Decoding Biomarin Pharmaceutical Inc (BMRN): A Strategic SWOT Insight

Comprehensive SWOT analysis based on the latest 10-K filing reveals Biomarin's competitive edge in rare-disease therapies.

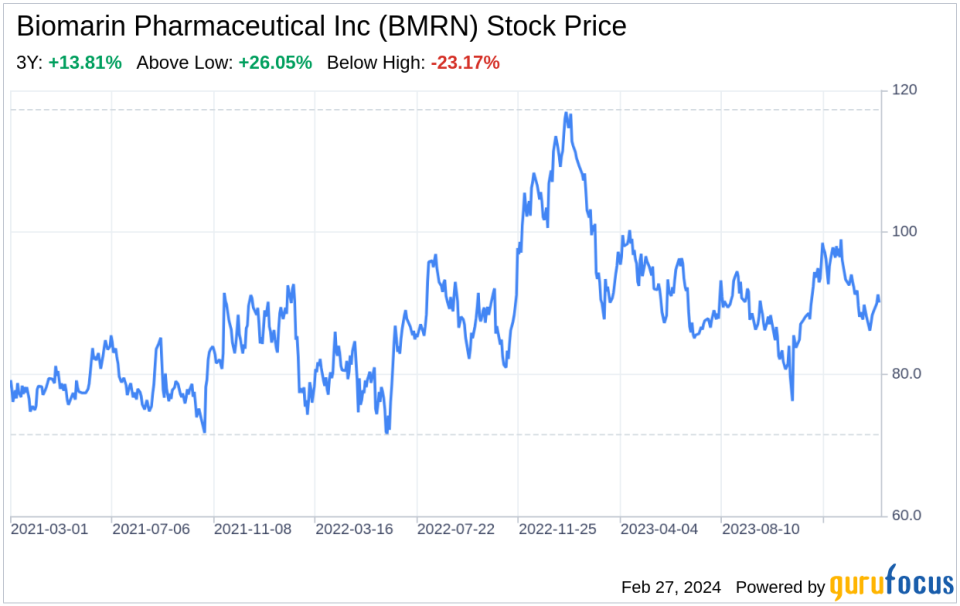

Financial overview indicates a robust market valuation and a diverse portfolio of patented therapies.

Strategic evaluation highlights Biomarin's innovation in gene therapy and potential market expansion.

Analysis uncovers challenges including competition, pricing pressures, and regulatory hurdles.

On February 26, 2024, Biomarin Pharmaceutical Inc (NASDAQ:BMRN) filed its annual 10-K report, providing a detailed overview of its financial health and strategic positioning. As a global biotechnology leader specializing in rare-disease therapies, Biomarin has established a strong market presence with its portfolio of innovative treatments. The company's financial tables reflect a solid performance, with a market capitalization of $10.1 billion as of June 30, 2023, and a diverse product lineup that includes recently approved therapies such as Voxzogo and Roctavian. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the filing, offering investors a comprehensive understanding of Biomarin's potential trajectory.

Strengths

Market Leadership in Rare-Disease Therapies: Biomarin Pharmaceutical Inc (NASDAQ:BMRN) has carved out a niche in the biotechnology industry with its focus on rare-disease therapies. The company's product portfolio, which includes Naglazyme, Vimizim, and the recently approved Roctavian, positions it as a leader in this specialized market. The strength of Biomarin's brand is bolstered by its patented treatments and the lack of direct competition for many of its products in the U.S. and EU markets. This exclusivity allows for significant market share and the ability to maintain high per-patient prices, contributing to the company's profitability.

Robust Intellectual Property Portfolio: Biomarin's success is underpinned by a strong intellectual property portfolio, which includes registered trademarks for its key products and a trademark for Roctavian in the U.S. The company's commitment to maintaining and expanding its patent portfolio through new filings, prosecutions, and strategic acquisitions provides a competitive edge and creates barriers to entry for potential competitors. This proactive approach to intellectual property management ensures long-term market exclusivity and revenue streams.

Weaknesses

Reliance on Coverage and Reimbursement: The high cost of rare-disease therapies necessitates substantial coverage and reimbursement from third-party payers. Biomarin's reliance on this coverage poses a financial risk, as inadequate reimbursement rates could adversely affect the company's revenues and gross margin. The need for extended treatment periods further amplifies this dependency, making the company vulnerable to changes in healthcare policies and payer decisions.

Impact of Generic Competition: The introduction of generic versions of KUVAN has negatively impacted Biomarin's revenues, demonstrating the company's susceptibility to generic competition. As patents expire and market exclusivity diminishes, the potential for increased generic competition represents a significant weakness that could lead to a faster-than-expected decline in product revenues.

Opportunities

Expansion of Gene Therapy Offerings: Biomarin's approval of Roctavian in Europe and the U.S. marks a significant advancement in gene therapy for rare diseases. The company's continued investment in research and development positions it to capitalize on the growing demand for gene therapies. By expanding its offerings in this cutting-edge field, Biomarin can tap into new markets and patient populations, driving future growth.

International Market Penetration: Biomarin's operations span across multiple countries, providing opportunities for increased international sales. The company's strategic focus on special access programs and collaborations with non-profit organizations enhances its global reach and ability to address unmet medical needs in various regions. This international expansion strategy presents a significant opportunity for revenue growth and diversification.

Threats

Regulatory and Pricing Pressures: Biomarin operates in a highly regulated industry, with ongoing requirements from the FDA, EC, EMA, and other international authorities. Compliance with these regulations is critical to maintaining market access for its products. Additionally, government price controls and changes in pricing regulation could restrict the amount Biomarin is able to charge for its therapies, potentially affecting revenues and profitability.

Economic and Currency Risks: As Biomarin's sales and operations are conducted outside of the U.S., the company is exposed to additional business risks, including economic volatility and currency fluctuations. Changes in foreign exchange rates and local economic conditions could adversely affect the company's operating results and net income, posing a threat to its financial stability.

In conclusion, Biomarin Pharmaceutical Inc (NASDAQ:BMRN) demonstrates a strong position in the rare-disease therapy market, backed by a robust intellectual property portfolio and a focus on gene therapy innovation. However, the company faces challenges from reliance on third-party payer coverage, generic competition, and regulatory pressures. Opportunities for international expansion and the development of new gene therapies offer promising avenues for growth, while economic and currency risks require careful management. Overall, Biomarin's strategic approach and ongoing investments in research and development position it well to navigate the dynamic biotechnology landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.