Decoding Dominion Energy Inc (D): A Strategic SWOT Insight

Robust commitment to safety and workforce diversity strengthens corporate culture.

Strategic investments in renewable energy and grid modernization signal growth potential.

Market volatility and regulatory challenges pose threats to operational stability.

Financial agility may be tested by the need to navigate complex partnership arrangements.

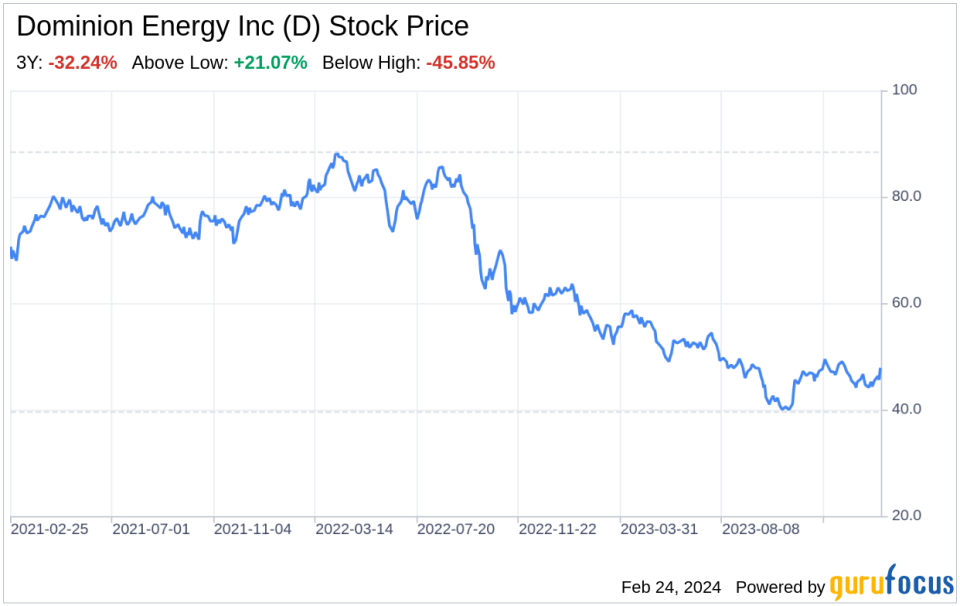

On February 23, 2024, Dominion Energy Inc (NYSE:D) filed its 10-K report, offering a comprehensive view of its financial health and strategic direction. As an integrated energy company based in Richmond, Virginia, Dominion Energy boasts a formidable electric generation capacity and an extensive network of electric transmission and distribution lines. The company's latest financial tables reveal a strategic focus on expanding its renewable energy footprint, notably through the construction of a 5.2 GW wind farm off the Virginia Beach coast. This financial overview sets the stage for a detailed SWOT analysis, providing investors with a nuanced understanding of Dominion Energy's competitive position and future prospects.

Strengths

Commitment to Safety and Employee Well-being: Dominion Energy's dedication to safety is evident in its impressive OSHA Recordable Rate, which consistently outperforms the industry average. The company's proactive approach to employee health, including safety performance measures in annual incentive plans, reflects a culture that prioritizes the well-being of its workforce. This commitment not only enhances employee morale but also reduces operational risks associated with workplace accidents.

Diversity and Talent Development: The company's focus on cultivating a diverse and skilled workforce is another significant strength. With a clear goal to increase diverse representation to 40% by 2026, Dominion Energy has made consistent progress in this area. The sponsorship of nine employee resource groups and the inclusion of diversity training in incentive plans underscore the company's strategic approach to fostering an inclusive work environment, which can drive innovation and attract top talent.

Strategic Capital Investments: Dominion Energy's capital plan, including the $9 billion investment in new generation capacity and grid modernization, positions the company to meet the growing demand for electricity, particularly from data centers. This forward-looking investment strategy is designed to enhance service reliability, accommodate renewable generation, and ultimately support long-term growth.

Weaknesses

Dependence on Regulatory Outcomes: Dominion Energy's earnings are significantly influenced by the regulatory environment, particularly the rates established by the Virginia and North Carolina Commissions. The company's financial performance can be impacted by changes in these rates, as well as by the variability in operating and maintenance expenditures. This regulatory dependence introduces an element of uncertainty into the company's revenue streams.

Operational Challenges in Nonregulated Generation: The nonregulated generation business faces a challenging market with exposure to price volatility for electricity and nuclear fuel. The company's financial results could be adversely affected if it fails to effectively manage these risks through long-term power purchase agreements or hedging strategies.

Complex Partnership Arrangements: Dominion Energy's operations through partnership arrangements may limit operational flexibility and introduce financial risks. Disputes or divergent interests among partners could lead to operational impasses or financial impacts that the company may not be able to unilaterally resolve.

Opportunities

Renewable Energy Expansion: The construction of the 5.2 GW wind farm and the company's commitment to renewable energy present significant growth opportunities. These initiatives align with global trends toward sustainable energy sources and can enhance Dominion Energy's market position as a leader in clean energy.

Grid Modernization Initiatives: The company's ten-year plan to transform its electric grid into a smarter, stronger, and greener infrastructure represents a strategic opportunity to improve system reliability and customer experience. By leveraging technology and integrating distributed energy resources, Dominion Energy can set a new standard for utility services.

Strategic Asset Sales: The potential sale of certain regulated gas distribution operations and a 50% noncontrolling interest in the CVOW Commercial Project could provide Dominion Energy with additional capital to invest in its core business areas, enhancing its financial flexibility and strategic focus.

Threats

Market and Price Volatility: Dominion Energy's exposure to the volatile wholesale electricity market and the fluctuating cost of nuclear fuel could impact its financial stability. The company's financial performance is susceptible to changes in natural gas prices, which influence the wholesale price of electricity.

Cybersecurity Risks: As an energy company with critical infrastructure, Dominion Energy faces the threat of cyber intrusions that could severely impair operations and damage its reputation. Despite a comprehensive cybersecurity program, the evolving nature of cyber threats remains a significant concern.

Public Health Crises: The COVID-19 pandemic highlighted the potential for public health crises to disrupt operations, reduce energy demand, and impact financial markets. Future outbreaks could similarly affect Dominion Energy's business, necessitating robust contingency planning.

In conclusion, Dominion Energy Inc (NYSE:D) exhibits a strong commitment to safety, workforce diversity, and strategic capital investments, positioning it well for future growth. However, the company must navigate regulatory dependencies, operational challenges in nonregulated markets, and complex partnership dynamics. Opportunities for expansion in renewable energy and grid modernization are promising, but threats from market volatility, cybersecurity risks, and public health crises loom large. Investors should weigh these factors carefully when considering Dominion Energy's prospects in an increasingly competitive and dynamic energy market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.