Decoding Equity Residential (EQR): A Strategic SWOT Insight

Equity Residential's strategic focus on high-demand urban markets positions it for long-term growth despite economic uncertainties.

Investment in sustainable practices and technology may enhance operational efficiency and attract environmentally conscious tenants.

Geographic concentration and market competition present ongoing challenges for Equity Residential.

Corporate responsibility and technology initiatives reflect a forward-thinking approach but carry execution risks.

On February 15, 2024, Equity Residential (NYSE:EQR) filed its 10-K report, revealing a comprehensive overview of the company's financial health and strategic direction. Equity Residential, a leading apartment real estate investment trust (REIT), owns a portfolio of 304 apartment communities with approximately 80,000 units and is actively developing additional properties. The company's focus on owning high-quality properties in strategic urban and suburban submarkets across key cities has positioned it for sustained growth. Despite broader economic concerns, Equity Residential's financial tables indicate a robust demand for its apartment communities, underpinned by high single-family home ownership costs and positive household formation trends. The company's commitment to sustainability, diversity, and inclusion further strengthens its market position, aligning with evolving stakeholder values.

Strengths

Market Position and Quality Portfolio: Equity Residential boasts a strong market presence, owning large, high-quality properties in urban and suburban submarkets of major cities. This strategic positioning allows the company to capitalize on the high costs of single-family home ownership and the strong demand for multifamily housing. The company's focus on affluent renters in high-earning sectors reduces the risk during economic downturns and enables more robust rent growth in favorable conditions.

Sustainability and Corporate Responsibility: Equity Residential's commitment to sustainability and corporate responsibility is a significant strength. The company's sustainability program aims to manage environmental impacts and climate-related risks through optimized capital investments and technologies. Initiatives like issuing green bonds and setting science-based targets to reduce greenhouse gas emissions underscore the company's dedication to environmental stewardship and may enhance its appeal to socially conscious investors and tenants.

Weaknesses

Geographic Concentration: While the company's focus on established coastal markets is a strength, it also presents a weakness due to the potential for localized economic or regulatory impacts. If adverse conditions arise in these concentrated markets, the effect on Equity Residential's operations could be more pronounced than if the portfolio were more geographically diverse.

Competition and Technological Advancements: Equity Residential faces stiff competition from other housing options, which could affect its ability to attract and retain residents. Additionally, the need to keep up with technological advancements and resident demands for modern amenities requires ongoing investment, posing a challenge to maintaining competitive edge and operational efficiency.

Opportunities

Expansion into New Markets: Equity Residential has the opportunity to expand its portfolio into new markets, potentially reducing the risks associated with geographic concentration. By strategically targeting markets with favorable multifamily property conditions, the company can diversify its holdings and tap into new sources of demand.

Demographic Trends and Housing Demand: Positive household formation trends, particularly among younger generations, present an opportunity for Equity Residential to cater to the needs of these demographic segments. The company's focus on locations with convenient access to transportation, employment, and amenities aligns well with the preferences of Millennials and Generation Z, who are more likely to rent.

Threats

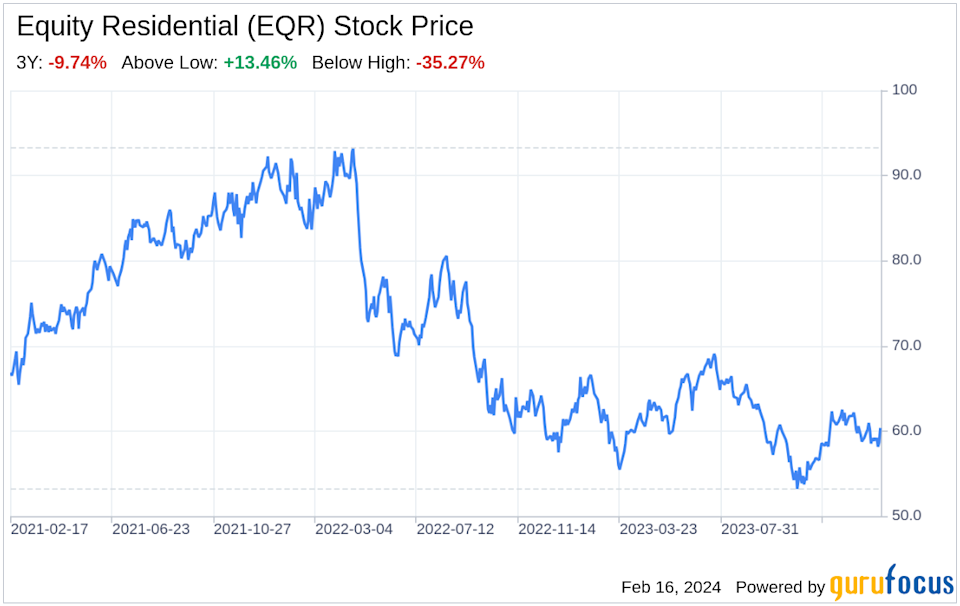

Economic Uncertainties and Market Volatility: Economic downturns and market volatility can adversely affect the real estate industry, impacting rental income and property values. Equity Residential's short-term lease structure exposes it to the effects of declining market rents more quickly, potentially making its results of operations and cash flows more volatile.

Regulatory Risks: The company operates in markets that may be subject to rent control or other regulatory changes, which could limit its ability to increase rents and affect profitability. Additionally, increased focus on corporate responsibility and sustainability could impose additional costs and expose Equity Residential to new risks if it fails to meet evolving standards.

In conclusion, Equity Residential (NYSE:EQR) demonstrates a robust strategic position with its high-quality portfolio and focus on dynamic urban markets. Its commitment to sustainability and corporate responsibility further enhances its appeal. However, the company must navigate the challenges of geographic concentration, competition, and regulatory risks. By leveraging its strengths and addressing its weaknesses, Equity Residential can capitalize on market opportunities and mitigate potential threats, positioning itself for continued success in the multifamily real estate sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.