Decoding Corcept Therapeutics (CORT)'s Market Value: An In-Depth Analysis

Corcept Therapeutics Inc (NASDAQ:CORT) has recently witnessed a daily gain of 1.95% and a 3-month gain of 33.85%. Its Earnings Per Share (EPS) stands at 0.83. But the question remains: Is the stock fairly valued? In this article, we will conduct a valuation analysis to answer this question and encourage readers to delve into the following analysis for a comprehensive understanding.

Company Overview

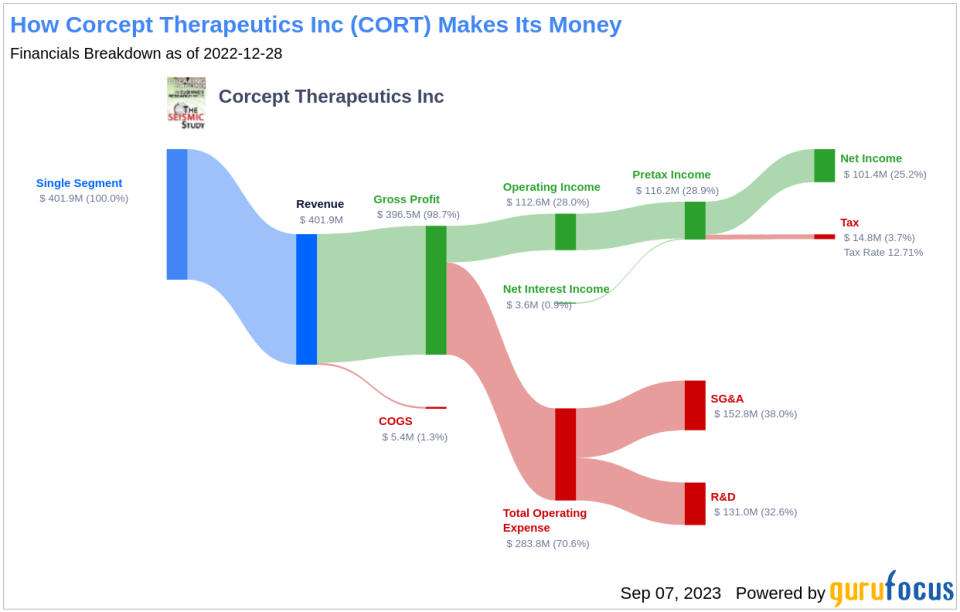

Corcept Therapeutics Inc is a commercial-stage pharmaceutical company dedicated to the discovery and development of medications that modulate the effects of the hormone cortisol. These medications are designed to address severe metabolic, oncologic, and neuropsychiatric disorders. As of September 07, 2023, the company's stock price stands at $32.15, with a market cap of $3.30 billion. Its sales have reached $428.20 million, indicating a robust performance.

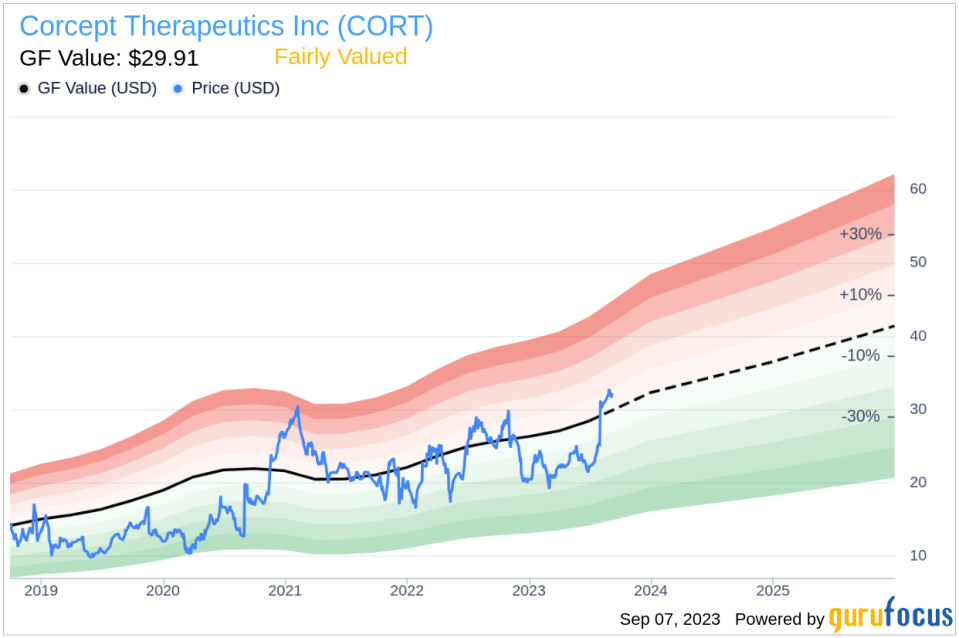

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If the stock price significantly deviates from the GF Value Line, it indicates that the stock is overvalued or undervalued, which can impact its future return.

Based on our calculations, Corcept Therapeutics (NASDAQ:CORT) appears to be fairly valued. Given its current price and market cap, the stock's long-term return is likely to be close to the rate of its business growth.

Financial Strength

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before purchasing shares. Corcept Therapeutics has a cash-to-debt ratio of 1223.1, ranking better than 83.66% of 1518 companies in the Biotechnology industry. This indicates the company's strong financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. Corcept Therapeutics has been profitable 7 out of the past 10 years, with an operating margin of 23.09%, ranking better than 91.35% of 1029 companies in the Biotechnology industry. This indicates its strong profitability.

However, growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of Corcept Therapeutics is 11.5%, ranking better than 56.96% of 762 companies in the Biotechnology industry. However, its 3-year average EBITDA growth rate is 2.4%, ranking worse than 53.82% of 1256 companies in the Biotechnology industry.

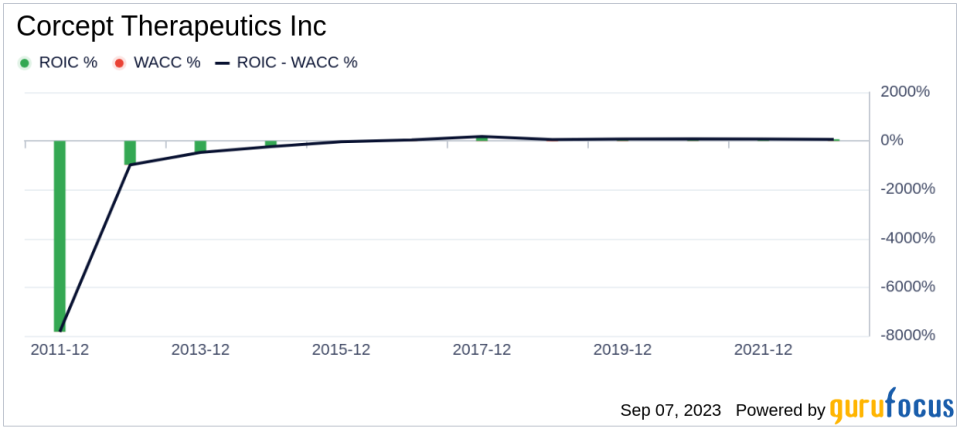

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to determine its profitability. In the past 12 months, Corcept Therapeutics's ROIC was 88.12, and its WACC was 6.93, indicating that the company is creating value for shareholders.

Conclusion

In conclusion, Corcept Therapeutics (NASDAQ:CORT) appears to be fairly valued. The company's financial condition and profitability are strong, although its growth ranks worse than 53.82% of 1256 companies in the Biotechnology industry. To learn more about Corcept Therapeutics stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.