Deckers (DECK) Q3 Earnings Beat Estimates, FY24 View Up

Deckers Outdoor Corporation DECK witnessed a 7.8% jump in its share price during the after-market trading session on Feb 1. This spike was in response to the company's outstanding third-quarter performance and optimistic outlook for fiscal 2024. The strong quarterly results were underpinned by the exceptional performance of the HOKA ONE ONE and UGG brands, led by the Direct-to-Consumer (“DTC”) channel and full-price selling.

Shares of this Goleta, CA-based company have rallied 38.6% in the past six months compared with the industry’s 22.9% growth.

Let’s Delve Deeper

Deckers delivered quarterly earnings of $15.11 per share, which surpassed the Zacks Consensus Estimate of $11.40 per share. The reported figure increased substantially from the prior-year quarter’s tally of $10.48 per share.

Net sales of this Zacks Rank #2 (Buy) company increased 16% to $1,560.3 million and outpaced the consensus estimate of $1,438 million. On a constant-currency basis, net sales grew 15.1%.

The gross margin in the third quarter expanded to 58.7% from 53% in the year-ago period and also significantly surpassed our expectation of 54.1%. This improvement can be attributed to several factors, including the higher mix of UGG full-price selling, freight savings, strategic pricing adjustments, and a favorable brand and product mix. Additionally, the positive impact of a favorable channel mix with DTC and tailwinds from foreign currency exchange rates further contributed to this enhanced gross margin.

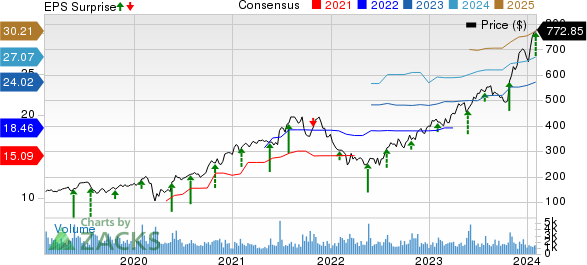

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

SG&A expenses climbed 22.5% year over year to $428.7 million. As a percentage of net sales, SG&A stood at 27.5%, 150 basis points higher than the last year. We had anticipated a year-over-year increase of 15.8% in the metric.

The company’s operating income came in at $487.9 million, up from $362.7 million in the year-ago quarter. The operating margin increased to 31.3% from 27% in the prior-year period.

Brand-Wise Discussion

The HOKA brand maintained its impressive performance, achieving a 21.9% increase in sales, reaching $429.3 million, which exceeded our projected figure of $409.2 million.

The UGG brand exhibited remarkable growth of 15.2% in net sales of $1,072 million, surpassing our estimate of $923 million.

Teva brand faced continued challenges, experiencing a 16.2% decline in net sales, amounting to $25.6 million, falling short of our projected $27.9 million in sales.

The Sanuk brand's poor performance persisted, resulting in a 28.9% decrease in net sales to $4 million, which was lower than our estimated figure of $4.7 million. Meanwhile, net sales for Other brands, primarily comprising Koolaburra, grew 10% to $29.6 million, exceeding our estimate of $26.9 million.

Channel & Geography-Wise Discussion

Wholesale net sales increased 8.6% year over year to $702.2 million and fared better than our projected number of $649.7 million. DTC net sales advanced 22.7% to $858.1 million, while DTC comparable net sales surged 21.8%. The reported number comfortably exceeded our estimate of $742 million.

Domestic net sales increased 15.6% to $1,048 million, while International net sales rose 16.7% to $511.9 million.

Other Financial Aspects

Cash and cash equivalents stood at $1,650.8 million as of Dec 31, 2023. The company ended the quarter with a total stockholders’ equity of $2,104.2 million. There were no outstanding borrowings.

During the quarter, Deckers repurchased about 196 thousand shares for $99.7 million. As of Dec 31, 2023, the company had $1,046 million remaining under its share repurchase authorization.

A Sneak Peek Into Outlook

Deckers envisions fiscal 2024 net sales to be approximately $4,150 million, up from the earlier projection of $4,025 million. This suggests an increase of about 14% from the $3,627 million reported in fiscal 2023.

With respect to brand performance, Deckers has revised its UGG growth expectations and now anticipates low double-digit growth instead of the prior forecast of mid-single digits. This upward adjustment is attributed to robust DTC demand. The company revised its outlook for HOKA's full-year revenue growth, expecting it to be 25%.

Deckers now expects gross margin to be approximately 54.5%, up from the previous projected range of 52.5%-53%. This revised outlook represents a notable improvement from the 50.3% gross margin reported in fiscal 2023. SG&A expenses, as a percentage of sales, are now expected to be about 34.5%. Management foresees the operating margin to be approximately 20% in fiscal 2024, up from 18% reported last fiscal.

Deckers now expects fiscal 2024 earnings in the band of $26.25-$26.50 per share, up from the $22.90-$23.25 per share range projected earlier. The current view compares favorably with the earnings of $19.37 per share reported in fiscal 2023.

3 More Stocks Looking Hot

Here, we have highlighted three other top-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters, Inc. AEO and Hibbett HIBB.

Abercrombie & Fitch, an omnichannel specialty retailer of apparel and accessories for men, women and kids, sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year revenues suggests growth of 15.1% from the year-ago reported figures. Abercrombie & Fitch has a trailing four-quarter earnings surprise of 713%, on average.

American Eagle Outfitters, a specialty retailer that provides clothing, accessories and personal care products, currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal sales calls for growth of 5% from the year-ago reported figure. AEO delivered a trailing four-quarter earnings surprise of 23%, on average

Hibbett, an athletic-inspired fashion retailer, carries a Zacks Rank #2. The Zacks Consensus Estimate for Hibbett’s current fiscal sales suggests growth of 1.7% from the year-ago reported figure.

Hibbett has a trailing four-quarter earnings surprise of 24.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Hibbett, Inc. (HIBB) : Free Stock Analysis Report