Deckers (DECK) Beats on Q2 Earnings Estimates, Raises FY24 View

Deckers Outdoor Corporation DECK witnessed an 11.2% jump in its share price during the after-market trading session on Oct 26. This spike was in response to the company's outstanding second-quarter performance and optimistic outlook for fiscal 2024. The strong quarterly results were underpinned by the exceptional performance of the HOKA ONE ONE and UGG brands and solid growth in direct-to-consumer (DTC) channels. Additionally, the global wholesale business delivered a commendable performance in the quarter.

Let’s Delve Deeper

Deckers delivered quarterly earnings of $6.82 per share, which surpassed the Zacks Consensus Estimate of $4.41 per share. The reported figure increased substantially from the prior-year quarter’s tally of $3.80 per share.

Net sales of this Zacks Rank #3 (Hold) company increased 24.7% to $1,092 million and outpaced the consensus estimate of $958 million. On a constant-currency basis, net sales grew 24.2%. Growth in the quarter was driven by robust demand experienced across the HOKA DTC channel and broad-based UGG growth across regions and channels.

The gross margin in the second quarter expanded 520 basis points to 53.4%, which significantly surpassed our expectation of a 200-basis point increase. This improvement can be attributed to several factors, including reduced ocean freight costs, a favorable mix of UGG products driven in part by increased early fall demand, a positive mix of full-price UGG products, a beneficial shift in the sales channel mix, with DTC sales outpacing wholesale, and a marginal benefit of foreign currency exchange rates.

SG&A expenses climbed 22% year over year to $358.4 million. As a percentage of net sales, SG&A stood at 32.8%, 80 basis points lower than the last year.

The company’s operating income came in at $224.6 million, up from $127.8 million in the year-ago quarter. The operating margin increased to 20.6% from 14.6% in the prior-year period.

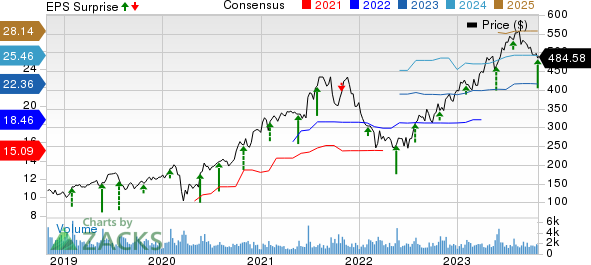

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

Brand-Wise Discussion

The HOKA brand maintained its impressive performance, achieving a 27.3% increase in sales, reaching $424 million, which exceeded our projected figure of $411.9 million.

In contrast, the UGG brand rebounded significantly after disappointing past quarters, exhibiting remarkable growth of 28.1% in net sales of $610.5 million, surpassing our estimate of $481.9 million.

Teva brand faced continued challenges, experiencing a 28.4% decline in net sales, amounting to $21.5 million, falling short of our projected $31.3 million in sales.

The Sanuk brand's poor performance persisted, resulting in a 28.5% decrease in net sales to $5.4 million, which was lower than our estimated figure of $7.1 million. Meanwhile, net sales for Other brands, primarily comprising Koolaburra, grew 7.2% to $30.6 million, exceeding our estimate of $24.8 million.

Channel & Geography-Wise Discussion

Wholesale net sales increased 19.4% year over year to $760.2 million and fared better than our projected number of $675.4 million. DTC net sales advanced 38.8% to $331.7 million, while DTC comparable net sales surged 36.8%. The reported number comfortably exceeded our estimate of $281.6 million.

Domestic net sales increased 21.1% to $748 million, while International net sales rose 33.3% to $343.9 million.

Other Financial Aspects

Cash and cash equivalents stood at $823.1 million as of Sep 30, 2023. The company ended the quarter with a total stockholders’ equity of $1,795.1 million. There were no outstanding borrowings.

During the quarter, Deckers repurchased about 347 thousand shares for $185.5 million. As of Sep 30, 2023, the company had $1,146 million remaining under its share repurchase authorization.

A Sneak Peek Into Outlook

Deckers envisions fiscal 2024 net sales to be approximately $4,025 million, up from the earlier projection of $3,980 million. This suggests an increase of about 11% from the $3,627 million reported in fiscal 2023.

With respect to brand performance, Deckers has revised its UGG growth expectations and now anticipates mid-single-digit growth instead of the prior forecast of low single digits. This upward adjustment is attributed to the sustained global brand momentum fueled by strong early demand.

The company maintained its outlook for HOKA's full-year revenue growth, expecting it to exceed 20%. However, it anticipates slower percentage growth in the third quarter due to this year's product launch schedule, which is more concentrated in the fourth quarter. Conversely, the company’s expectations for Teva have been adjusted downward due to a weakening macroeconomic environment.

Deckers now expects gross margin in the range of 52.5%-53%, up from the previous projection of 52%. This revised outlook represents a notable improvement from the 50.3% gross margin reported in fiscal 2023. SG&A expenses, as a percentage of sales, are expected in the range of 34%-34.5%. Management foresees the operating margin to be approximately 18.5% in fiscal 2024, up from 18% reported last fiscal.

Deckers now expects fiscal 2024 earnings in the band of $22.90-$23.25 per share, up from the $21.75-$22.25 per share projected earlier. The current view compares favorably with the earnings of $19.37 per share reported in fiscal 2023.

Shares of this Goleta, CA-based company have rallied 33.5% year to date against the industry’s 1% decline.

3 Stocks Looking Hot

Here, we have highlighted some better-ranked stocks, namely American Eagle Outfitters AEO, Abercrombie & Fitch ANF and G-III Apparel Group GIII.

American Eagle Outfitters is a leading global specialty retailer offering on-trend clothing, accessories and personal care under its American Eagle and Aerie brands. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal sales and EPS suggests growth of 2.2% and 33%, respectively, from the year-ago reported figure. AEO has a trailing four-quarter earnings surprise of 43.2%, on average.

Abercrombie & Fitch, a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids, sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 724.8%, on average.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10% from the year-ago period.

G-III Apparel Group, a global leader in fashion with expertise in design, sourcing and manufacturing, sports a Zacks Rank #1. GIII has a trailing four-quarter earnings surprise of 526.6%, on average.

The Zacks Consensus Estimate for G-III Apparel Group’s current fiscal sales and EPS suggests growth of 2.4% and 14.7%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report