Decoding BRT Apartments Corp's Dividend Potential: A Deep Dive

Comprehensive Analysis of BRT Apartments Corp's Dividend Performance and Sustainability

BRT Apartments Corp (NYSE:BRT) has recently declared a dividend of $0.25 per share, scheduled for payment on October 11, 2023, with the ex-dividend date set for October 2, 2023. As investors anticipate this forthcoming payment, it's important to examine BRT Apartments Corp's dividend history, yield, and growth rates. This article, using data from GuruFocus, provides an in-depth analysis of BRT Apartments Corp's dividend performance and assesses its sustainability.

About BRT Apartments Corp

Warning! GuruFocus has detected 7 Warning Signs with BRT. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

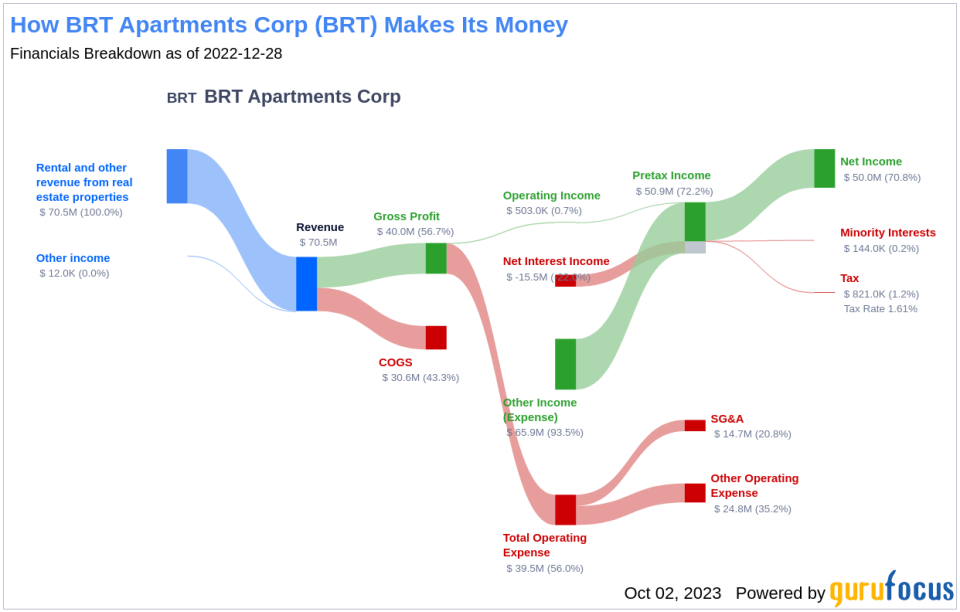

BRT Apartments Corp is a real estate investment trust (REIT) that primarily focuses on the ownership, operation, and development of multi-family properties. The company also owns and operates other real estate assets. All of the company's assets consist of multi-family real estate properties, typically leased to tenants on a one-year basis.

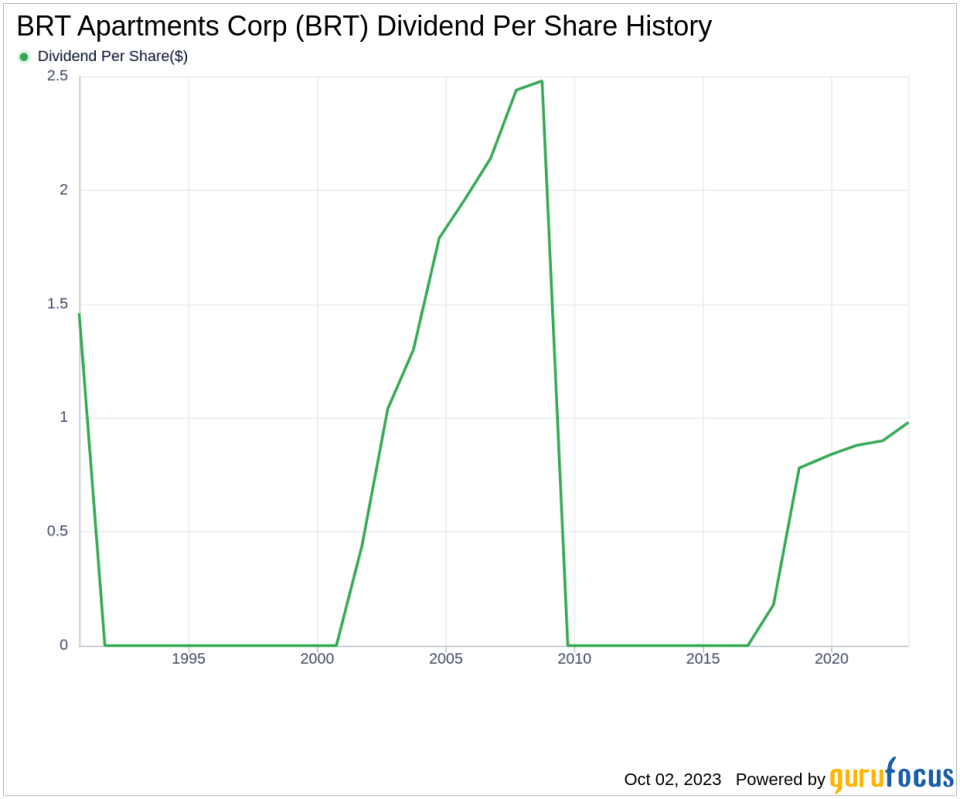

BRT Apartments Corp's Dividend History

Since 2017, BRT Apartments Corp has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The following chart displays the annual Dividends Per Share for tracking historical trends.

