Decoding Campbell Soup Co (CPB): A Strategic SWOT Insight

Insight into Campbell Soup Co's enduring brand strength and market presence.

Examination of competitive challenges and strategic opportunities ahead.

Analysis of financial performance and future prospects in light of recent SEC filings.

Exploration of potential impacts from the pending acquisition of Sovos Brands.

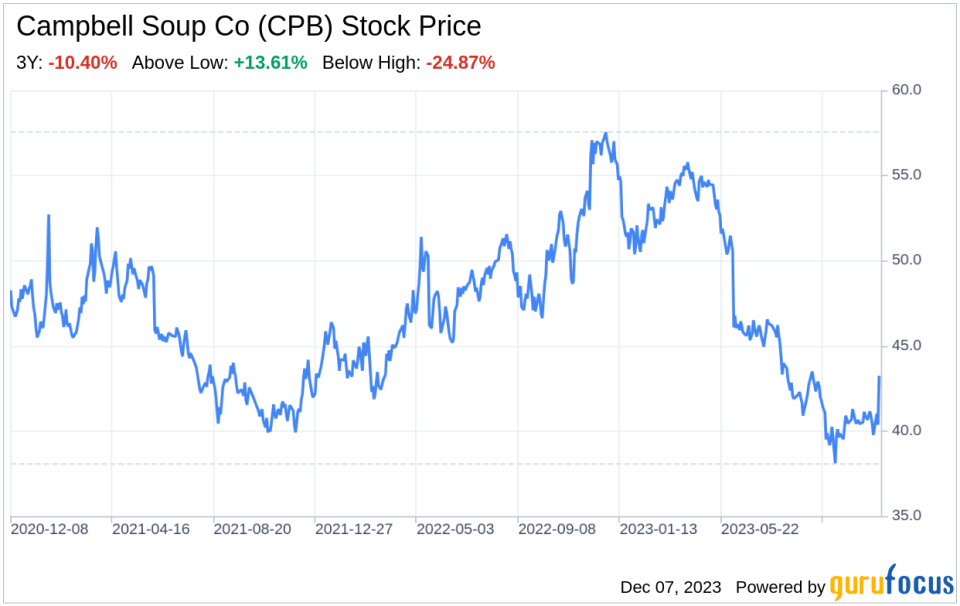

On December 6, 2023, Campbell Soup Co (NYSE:CPB) filed its latest 10-Q report, offering a window into the company's financial health and strategic positioning. With a rich heritage spanning 150 years, Campbell Soup Co stands as a titan in the convenience food products industry, boasting iconic brands such as Campbell's, Pace, Prego, and V8. The company's recent financial tables reveal a nuanced picture: net sales have seen a slight decrease of 2% in the quarter to $2.518 billion, with a gross profit margin of 31.3%. Despite facing cost inflation and supply chain challenges, Campbell Soup Co reported net earnings of $234 million, or $.78 per share, a testament to its enduring market resilience.

The main body of the article starts here...

Strengths

Brand Equity and Market Presence: Campbell Soup Co's strength lies in its powerful brand equity and dominant market presence. The company's portfolio includes some of the most recognizable and trusted brands in the food industry, such as Campbell's soup and V8 beverages. This brand power is not just a testament to the company's history but also to its ability to maintain relevance in the modern market. The brand strength is further evidenced by the company's ability to command premium pricing and maintain customer loyalty, which is crucial in the competitive food industry.

Strategic Acquisitions: Campbell Soup Co has strategically expanded its product mix through acquisitions, such as the Snyder's-Lance deal in March 2018. This move not only diversified the company's offerings but also bolstered its presence in the faster-growing snack food aisle, complementing its Pepperidge Farm lineup. The acquisition strategy demonstrates Campbell Soup Co's commitment to growth and its ability to integrate new brands effectively, leveraging synergies and expanding its consumer base.

Financial Resilience: Despite the challenges posed by the pandemic and subsequent economic fluctuations, Campbell Soup Co has displayed financial resilience. The company's balance sheet remains robust, with a disciplined approach to cost management and operational efficiency. This financial stability provides a solid foundation for the company to navigate market uncertainties and invest in growth opportunities.

Weaknesses

Volume/Mix Declines: A notable weakness for Campbell Soup Co is the volume/mix declines observed in its Meals & Beverages segment, particularly in U.S. retail products like soup and beverages. This trend, reflected in a 4% sales decrease in this segment, indicates a potential shift in consumer preferences or increased competition. Addressing these declines is critical for maintaining market share and ensuring long-term profitability.

Supply Chain Vulnerabilities: The company has faced supply chain challenges, as indicated by the increased cost of products sold and other supply chain costs. These vulnerabilities can lead to disruptions, inefficiencies, and increased operational costs, which can erode profit margins and competitive advantage. Campbell Soup Co must continue to innovate and optimize its supply chain to mitigate these risks.

Input Cost Inflation: Input cost inflation has been a persistent issue for Campbell Soup Co, impacting gross profit margins. The company's ability to manage these costs is crucial for maintaining profitability. While pricing actions and supply chain productivity improvements have helped offset some inflationary pressures, ongoing vigilance and strategic cost management are required to combat this weakness.

Opportunities

Health and Wellness Trends: The growing consumer focus on health and wellness presents a significant opportunity for Campbell Soup Co. By leveraging its V8 and Pacific Foods brands, the company can capitalize on the demand for healthier, nutrient-rich food options. Expanding these product lines and innovating within this space can drive growth and attract health-conscious consumers.

Snacking Segment Growth: The snacking segment continues to exhibit robust growth, and Campbell Soup Co's Snacks division, featuring power brands like Goldfish and Snyder's of Hanover, is well-positioned to benefit from this trend. Continued innovation and marketing in this category can lead to increased sales and market share.

Emerging Markets Expansion: Campbell Soup Co has the opportunity to expand its footprint in emerging markets, where there is a growing middle class with increasing purchasing power. By tailoring products to local tastes and investing in market-specific strategies, the company can tap into new revenue streams and diversify its geographic presence.

Threats

Intense Competition: The food industry is highly competitive, with numerous players vying for market share. Campbell Soup Co faces competition from both established companies and new entrants, which can lead to price wars, margin compression, and the need for continuous innovation. Staying ahead of competitors requires a relentless focus on product quality, brand differentiation, and consumer engagement.

Macroeconomic Challenges: Macroeconomic factors such as commodity cost fluctuations, labor cost inflation, and broader economic uncertainties pose threats to Campbell Soup Co's operations. These factors can impact consumer spending patterns and operational costs, necessitating agile management and strategic planning to navigate potential headwinds.

Regulatory and Legal Risks: Campbell Soup Co operates in a highly regulated industry, and changes in regulations or legal challenges can have significant impacts. For instance, the company's pending acquisition of Sovos Brands is subject to regulatory approval, and any delays or issues in this process could affect the company's strategic plans. Additionally, legal risks, such as those related to product liability or intellectual property, can

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.