Decoding Brown-Forman Corp (BF.B): A Strategic SWOT Insight

Strong brand portfolio with Jack Daniel's leading the charge in the whiskey category.

Robust financial performance with increased sales and strategic acquisitions.

Challenges include intense competition and potential market disruptions.

Opportunities for growth in emerging markets and product innovation.

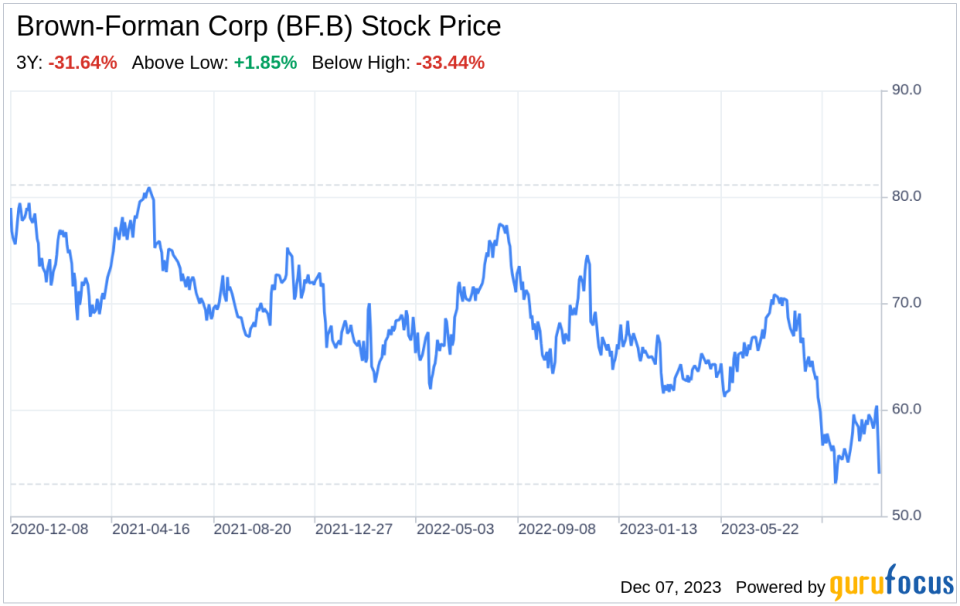

On December 6, 2023, Brown-Forman Corp (NYSE:BF.B), a leading name in the premium distilled spirits industry, filed its 10-Q report, revealing a financial landscape that investors and market analysts keenly observe. The company, known for its iconic Jack Daniel's brand, has shown resilience and strategic growth, with sales climbing from $1,384 million to $1,405 million in the three months ended October 31, 2023. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the recent SEC filing, offering a comprehensive view of the company's current standing and future prospects.

Strengths

Brand Equity and Market Presence: Brown-Forman Corp (NYSE:BF.B) boasts a formidable brand portfolio, headlined by Jack Daniel's, which commands a significant share in the whiskey market. This brand strength is a testament to the company's robust marketing strategies and loyal customer base. The financials reflect this, with a steady increase in sales, indicating a strong market presence and consumer demand. The company's ability to maintain and grow its brand equity in a competitive market is a clear strength, contributing to its overall financial health and investor appeal.

Financial Performance and Diversification: The company's financial performance has been solid, with sales showing an upward trajectory. Brown-Forman's diversification strategy, which includes premium bourbons like Woodford Reserve and Old Forester, as well as tequilas and wines, provides a buffer against market volatility. This diversification is evident in the sales figures, which have risen despite the complex global economic landscape. The company's strategic acquisitions, such as the Diplomatico Rum brand, also indicate a proactive approach to expanding its portfolio and entering new market segments.

Weaknesses

Dependence on Core Brands: While a strong brand like Jack Daniel's is an asset, over-reliance on core brands can be a double-edged sword. Any negative impact on the flagship brand, whether from market trends or reputational issues, could significantly affect the company's overall performance. The financials, though positive, must be scrutinized for over-dependence on specific products, which could pose a risk in a rapidly evolving spirits market.

Market Saturation and Competition: The premium spirits market is highly competitive, with numerous players vying for consumer attention. Brown-Forman Corp (NYSE:BF.B) faces intense competition from both established companies and new entrants, which could lead to market saturation. This competition may pressure the company to increase marketing spend or engage in price wars, potentially impacting profit margins as reflected in the financial statements.

Opportunities

Emerging Markets and Consumer Trends: Brown-Forman Corp (NYSE:BF.B) has the opportunity to capitalize on emerging markets, where there is a growing middle class with increasing disposable income. The company's international sales, particularly in regions like Europe, Australia, and Latin America, suggest that there is room for growth. Additionally, consumer trends towards premiumization and craft spirits offer avenues for product innovation and portfolio expansion, which could drive future sales growth.

Strategic Acquisitions and Partnerships: The acquisition of brands like Diplomatico Rum showcases Brown-Forman's commitment to expanding its global footprint. Strategic acquisitions and partnerships can open new markets, diversify product offerings, and enhance the company's competitive edge. The financials indicate that the company is in a strong position to pursue such opportunities, which could lead to increased market share and revenue streams.

Threats

Regulatory and Economic Uncertainties: The spirits industry is subject to stringent regulations, which can vary significantly across different markets. Brown-Forman Corp (NYSE:BF.B) must navigate these complexities, which can pose challenges in terms of compliance and market access. Economic uncertainties, including currency fluctuations and potential trade barriers, could also impact the company's international operations, as suggested by the hedging activities reported in the financials.

Changing Consumer Preferences: Consumer preferences are ever-changing, and a shift away from spirits or premium products could adversely affect Brown-Forman's sales. The company must remain agile and responsive to consumer trends to mitigate this threat. The financials indicate a current strength in sales, but the company must continue to innovate and adapt to sustain this momentum in the face of potential shifts in consumer behavior.

In conclusion, Brown-Forman Corp (NYSE:BF.B) exhibits a strong market position with a portfolio of esteemed brands and a solid financial performance. However, the company must address its reliance on core brands and navigate a competitive landscape. Opportunities in emerging markets and strategic acquisitions present avenues for growth, while regulatory challenges and changing consumer preferences pose threats. Overall, Brown-Forman's strategic approach and financial acumen position it well to leverage its strengths and opportunities while addressing its weaknesses and threats.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.