DecisionPoint (DPSI) Q3 Earnings Top Estimates, Revenues Up Y/Y

DecisionPoint Systems DPSI reported third-quarter 2023 earnings of 13 cents per share compared with 16 cents a year ago. The Zacks Consensus Estimate was pegged at 7 cents.

Revenues increased 5.4% year over year to $27.1 million but missed the consensus mark by 3.4%.

The top line was driven by higher software and services revenues along with contributions from buyouts and cross-selling opportunities. The acquisition of Macro Integration Services (MIS) shifted product mix toward higher gross margin software and services, and expanded presence in the retail vertical, particularly grocery and food service.

Following the announcement, shares of DPSI rose 15.8% and closed trading $5.78 on Nov 14. In the past year, the stock has fallen 1.9% compared with sub-industry’s growth of 45.8%.

Image Source: Zacks Investment Research

Quarterly Details

Hardware revenues (51.7% of total revenues) declined 27.1% year over year to $14 million.

Software and Services revenues (43.2%) climbed to $11.7 million from $4.7 million in the year-earlier quarter.

Consumables (5.1%) revenues plunged 21.5% year over year to $1.4 million.

Gross profit jumped 30.3% year over year to $7.5 million.

Adjusted EBITDA totaled $2.3 million, up 1.5% year over year.

Operating income was nearly $1.5 million, down 0.7% on a year-over-year basis.

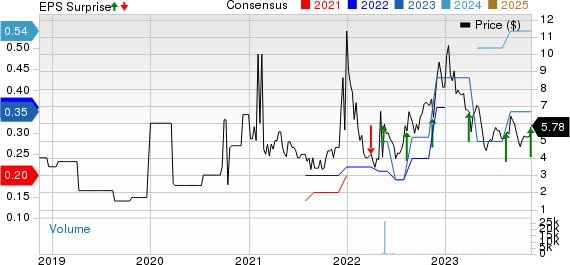

DecisionPoint Systems Inc. Price, Consensus and EPS Surprise

DecisionPoint Systems Inc. price-consensus-eps-surprise-chart | DecisionPoint Systems Inc. Quote

Balance Sheet and Cash Flow

As of Sep 30, DPSI had cash and cash equivalents of $3.6 million compared with $7.2 million as of Jun 30, 2023. Long-term debt was $5.7 million compared with $6.9 million as of Jun 30, 2023. Management noted that strong cash flow generation enabled it to repay another $1.5 million in debt related to the MIS acquisition.

For the nine months ended Sep 30, 2023, cash generated from operations was $2.8 million compared with $13.9 million in the previous year.

Guidance

For full-year 2023, the company expects revenues between $111 million and $113 million. Adjusted EBITDA is projected in the range of $8.9-$9.2 million.

Zacks Rank

DecisionPoint carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks worth consideration in the broader technology space are Adobe ADBE, Synopsys SNPS and Cadence Design Systems CDNS. Each stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Adobe’s fiscal 2023 EPS has increased 3% in the past 60 days to $15.93. ADBE’s long-term earnings growth rate is 13.5%.

Adobe’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 3.3%. Shares of ADBE have climbed 74.7% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has remained flat in the past 60 days at $11.09. SNPS’ long-term earnings growth rate is 16.7%. Shares of SNPS have gained 61.1% in the past year.

The Zacks Consensus Estimate for Cadence 2023 EPS has improved 0.4% in the past 60 days to $5.11.

Cadence’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 4.1%. Shares of CDNS have jumped 61.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

DecisionPoint Systems Inc. (DPSI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report