Decoding Camden Property Trust (CPT): A Strategic SWOT Insight

Camden Property Trust (NYSE:CPT) showcases a robust portfolio with strategic market presence and sophisticated property management.

Despite strong operational strategies, CPT faces intense competition and market volatility that could impact leasing and revenue.

Opportunities for growth through selective acquisitions and developments are tempered by potential economic downturns and interest rate fluctuations.

Camden Property Trust's commitment to human capital and a culture of excellence positions it well for future challenges and opportunities.

On February 22, 2024, Camden Property Trust (NYSE:CPT), a leading real estate investment trust, released its annual 10-K filing, offering a comprehensive view of its financial health and strategic positioning. With a portfolio of 176 multifamily properties and a market capitalization of approximately $11.58 billion as of June 30, 2023, CPT continues to demonstrate its prowess in the multifamily apartment community sector. The financial tables within the filing reveal a company that has maintained a strong balance sheet, with positive cash flows from operations and a strategic approach to managing its debt levels and leverage ratios. This financial overview sets the stage for a deeper dive into the company's strengths, weaknesses, opportunities, and threats as we explore the nuances of CPT's market position and future prospects.

Strengths

Geographic Diversification and Market Presence: Camden Property Trust (NYSE:CPT) boasts a geographically diverse portfolio, primarily concentrated in the Sun Belt region, which is known for its strong economic growth and high demand for multifamily housing. This strategic market presence is a significant strength, as it positions CPT to capitalize on the robust household formation and job growth in these areas. The company's focus on markets with an attractive quality of life further enhances its ability to attract and retain residents, allowing for potential revenue growth.

Sophisticated Property Management: CPT's sophisticated property management capabilities are a cornerstone of its operational success. The company employs a team of professionals, including certified property managers and experienced maintenance technicians, who are adept at delivering high-quality services and promoting resident satisfaction. This operational excellence not only drives occupancy rates but also enables CPT to adjust rental rates swiftly in response to market conditions, thereby optimizing financial performance.

Weaknesses

Competition and Market Saturation: The multifamily housing market is highly competitive, with numerous alternatives such as single-family homes, condominiums, and short-term rentals vying for the same customer base. CPT's properties face direct competition from these alternatives, which could impact the company's ability to lease apartment homes and realize expected rents. This competitive landscape necessitates continuous innovation and investment in property offerings to maintain a competitive edge.

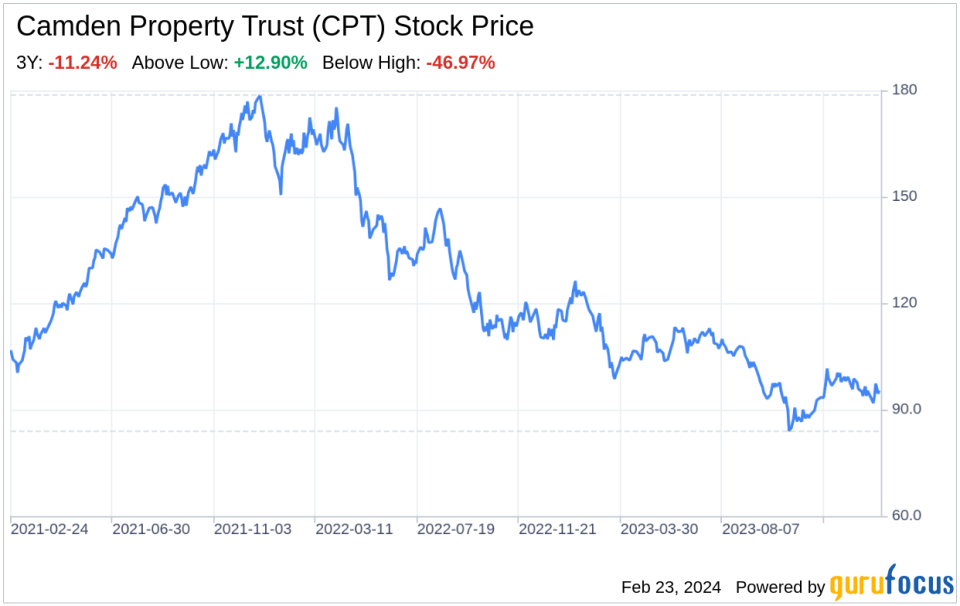

Interest Rate Sensitivity: As noted in the 10-K filing, the volatility in capital and credit markets, particularly with the Federal Reserve's interest rate hikes throughout 2023, poses a weakness for CPT. Higher interest rates can increase the cost of debt, potentially affecting the company's ability to finance acquisitions and developments. Additionally, rising interest rates may lower the value of real estate assets and the price of CPT's shares, impacting investor sentiment and capital raising efforts.

Opportunities

Selective Acquisitions and Development: CPT has the opportunity to grow its portfolio through the strategic acquisition and development of new properties. The company's established presence in its core markets provides a platform for identifying and capitalizing on selective opportunities that align with its long-term growth objectives. By focusing on markets with favorable multifamily property appreciation conditions, CPT can enhance its asset value and generate sustained earnings growth.

Human Capital and Organizational Culture: CPT's emphasis on human capital management and a culture that values diversity, equity, and inclusion presents an opportunity to attract and retain top talent. The company's recognition as a great place to work and its commitment to employee development can lead to enhanced operational efficiency and innovation, positioning CPT to navigate market challenges and seize growth opportunities effectively.

Threats

Economic Downturns and Market Volatility: Economic downturns and continued market volatility pose significant threats to CPT's operations. A slowdown in economic activity could lead to reduced demand for apartment homes, affecting occupancy rates and rental income. Additionally, market disruptions, such as bank failures or shifts in investor sentiment, can impact the availability and cost of capital, hindering CPT's growth initiatives and financial flexibility.

Regulatory and Environmental Changes: Changes in regulations, including those related to zoning, land use, and environmental standards, could affect CPT's ability to develop and manage properties. Moreover, the increasing focus on sustainability and climate change may require significant investment in property upgrades to meet new standards, potentially impacting the company's profitability and operational costs.

In conclusion, Camden Property Trust (NYSE:CPT) exhibits a strong market presence and operational expertise, which are pivotal to its success in the multifamily housing sector. However, the company must navigate the challenges posed by intense competition, interest rate sensitivity, and economic uncertainties. By leveraging its opportunities for strategic acquisitions and fostering a culture of excellence, CPT is well-positioned to address its weaknesses and threats, ensuring sustained growth and value creation for its shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.