DecisionPoint (DPSI) to Post Q4 Earnings: What's in Store?

DecisionPoint Systems DPSI is scheduled to report fourth-quarter 2023 results on Apr 1.

The Zacks Consensus Estimate for revenues is pegged at $26.8 million, suggesting an improvement of 9.4% from a year ago. For full-year 2023, the company expects revenues between $111 million and $113 million.

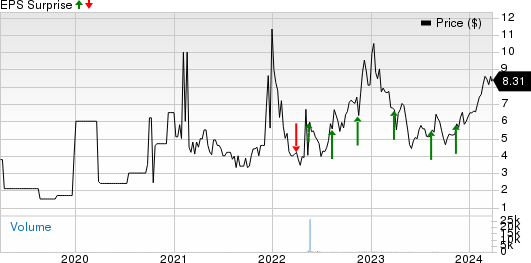

The consensus mark for fourth-quarter earnings is pegged at 6 cents per share. The company reported earnings of 10 cents in the prior-year quarter. DecisionPoint has a trailing four-quarter earnings surprise of 386.9%, on average.

DecisionPoint Systems Inc. Price and EPS Surprise

DecisionPoint Systems Inc. price-eps-surprise | DecisionPoint Systems Inc. Quote

Factors to Consider

The company’s performance in the fourth quarter is likely to have benefited from the strategy to shift the revenue mix toward services and software. In the last reported quarter, software and services accounted for about 45% of revenues.

The company plans to increase growth and margin expansion by raising services and software attach rates. These include professional services, managed mobile services, managed network services, SaaS services, software from partners and repair and maintenance services.

Rising adoption of its products and services across verticals like retail, including grocery, convenience stores, hospitality and transportation and logistics, along with geographic expansion, is a tailwind.

Synergies from acquisitions also bode well. In April 2023, it completed the acquisition of Macro Integration Services, which provides hardware, software and project services solutions mainly to companies in the retail sector. The addition of new services and capabilities like digital signage and video systems is likely to have boosted DPSI’s margin performance.

However, macroeconomic uncertainty, volatile supply-chain dynamics and increasing integration risks owing to frequent buyouts might have dented the to-be-reported quarter’s performance.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for DPSI this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

DPSI has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are some stocks you may consider, as our proven model shows that these have the right mix of elements to beat estimates this time around.

PVH Corp PVH has an Earnings ESP of +1.82% and a Zacks Rank #2. PVH is set to report fourth-quarter 2023 earnings on Apr 1.

The Zacks Consensus Estimate for PVH’s to-be-reported quarter’s earnings and revenues is pegged at $3.50 per share and $2.41 billion, respectively. Shares of PVH have risen 86.4% in the past year.

Canoo GOEV has an Earnings ESP of +22.55% and a Zacks Rank #3. GOEV is set to report fourth-quarter 2023 earnings on Apr 1.

The Zacks Consensus Estimate for GOEV’s to-be-reported quarter’s loss and revenues is pegged at $1.78 per share and $0.7 million, respectively. Shares of GOEV have lost 74.2% in the past year.

Consolidated Water CWCO has an Earnings ESP of +5.88% and a Zacks Rank #2. CWCO is set to report fourth-quarter 2023 earnings on Mar 28.

The Zacks Consensus Estimate for CWCO’s to-be-reported quarter’s earnings and revenues is pegged at 45 cents per share and $45 million, respectively. Shares of CWCO have risen 102.7% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PVH Corp. (PVH) : Free Stock Analysis Report

DecisionPoint Systems Inc. (DPSI) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report