Decoding Colgate-Palmolive Co (CL): A Strategic SWOT Insight

Colgate-Palmolive Co exhibits a robust brand portfolio and market leadership in oral care.

Global presence with significant revenue generation from emerging markets.

Challenges include intense competition and reliance on key retailers.

Opportunities for growth in e-commerce and sustainability initiatives.

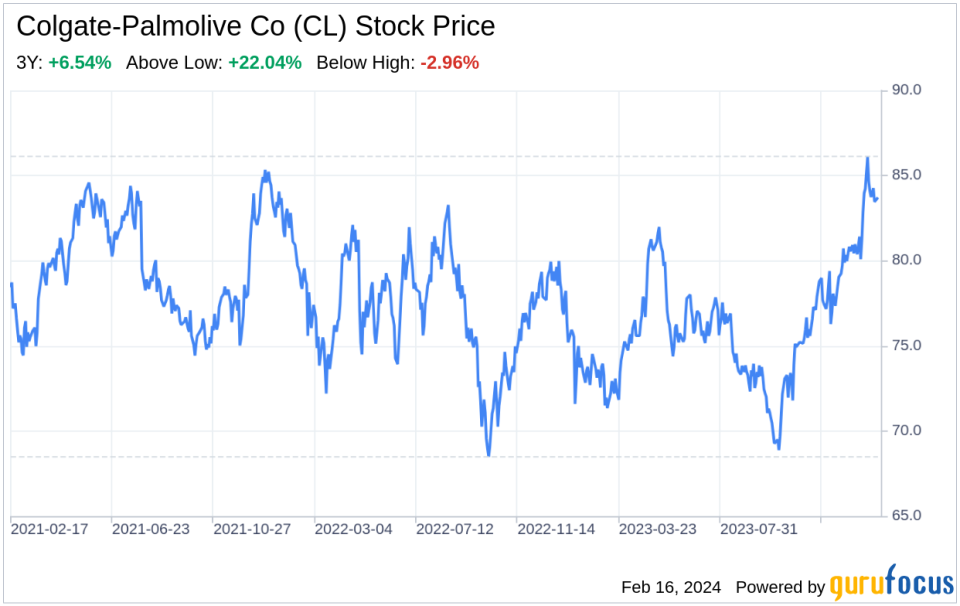

On February 15, 2024, Colgate-Palmolive Co (NYSE:CL), a global leader in consumer products, released its 10-K filing, providing a comprehensive overview of the company's financial health and strategic positioning. With a history dating back to 1806, Colgate-Palmolive has established itself as a household name, offering a wide range of products in oral, personal, and home care, as well as pet nutrition. The company's financial tables reveal a solid performance, with a diverse product portfolio that has secured a substantial market share across various categories. The aggregate market value of Colgate-Palmolive's common stock held by non-affiliates as of June 30, 2023, was approximately $63.6 billion, reflecting the company's strong investor confidence and market presence.

Strengths

Global Brand Leadership: Colgate-Palmolive Co (NYSE:CL) stands out for its global brand leadership, particularly in the oral care segment. The company's flagship toothpaste and manual toothbrush brands, such as Colgate, are recognized worldwide, contributing to a dominant market share. This brand power is not only a testament to the company's extensive history but also to its continuous innovation and marketing efforts. The strength of Colgate-Palmolive's brand portfolio is further reinforced by its diverse range of well-known trademarks, including Palmolive, elmex, and Tom's of Maine, which endure as long as they are used and/or registered. The company's strategic focus on maintaining a strong brand presence has resulted in a loyal customer base and a competitive edge in the global market.

Financial Resilience: Colgate-Palmolive's financial resilience is evident in its balance sheet and overall financial performance. With a market capitalization of approximately $63.6 billion and a widespread international presence accounting for about 70% of total sales, the company has demonstrated its ability to generate consistent revenue streams. This financial stability is crucial in allowing Colgate-Palmolive to invest in growth opportunities, research and development, and marketing initiatives that further strengthen its market position. The company's financial health also provides the flexibility to navigate economic fluctuations and invest in strategic acquisitions, enhancing its product offerings and geographic reach.

Weaknesses

Intense Competition and Market Dependence: Despite its strong brand presence, Colgate-Palmolive faces intense competition from both established players and emerging brands. Competitors may spend more aggressively on advertising, introduce products more quickly, or respond more effectively to changing consumer preferences. Colgate-Palmolive's performance is also influenced by its dependence on key retailers, which can leverage their bargaining power to demand higher trade discounts or increased investment. This reliance poses a risk to the company's sales and profitability, particularly in developed markets where retail consolidation and the growth of e-commerce have shifted the balance of power.

Supply Chain Vulnerabilities: Colgate-Palmolive's supply chain is subject to various risks, including geopolitical events, health emergencies, and natural disasters. The company's reliance on single-source suppliers or a limited number of suppliers for key raw and packaging materials adds to this vulnerability. Although Colgate-Palmolive has business continuity and contingency plans in place, significant disruptions in manufacturing or sourcing could interrupt product supply and adversely impact business operations, financial condition, and market reputation.

Opportunities

E-commerce and Digital Transformation: The evolving retail landscape presents significant opportunities for Colgate-Palmolive to expand its e-commerce footprint and leverage digital technologies. With consumers increasingly shopping online, the company can capitalize on this trend by enhancing its online presence, optimizing its digital marketing strategies, and exploring alternative retail channels such as subscription services and direct-to-consumer models. Embracing digital transformation will enable Colgate-Palmolive to reach new customers, personalize consumer experiences, and drive sales growth in a rapidly changing market.

Sustainability and Social Impact: Colgate-Palmolive's commitment to sustainability and social impact aligns with growing consumer demand for environmentally responsible products. The company's 2025 Sustainability & Social Impact Strategy, which focuses on reducing plastic waste, accelerating action on climate change, and driving social impact, positions it as a leader in corporate responsibility. By achieving its sustainability targets, Colgate-Palmolive can enhance its brand image, attract eco-conscious consumers, and differentiate itself from competitors, while contributing positively to the environment and society.

Threats

Regulatory and Legal Challenges: As a global entity, Colgate-Palmolive is subject to extensive governmental regulations across different markets. These regulations impact various aspects of the business, including product development, advertising, and environmental impact. Compliance with these ever-evolving legal requirements necessitates significant resources and can affect the company's ability to innovate and market its products effectively. Additionally, any failure to comply with regulations could result in legal penalties, damage to the company's reputation, and financial setbacks.

Consumer Preferences and Market Dynamics: Consumer preferences are constantly shifting, influenced by factors such as health and wellness trends, ingredient transparency, and ESG concerns. Colgate-Palmolive must continuously adapt its product offerings to meet these changing demands. Moreover, the company must navigate the complexities of global market dynamics, including currency fluctuations, economic instability, and competitive pressures, which can impact sales and profitability. Staying attuned to consumer trends and market

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.