44% of its profit as dividends , with analysts expecting a 55.49% payout in three years. AP.UN’s dividends have increased in the last 10 years, with DPS increasing from $1.26 to $1.56. It should comfort existing and potential future shareholders to know that AP.UN hasn’t missed a payment during this time. Allied Properties Real Estate Investment Trust’s earnings per share growth of % over the past 12 months outpaced the CA Equity Real Estate Investment Trusts (REITs) industry’s average growth rate of 0.24627%.

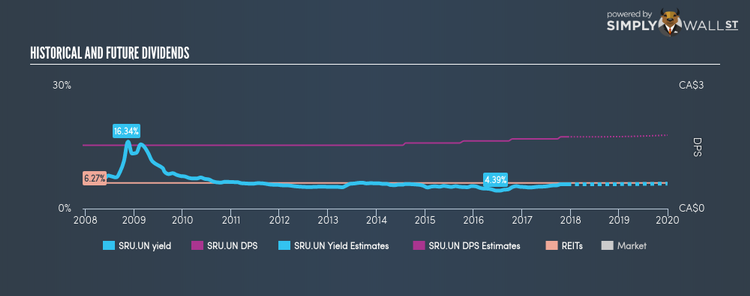

SmartCentres Real Estate Investment Trust (TSX:SRU.UN)

SmartCentres Real Estate Investment Trust is one of Canada’s largest real estate investment trusts with total assets of exceeding $8.8 billion. Founded in 1945, and currently headed by CEO J. Thomas, the company size now stands at 320 people and with the company’s market capitalisation at CAD CA$4.63B, we can put it in the mid-cap stocks category.

SRU.UN has an alluring dividend yield of 5.95% and distributes 78.00% of its earnings to shareholders as dividends . SRU.UN has increased its dividend from $1.548 to $1.74996 over the past 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. SmartCentres Real Estate Investment Trust’s earnings per share growth of % outpaced the CA Equity Real Estate Investment Trusts (REITs) industry’s 0.24627% average growth rate over the last year.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.