Decoding Archer-Daniels Midland Co (ADM): A Strategic SWOT Insight

ADM's expansive global supply chain and processing capabilities underscore its market leadership.

Innovation and sustainability are at the core of ADM's strategic growth, with over 40 new products introduced in 2023.

Operational risks and geopolitical tensions present ongoing challenges for ADM.

Investigation risks and government probes could impact ADM's financial stability and stock performance.

On March 12, 2024, Archer-Daniels Midland Co (NYSE:ADM), a global leader in agricultural processing and food ingredient provision, filed its annual 10-K report with the SEC. The filing paints a picture of a company deeply integrated into the fabric of global food supply, with a market capitalization of $40.3 billion as of June 30, 2023. ADM's operations span across a vast network of logistical assets, enabling it to store and transport crops worldwide efficiently. In 2023, ADM introduced over 40 new products, signaling a strong focus on innovation and meeting evolving customer needs. However, the company also faces operational risks and geopolitical uncertainties, which could disrupt its business continuity. Additionally, ongoing government investigations pose potential threats to ADM's financial health and reputation.

Strengths

Global Supply Chain and Processing Prowess: ADM's extensive network of processing facilities and logistical assets provides it with a significant competitive edge. The company's ability to manage and process a diverse range of agricultural commodities, including oilseeds, corn, wheat, and other crops, positions it as a critical player in the global food supply chain. Its strategic acquisitions, such as Prairie Pulse Inc., Buckminster Quimica, and D.C.A. Finance B.V. in 2023, further enhance its capabilities and reach.

Innovation and Product Development: ADM's commitment to innovation is evident in its R&D strategy, which resulted in the launch of over 40 new products in 2023. The company's R&D centers across four continents and collaborations with external partners amplify its scientific prowess, enabling it to rapidly transform ideas into marketable products. This focus on innovation not only meets immediate customer needs but also positions ADM for future growth in sustainable nutrition.

Weaknesses

Operational Risks: ADM's operations are susceptible to disruptions from equipment failures, raw material shortages, natural disasters, and other unforeseen events. Such disruptions could lead to unplanned downtime, property damage, and business interruption, adversely affecting the company's operating results. Despite ADM's commitment to resiliency, these risks may not always be effectively mitigated or covered by insurance.

Human Capital Challenges: The availability of skilled trade and production workers is crucial for ADM's global operations. A limited number of qualified resources could negatively impact the company's ability to staff manufacturing facilities adequately, potentially hindering its operational efficiency.

Opportunities

Sustainability and ESG Initiatives: ADM's focus on sustainability aligns with global trends and consumer demand for environmentally responsible products. The company's strategic plan leverages sustainability to drive growth, with initiatives such as traceability of sourcing, low carbon agricultural practices, and decarbonization efforts. These efforts not only enhance ADM's reputation but also open up new market opportunities.

Expansion in Emerging Markets: ADM's growth strategy includes expanding its presence in new geographies, which presents opportunities for increased market share and revenue. However, this also exposes the company to volatile economic, political, and regulatory risks that need to be carefully managed.

Threats

Geopolitical Tensions and Trade Policies: International conflicts and changes in trade policies can significantly impact ADM's operations. The ongoing war in Ukraine and other geopolitical events could disrupt supply chains, affect commodity prices, and impose trade restrictions, posing substantial risks to the company's financial results.

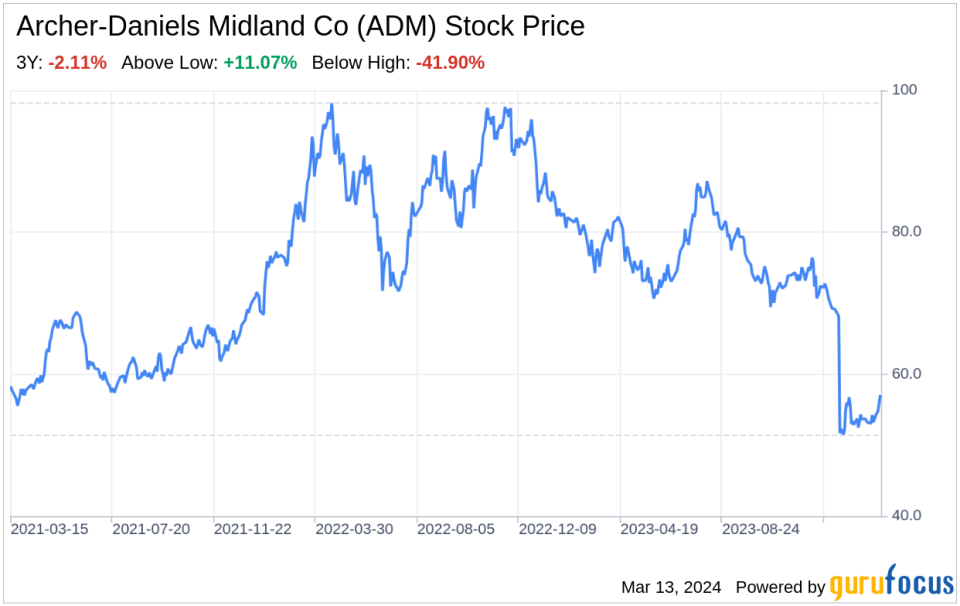

Government Investigations: ADM is subject to ongoing government investigations, which could lead to legal and financial repercussions. The SEC's voluntary document request and the potential for additional litigation or regulatory actions create uncertainty and could adversely affect ADM's stock price and access to credit markets.

In conclusion, Archer-Daniels Midland Co (NYSE:ADM) exhibits robust strengths in its global supply chain management and innovative product development. However, it must navigate operational vulnerabilities and human capital constraints. Opportunities for growth through sustainability initiatives and market expansion are countered by threats from geopolitical instability and ongoing government investigations. ADM's strategic focus on sustainability and innovation positions it well to capitalize on market trends, but it must remain vigilant in managing the risks that come with its expansive global footprint.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.