Decoding Fifth Third Bancorp (FITB): A Strategic SWOT Insight

Comprehensive SWOT analysis based on Fifth Third Bancorp's latest SEC 10-K filing.

Deep dive into the company's competitive positioning and future outlook.

Expert financial overview and strategic assessment of Fifth Third Bancorp's market dynamics.

On February 27, 2024, Fifth Third Bancorp (NASDAQ:FITB), a diversified financial-services company headquartered in Cincinnati, filed its annual 10-K report with the SEC. With over $200 billion in assets, Fifth Third operates a vast network of full-service banking centers and ATMs across multiple states. The 10-K filing provides a detailed account of the company's financial performance, revealing a robust financial foundation with significant revenue contributions from both net interest income and noninterest income. The bank's strategic initiatives and investments in technology and human capital resources reflect its commitment to growth and competitive advantage. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as disclosed in the 10-K filing, offering investors a nuanced understanding of Fifth Third Bancorp's position in the financial sector.

Strengths

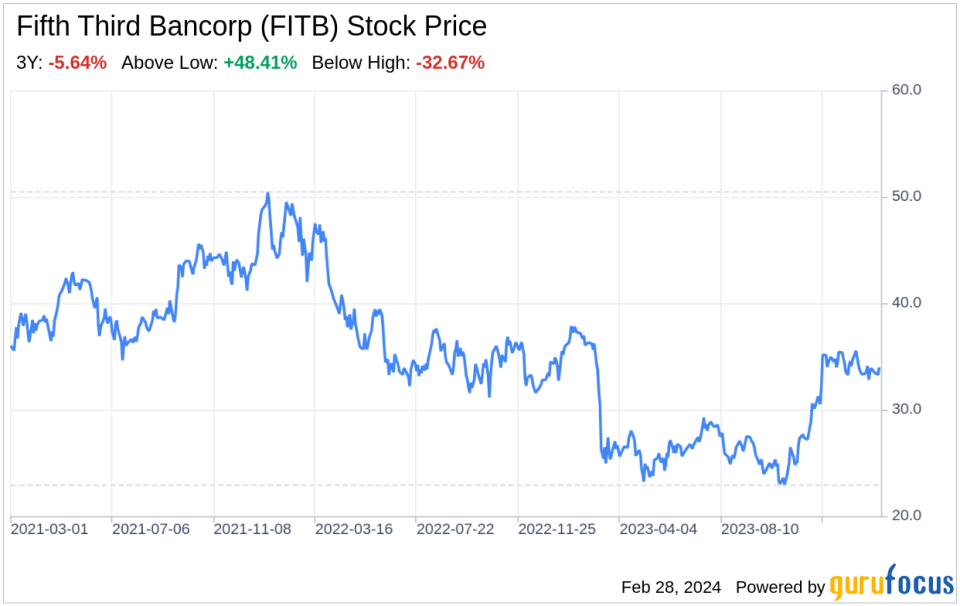

Robust Financial Performance: Fifth Third Bancorp's financial health is a testament to its operational efficiency and strategic focus. The bank's revenue streams are well-diversified, with 67% of total revenue derived from net interest income and 33% from noninterest income, indicating a balanced approach to revenue generation. This financial stability is further underscored by the bank's competitive performance against market indices, with shareholders experiencing notable returns over five and ten-year periods. Such a strong financial base positions Fifth Third Bancorp favorably for sustained growth and resilience in the face of market fluctuations.

Human Capital and Inclusive Culture: Fifth Third Bancorp's emphasis on human capital strategy has resulted in a workforce that is both skilled and diverse. With approximately 57% female and 29% persons of color, the bank's commitment to equality, equity, and inclusion is clear. The establishment of Business Resource Groups (BRGs) and significant investments in employee development, including over 779,000 training hours in 2023, demonstrate Fifth Third's dedication to fostering an engaging workplace. This focus on human capital not only enhances employee satisfaction and retention but also drives innovation and business success.

Weaknesses

Operational Challenges with Strategic Initiatives: Fifth Third Bancorp acknowledges the complexity and resource intensity of its strategic initiatives. The bank faces the challenge of effectively managing and executing these initiatives amidst competing priorities, which could potentially impact its business operations and reputation. The difficulty in adapting to organizational changes and integrating new products, services, and partnerships is a weakness that requires careful management to avoid litigation, regulatory action, or reputational damage.

Technological System Enhancements: While technology investments are crucial for staying competitive, Fifth Third Bancorp's ability to successfully implement and integrate system enhancements remains a concern. Any failure in this regard could lead to financial reporting inaccuracies, regulatory sanctions, reputational harm, and additional costs. The bank must navigate these technological challenges to maintain its competitive position and ensure operational efficiency.

Opportunities

Market Expansion and Product Innovation: Fifth Third Bancorp operates in a dynamic industry where changes in technology and customer preferences present opportunities for growth. The bank's strategic focus on product development and process re-engineering positions it to capitalize on emerging market trends. By leveraging its strong financial foundation and commitment to innovation, Fifth Third has the potential to expand its market share and introduce new offerings that meet evolving customer needs.

Investment in Fraud Prevention: The rise in financial crimes such as fraud and identity theft presents an opportunity for Fifth Third Bancorp to strengthen its position as a secure and trustworthy financial institution. The bank's ongoing investments in people and systems to prevent, detect, and mitigate fraud not only protect its customers but also enhance its reputation for security and reliability, potentially attracting more clients who prioritize these aspects.

Threats

Intense Competition and Regulatory Changes: Fifth Third Bancorp operates in a highly competitive environment with constant regulatory changes. The bank faces threats from non-traditional banking services and must navigate an evolving landscape of financial regulations. These external factors could impact the bank's ability to innovate, grow, and maintain profitability. Staying ahead of the competition and adapting to regulatory demands are critical challenges that Fifth Third must address to safeguard its market position.

Economic and Political Uncertainties: Global and domestic uncertainties, such as political conflicts, trade disputes, and monetary policy changes, pose significant threats to Fifth Third Bancorp's operations. These factors can affect financial markets, economic activity, and the bank's ability to raise liquidity. Additionally, changes in interest rates impact Fifth Third's income and cash flows, necessitating effective risk management strategies to mitigate potential adverse effects on the bank's financial performance.

In conclusion, Fifth Third Bancorp (NASDAQ:FITB) exhibits a strong financial foundation and a commitment to an inclusive and skilled workforce, positioning it well in the competitive financial services landscape. However, the bank must navigate operational challenges, technological advancements, and an intense competitive environment while seizing opportunities for market expansion and fraud prevention. External threats from economic and political uncertainties, as well as regulatory changes, require vigilant risk management. Overall, Fifth Third Bancorp's strategic initiatives and focus on innovation suggest a forward-looking approach that could drive future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.