Decoding Affirm Holdings Inc (AFRM): A Strategic SWOT Insight

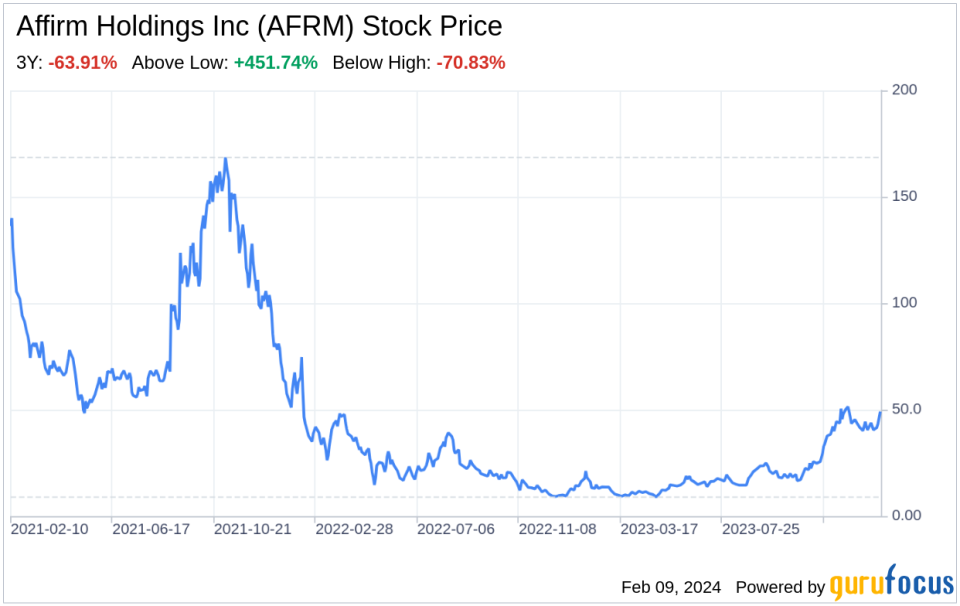

Exploring the robust growth trajectory of Affirm Holdings Inc amidst a challenging economic landscape.

Delving into the opportunities and threats facing Affirm Holdings Inc in the evolving digital payment space.

Assessing the strengths and weaknesses that shape Affirm Holdings Inc's market presence and future outlook.

On February 8, 2024, Affirm Holdings Inc, a leading platform for digital and mobile-first commerce, filed its 10-Q report, revealing a detailed account of its financial performance and operational strategies. This SWOT analysis aims to dissect the financial intricacies presented in the report, providing investors with a comprehensive understanding of the company's current standing and future prospects. Affirm Holdings Inc has demonstrated a significant increase in total revenue, netting $591.1 million for the three months ended December 31, 2023, a 48% increase from the previous year. This growth is primarily attributed to a substantial rise in interest income, which soared by 86% to $288.3 million. Despite the revenue uptick, the company faced a net loss of $166.9 million, a slight improvement from the $322.4 million loss in the prior year. Operating expenses also saw a marginal increase of 1%, with notable rises in funding costs and loss on loan purchase commitments. These figures set the stage for a nuanced SWOT analysis, providing a window into the company's operational dynamics and strategic positioning.

Strengths

Market Position and Revenue Growth: Affirm Holdings Inc has cemented its position in the digital payment solutions market, as evidenced by its robust revenue growth. The company's merchant network revenue surged by 41% to $188.3 million, while card network revenue increased by 35% to $39.3 million for the three months ended December 31, 2023. This growth trajectory underscores Affirm's ability to expand its merchant base and enhance its service offerings, which in turn, fortifies its market presence.

Interest Income Surge: A pivotal strength for Affirm Holdings Inc is the substantial increase in interest income, which nearly doubled from the previous year. This rise is indicative of the company's effective credit risk modeling and loan origination strategies, which have enabled it to capitalize on interest earnings while managing credit risk effectively.

Innovative Technology and Consumer Experience: Affirm's proprietary technology and commitment to transparent financing options have fostered a loyal customer base. The company's unique selling proposition of no hidden fees and clear terms resonates with consumers, driving repeat business and enhancing brand equity.

Weaknesses

Net Losses and Operating Expenses: Despite revenue growth, Affirm Holdings Inc reported a net loss, primarily due to high operating expenses. The company's funding costs and provision for credit losses have increased significantly, reflecting a 93% and 13% rise, respectively. These figures suggest that while the company is growing, it must better manage its expenses to achieve profitability.

Dependence on Top Merchants: A potential weakness is Affirm's reliance on a few key merchants for a substantial portion of its GMV. The top five merchants and platform partners accounted for nearly half of the total GMV, which could pose risks if these relationships are disrupted or if merchant performance declines.

Restructuring and Other Expenses: The company incurred restructuring and other expenses, albeit not material, which may indicate ongoing organizational changes that could impact operational efficiency and focus.

Opportunities

Expansion of Merchant and Consumer Base: Affirm Holdings Inc has the opportunity to further expand its merchant network and consumer base. The growth in active consumers by 13% to approximately 17.6 million as of December 31, 2023, demonstrates the potential for increased market penetration and revenue diversification.

Product Innovation: The company's focus on product innovation, such as the Affirm Card and Pay-in-4 offerings, presents opportunities to capture new market segments and meet evolving consumer preferences for flexible payment solutions.

Strategic Partnerships: Affirm's collaboration with Shopify to offer Shop Pay Installments powered by Affirm is a testament to the company's ability to forge strategic partnerships. These alliances can enhance market reach and drive GMV growth.

Threats

Macroeconomic Conditions: The current economic climate, characterized by inflation and potential recession, poses a threat to consumer spending patterns. Affirm's business could be impacted if these conditions lead to a deceleration in consumer demand for discretionary items.

Regulatory Changes: As a financial services provider, Affirm is subject to regulatory scrutiny. Changes in regulations or enforcement actions could necessitate adjustments to business practices, potentially affecting operations and profitability.

Competitive Landscape: The digital payment solutions market is highly competitive, with numerous players vying for market share. Affirm must continuously innovate and differentiate its offerings to maintain its competitive edge and attract consumers and merchants.

In conclusion, Affirm Holdings Inc's latest SEC 10-Q filing reveals a company with strong revenue growth and technological prowess, balanced by the challenges of operating losses and market dependencies. The company's opportunities lie in expanding its merchant and consumer base, innovating its product offerings, and leveraging strategic partnerships. However, macroeconomic uncertainties, regulatory changes, and a competitive landscape present ongoing threats. As Affirm Holdings Inc navigates these dynamics, its strategic decisions will be crucial in shaping its future trajectory and financial health.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.