Decoding Cadence Design Systems Inc (CDNS): A Strategic SWOT Insight

Exploring Cadence Design Systems Inc's robust EDA software suite and IP portfolio as key market differentiators.

Assessing the impact of recent strategic acquisitions on Cadence's competitive positioning.

Identifying growth opportunities in emerging technology sectors and potential regulatory challenges.

Understanding Cadence's human capital management and its role in fostering innovation and growth.

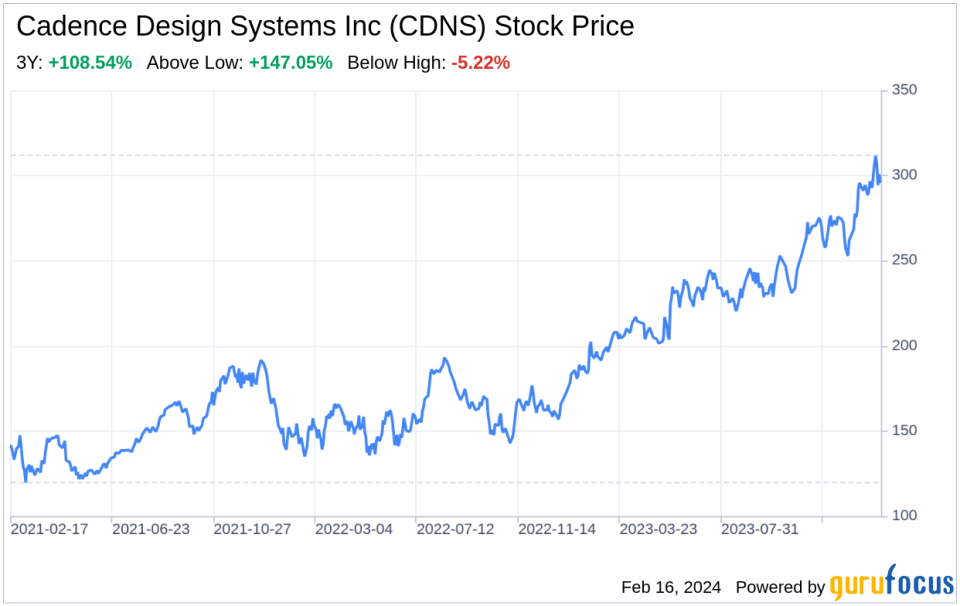

On February 14, 2024, Cadence Design Systems Inc (NASDAQ:CDNS), a leader in electronic design automation (EDA) software and intellectual property (IP), filed its annual 10-K report, revealing a comprehensive overview of its financial health and strategic positioning. With a market capitalization of approximately $63.74 billion as of June 30, 2023, and a global workforce of around 11,200 employees, Cadence stands as a formidable player in the semiconductor and electronic systems industries. The company's financial tables reflect a robust business model, with significant investments in research and development to maintain its competitive edge. Cadence's strategic acquisitions, such as Pulsic Ltd., Rambus SerDes, and Invecas Inc., underscore its commitment to expanding its technology portfolio and enhancing its market reach. The company's focus on addressing the increasing complexity of design requirements in various vertical sectors, including automotive, AI, and aerospace, positions it well for future growth.

Strengths

Comprehensive Product Portfolio and Market Position: Cadence Design Systems Inc (NASDAQ:CDNS) boasts a diverse and advanced suite of EDA software, special-purpose computational hardware, and IP, which are integral to the design of cutting-edge semiconductor and electronic systems. With over 35 years of experience, Cadence's products are deeply embedded in the design process across various industries, from automotive to AI, and aerospace to defense. The company's market position is further solidified by its continuous innovation and ability to adapt to dynamic design requirements, ensuring that it remains at the forefront of technology trends.

Strategic Acquisitions and Expansion: Cadence's strategic acquisitions, such as Pulsic Ltd. and the Rambus SerDes IP assets, have significantly enhanced its generative AI capabilities and broadened its enterprise IP portfolio. These acquisitions not only strengthen Cadence's existing offerings but also open new avenues for growth by extending its reach into additional vertical sectors. The acquisition of Intrinsix Corporation, with its focus on the U.S. aerospace and defense industry, adds valuable engineering expertise in advanced nodes and security algorithms, further diversifying Cadence's customer base and service capabilities.

Financial Stability and Shareholder Value: With a strong balance sheet and a disciplined approach to capital allocation, Cadence has demonstrated financial stability and a commitment to enhancing shareholder value. The company's share repurchase program, with approximately $1.4 billion remaining as of December 31, 2023, reflects confidence in its long-term growth prospects and a shareholder-friendly policy. This financial prudence, combined with consistent revenue growth, positions Cadence favorably in the eyes of investors and market analysts.

Weaknesses

Dependence on Continuous Innovation: The rapid pace of technological advancement in the semiconductor and electronic systems industries necessitates constant innovation and product development. Cadence's success is heavily reliant on its ability to keep up with the latest manufacturing technologies and customer demands. This dependence on continuous R&D investment, while necessary, exposes the company to risks associated with the fast-evolving tech landscape and the pressure to deliver cutting-edge solutions consistently.

Regulatory and Compliance Risks: Cadence operates in a complex regulatory environment, with exposure to various laws and regulations, including export controls, anti-corruption, and data privacy. Changes or developments in these regulations could negatively impact Cadence's business operations and increase compliance-related expenditures. For instance, new restrictions concerning advanced node IC production in China and controls on electronic computer-aided design software could affect Cadence's ability to transact business in certain countries or with certain customers.

Concentration of Technical Workforce: Cadence's workforce is highly specialized, with a substantial majority of employees working in engineering roles. While this concentration of technical expertise is a strength, it also presents a challenge in terms of talent retention and development. The technology field's gender and racial disparities, particularly in technical roles, require Cadence to invest significantly in diversity, equity, and inclusion initiatives to maintain a competitive edge in attracting and retaining top talent.

Opportunities

Emerging Technology Sectors: Cadence is well-positioned to capitalize on emerging opportunities in sectors such as digital twin, generative AI, AR/VR, IIoT, edge computing, and hyperscale computing. The company's comprehensive product offerings and expertise in these areas provide a solid foundation for growth as these technologies become increasingly prevalent in consumer and industrial applications.

Global Expansion and Market Penetration: With a global presence and a diverse customer base, Cadence has the opportunity to further expand its market penetration, particularly in high-growth regions. The company's recent acquisitions have added valuable engineering teams with expertise in various verticals, enabling Cadence to offer customized solutions across chip design, product engineering, and advanced packaging, thereby enhancing its competitive positioning in international markets.

Investment in Human Capital: Cadence's focus on human capital management, including initiatives for diversity, equity, and inclusion, health and wellness, and talent development, positions the company to attract and retain a high-performing workforce. These investments in human capital are crucial for fostering a culture of innovation and driving long-term growth.

Threats

Intense Competition: The EDA software and IP market is highly competitive

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.