Decoding CNH Industrial NV (CNHI): A Strategic SWOT Insight

Comprehensive SWOT analysis based on CNH Industrial NV's latest SEC 10-K filing.

Deep dive into CNH Industrial NV's competitive positioning and market dynamics.

Strategic evaluation of CNH Industrial NV's operational strengths and potential growth opportunities.

Assessment of challenges and external threats impacting CNH Industrial NV's business trajectory.

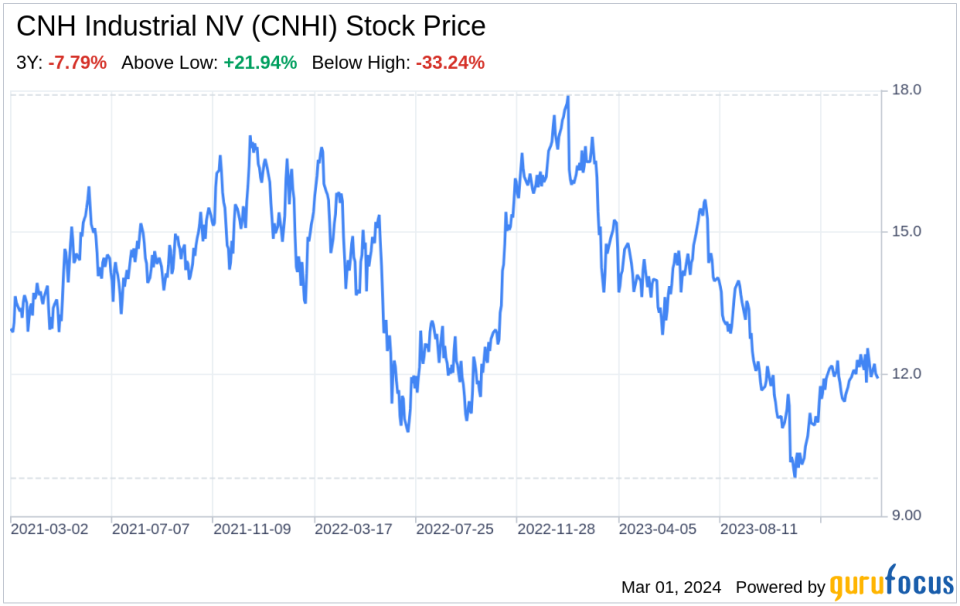

On February 29, 2024, CNH Industrial NV (NYSE:CNHI), a global leader in heavy machinery manufacturing, released its SEC 10-K filing, providing a detailed account of its financial performance for the fiscal year ended December 31, 2023. With a diverse product portfolio that includes agricultural and construction equipment, CNH Industrial NV stands out in the market with its iconic brands such as Case IH. The company's robust dealer network, comprising over 3,600 locations worldwide, and its finance arm play a pivotal role in facilitating equipment sales. As of June 30, 2023, the market capitalization of CNH Industrial NV was approximately $13.9 billion, reflecting its significant presence in the industry. The following SWOT analysis delves into the company's internal dynamics and external environment, offering investors a comprehensive view of its strategic positioning.

Strengths

Brand Recognition and Dealer Network: CNH Industrial NV's strength lies in its well-established brands, such as Case IH, which command loyalty and recognition among customers and dealers. The company's extensive dealer network ensures widespread availability and customer support, contributing to a strong market presence. The brand equity built over generations provides CNH with a competitive edge in customer retention and new sales.

Product Innovation and Technology Integration: The company's focus on high-quality, high-value products with environmental protection features positions it favorably in markets with stringent emission regulations. CNH Industrial NV's investment in technology, such as precision agriculture and digital platforms, enhances product appeal and operational efficiency, further solidifying its market leadership.

Weaknesses

Supply Chain and Manufacturing Risks: CNH Industrial NV's supply chain and manufacturing systems are subject to risks associated with industry volume forecasts and competitive pressures. The company acknowledges the criticality of maintaining positive price realization amidst inflationary cost increases, which poses a challenge in sustaining profitability and competitiveness.

Upcoming Labor Negotiations: The impending expiration of collective bargaining agreements in 2024 with the International Association of Machinists in the United States could introduce uncertainty and potential disruptions. Successful negotiation of new agreements is crucial to maintaining stable labor relations and operational continuity.

Opportunities

Emerging Markets and New Legislation: With new emission legislation in countries like India and China, CNH Industrial NV has the opportunity to leverage its expertise in meeting stringent standards to capture market share. The company's commitment to product innovation and environmental stewardship can drive growth in these rapidly developing markets.

Digital and Precision Agriculture Advancements: The acquisition of AgDNA and the development of AFS-PLM digital platforms present significant opportunities for CNH Industrial NV to lead in the digital transformation of agriculture. By offering integrated solutions and enhancing data-driven farming practices, CNH can expand its customer base and create new revenue streams.

Threats

Intense Competition and Market Volatility: CNH Industrial NV operates in a highly competitive environment with key players like Deere & Company and Caterpillar Inc. The company must continuously innovate and adapt to maintain its market position. Additionally, market volatility, influenced by economic conditions and commodity prices, can impact sales volumes and profitability.

Global Economic and Supply Chain Disruptions: The company has experienced supply chain disruptions and inflationary pressures, which, despite improvements, continue to pose a threat. Global economic conditions, including rising interest rates and recession fears, could adversely affect CNH Industrial NV's business operations and financial performance.

In conclusion, CNH Industrial NV (NYSE:CNHI) exhibits a robust set of strengths, including strong brand recognition and a commitment to innovation, which provide a solid foundation for growth. However, the company must navigate weaknesses such as supply chain vulnerabilities and upcoming labor negotiations with strategic foresight. Opportunities in emerging markets and digital agriculture present avenues for expansion, while threats from intense competition and global disruptions require vigilant management. Overall, CNH Industrial NV's strategic initiatives and market positioning suggest a resilient outlook, with careful attention to external risks and internal improvements poised to shape its future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.