Decoding Flutter Entertainment PLC (LSE:FLTR): A Strategic SWOT Insight

Flutter Entertainment PLC exhibits a robust online presence with 12.3 million Average Monthly Players.

The company's diversified portfolio and global reach position it well in the competitive sports betting and iGaming market.

Regulatory changes and market expansion opportunities are key factors influencing Flutter Entertainment PLC's future performance.

Financial performance reflects a net loss per share, indicating areas for strategic improvement and growth.

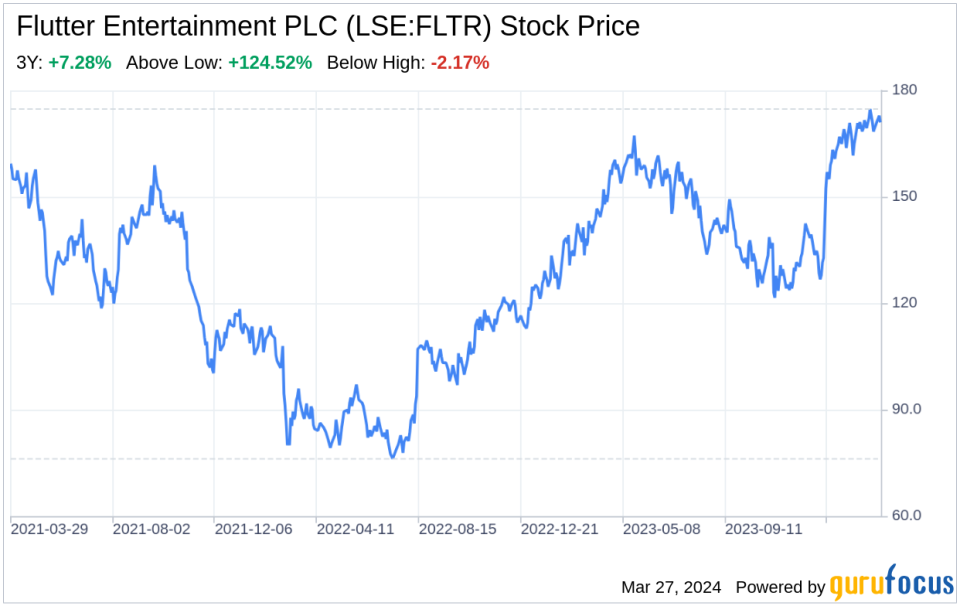

On March 26, 2024, Flutter Entertainment PLC, a leading global sports betting, gaming, and entertainment provider, released its 10-K filing, offering a comprehensive view of its financial health and strategic positioning. Flutter Entertainment PLC operates through various segments, including PBB Online, Australia, U.S., and PBB Retail, with PBB Online being the largest revenue contributor. The company's financial tables reveal a dynamic operation with 12.3 million Average Monthly Players and a revenue of $11,790 million for fiscal 2023. Despite these impressive figures, the company reported a net loss per share of $(6.89), highlighting areas for potential improvement. This SWOT analysis aims to dissect the strengths, weaknesses, opportunities, and threats as presented in the filing, providing investors with a nuanced understanding of Flutter Entertainment PLC's market position and future prospects.

Strengths

Market Leadership and Brand Portfolio: Flutter Entertainment PLC's market leadership is underscored by its substantial online presence, boasting 12.3 million Average Monthly Players. The company's diverse brand portfolio, including FanDuel, Sportsbet, and Sky Betting & Gaming, provides a competitive edge in the sports betting and iGaming industry. This strength is not only reflected in the company's significant revenue generation but also in its ability to leverage the "Flutter Edge," which encompasses product, technology, people, and capital advantages derived from its scale and experience.

Geographic and Product Diversification: The company's operations span across key markets in the U.S., UKI, Australia, and internationally, offering products like sportsbook, iGaming, and other betting services. This geographic and product diversification mitigates risks associated with regulatory changes in individual markets and allows Flutter Entertainment PLC to tap into various growth profiles, enhancing its resilience and stability.

Weaknesses

Financial Performance Concerns: Despite its strong revenue figures, Flutter Entertainment PLC reported a net loss per share for fiscal 2023. This financial performance indicates challenges in achieving profitability and may raise concerns among investors regarding the company's cost management and long-term financial sustainability.

Regulatory Compliance and Market Adaptability: The company operates in a highly regulated industry, where laws and regulations are constantly evolving. Adapting to these changes requires significant resources and can impact market strategies. Additionally, the filing notes material weaknesses in internal control over financial reporting, which could affect the company's ability to accurately report financial conditions or prevent fraud.

Opportunities

Expansion into New Markets: The ongoing legalization of sports betting and iGaming in various regions, particularly in the U.S., presents significant growth opportunities for Flutter Entertainment PLC. The company's established presence and brand recognition position it well to capitalize on new market openings and extend its leadership position.

Technological Advancements and Product Innovation: Flutter Entertainment PLC's commitment to innovation and technology can drive future growth. By introducing new products and enhancing user experiences, the company can attract new customers and retain existing ones, further solidifying its market position.

Threats

Intensifying Market Competition: The sports betting and iGaming market is becoming increasingly competitive, with low barriers to player switching between operators. Flutter Entertainment PLC must continuously innovate and leverage its competitive advantages to maintain and grow its market share.

Regulatory Risks and Compliance Costs: Changes in the regulatory landscape can limit marketing channels or alter player engagement with products. Compliance with new regulations can also lead to increased operational costs, affecting the company's profitability and strategic flexibility.

In conclusion, Flutter Entertainment PLC's SWOT analysis reveals a company with a strong market presence and a diversified portfolio that positions it well in the competitive sports betting and iGaming industry. While financial performance and regulatory compliance present challenges, the company's opportunities for market expansion and technological innovation offer pathways for growth. The threats of market competition and regulatory risks must be navigated carefully to ensure long-term success. Overall, Flutter Entertainment PLC's strategic approach and market dynamics suggest a company with the potential to overcome its weaknesses and threats, leveraging its strengths and opportunities to drive future growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.