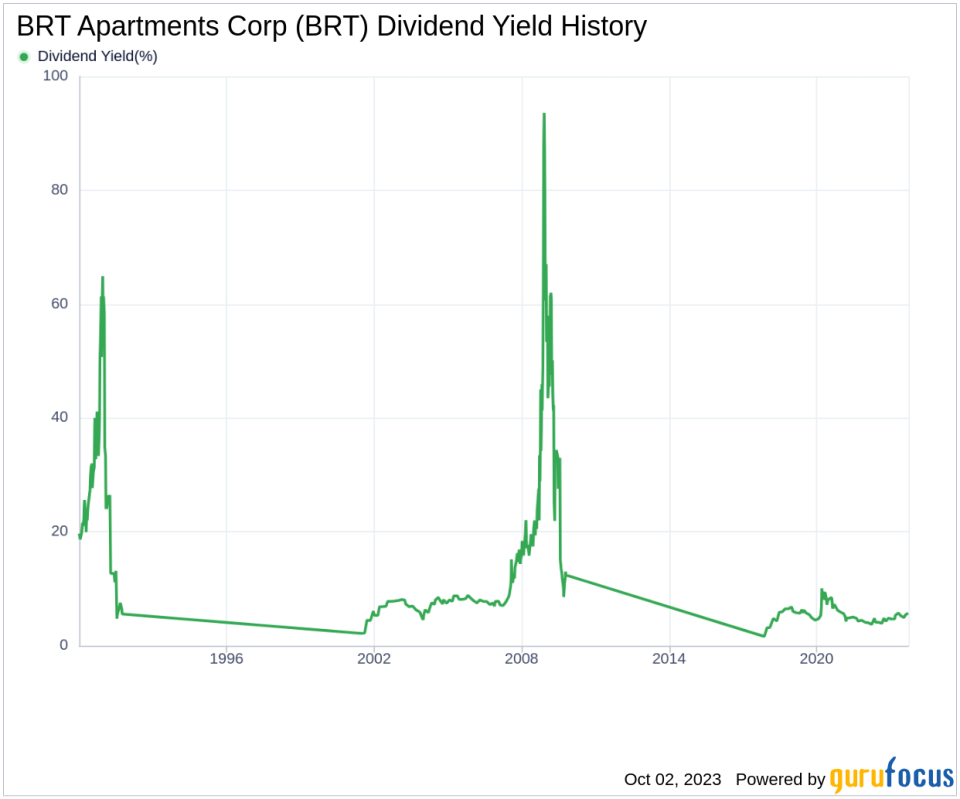

Understanding BRT Apartments Corp's Dividend Yield and Growth

As of today, BRT Apartments Corp has a 12-month trailing dividend yield of 5.79% and a 12-month forward dividend yield of 5.79%, indicating an expectation of consistent dividend payments over the next 12 months.

In the past three years, BRT Apartments Corp's annual dividend growth rate was 5.30%. This rate escalated to 29.10% per year when extended to a five-year horizon. Consequently, the 5-year yield on cost of BRT Apartments Corp's stock is approximately 20.91% as of today.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a company's dividend is often determined by its payout ratio. The dividend payout ratio reveals the portion of earnings distributed as dividends. A lower ratio indicates that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, BRT Apartments Corp's dividend payout ratio is 2.00, which may suggest potential concerns regarding the sustainability of the company's dividend.

Further, BRT Apartments Corp's profitability rank of 5 out of 10 as of June 30, 2023, indicates fair profitability. The company has reported net profit in 7 out of the past 10 years.

Growth Metrics: Future Outlook

A company's robust growth metrics are crucial for the sustainability of dividends. BRT Apartments Corp's growth rank of 5 out of 10 suggests a fair growth outlook. BRT Apartments Corp's revenue per share and 3-year revenue growth rate indicate a strong revenue model. The company's revenue has increased by approximately 32.00% per year on average, outperforming approximately 93.82% of global competitors.

The company's 3-year EPS growth rate showcases its ability to grow its earnings, a crucial component for sustaining dividends in the long run. Over the past three years, BRT Apartments Corp's earnings increased by approximately 276.10% per year on average, outperforming approximately 98.96% of global competitors.

Conclusion

While BRT Apartments Corp has demonstrated a consistent dividend payment record and impressive growth rates, potential sustainability concerns arise from its current payout ratio. However, the company's robust revenue model and remarkable earnings growth rate provide a positive outlook. Investors should keep a close eye on these factors when considering BRT Apartments Corp's dividend potential.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.