Decoding Chesapeake Energy Corp (CHK): A Strategic SWOT Insight

Strengths highlight Chesapeake Energy Corp's robust asset portfolio and strategic mergers.

Weaknesses underscore the challenges of high debt levels and integration risks.

Opportunities emphasize the potential in ESG initiatives and market expansion.

Threats include regulatory changes and volatile commodity prices.

Chesapeake Energy Corp (NASDAQ:CHK), a leading US-based exploration and production company, filed its 10-K on February 21, 2024, revealing a detailed account of its financial and operational status. The company, known for its focus on the Marcellus, Haynesville, and Eagle Ford regions, has recently entered into a significant all-stock merger agreement with Southwestern Energy Company, indicating a strategic move to consolidate its market position. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as disclosed in the 10-K filing, providing investors with a comprehensive understanding of CHK's potential trajectory.

Strengths

Robust Asset Portfolio and Production Efficiency: Chesapeake Energy Corp's strength lies in its extensive portfolio of onshore unconventional natural gas assets, with interests in approximately 5,000 gross natural gas wells. The company's efficient production capabilities are evident in its ability to maintain a strong foothold in key shale plays, which contributes to its competitive advantage. The recent merger agreement with Southwestern Energy further bolsters CHK's asset base, potentially leading to increased operational synergies and a more diversified production profile.

Strategic Mergers and Acquisitions: The strategic all-stock merger with Southwestern Energy represents a significant strength for Chesapeake Energy Corp, as it is poised to create a combined entity with enhanced scale and financial resilience. This move is expected to provide CHK with a broader geographic footprint, access to complementary assets, and the ability to leverage economies of scale. The merger is subject to shareholder and regulatory approvals, but if successful, it could lead to substantial cost savings and improved market positioning.

Weaknesses

High Debt Levels and Financial Obligations: Despite its operational strengths, Chesapeake Energy Corp's financial flexibility is constrained by its considerable level of indebtedness and the restrictive covenants associated with its debt instruments. The company's long-term financial obligations, including gathering, processing, and transportation agreements, could limit its ability to respond to market changes and invest in growth opportunities. The merger with Southwestern Energy, while strategically beneficial, also carries the risk of exacerbating the debt situation if not managed effectively.

Integration Risks and Operational Challenges: The integration of Southwestern Energy's operations poses significant risks for Chesapeake Energy Corp. The complexity of merging two large entities can lead to disruptions in ongoing business operations, potential loss of key personnel, and challenges in achieving the anticipated synergies. Additionally, CHK's operational performance could be affected by unforeseen costs or complications arising from the merger, which may impact its ability to execute its business strategy smoothly.

Opportunities

ESG Initiatives and Certifications: Chesapeake Energy Corp has the opportunity to enhance its market reputation and investor appeal through its commitment to environmental, social, and governance (ESG) excellence. The company's efforts to achieve and maintain ESG certifications and meet its goals can attract ESG-focused investors and potentially lead to favorable financing terms. CHK's proactive stance on safety, diversity, equity, and inclusion further strengthens its corporate culture and aligns with broader societal and investor expectations.

Market Expansion and Diversification: The merger with Southwestern Energy opens up opportunities for Chesapeake Energy Corp to expand its market presence and diversify its product offerings. By combining resources and expertise, CHK can explore new markets and enhance its competitive edge. The company's ability to leverage its expanded asset base and operational efficiencies could lead to increased market share and revenue growth in the long term.

Threats

Regulatory Changes and Environmental Policies: Chesapeake Energy Corp operates in an industry that is highly sensitive to regulatory changes, particularly those related to environmental protection and climate change. The Biden Administration's focus on reducing the climate change impacts of federal actions could result in additional restrictions on drilling and production activities. Such regulatory developments could increase CHK's operating and compliance costs and potentially limit its production capabilities.

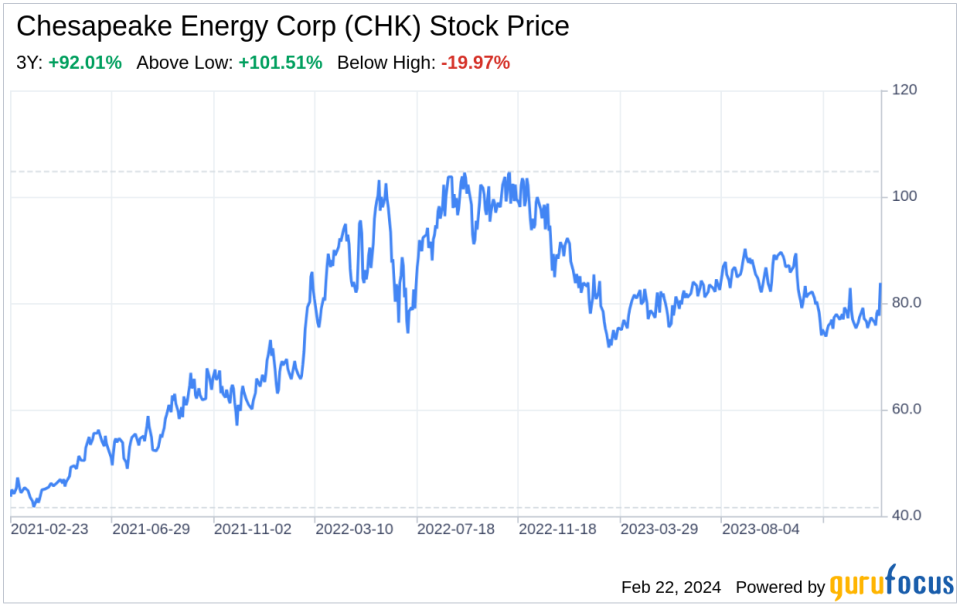

Commodity Price Volatility and Economic Conditions: The company's financial performance is closely tied to the volatility of commodity prices, which can be influenced by global economic conditions, geopolitical events, and market demand. The ongoing instability in Europe and the Middle East, coupled with the effects of the global economic environment, could lead to fluctuations in natural gas and oil prices, impacting CHK's revenue and profitability. Additionally, the company's ability to access capital markets on favorable terms could be affected by these external factors.

In conclusion, Chesapeake Energy Corp (NASDAQ:CHK) exhibits a strong operational foundation with a robust asset portfolio and strategic growth initiatives. However, the company must navigate high debt levels, integration risks, and a dynamic regulatory landscape. The opportunities presented by ESG initiatives and market expansion are promising, but CHK must remain vigilant against the threats of commodity price volatility and economic uncertainties. The company's ability to leverage its strengths and address its weaknesses while capitalizing on opportunities and mitigating threats will be crucial for its future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.