Decoding Franklin Resources Inc (BEN): A Strategic SWOT Insight

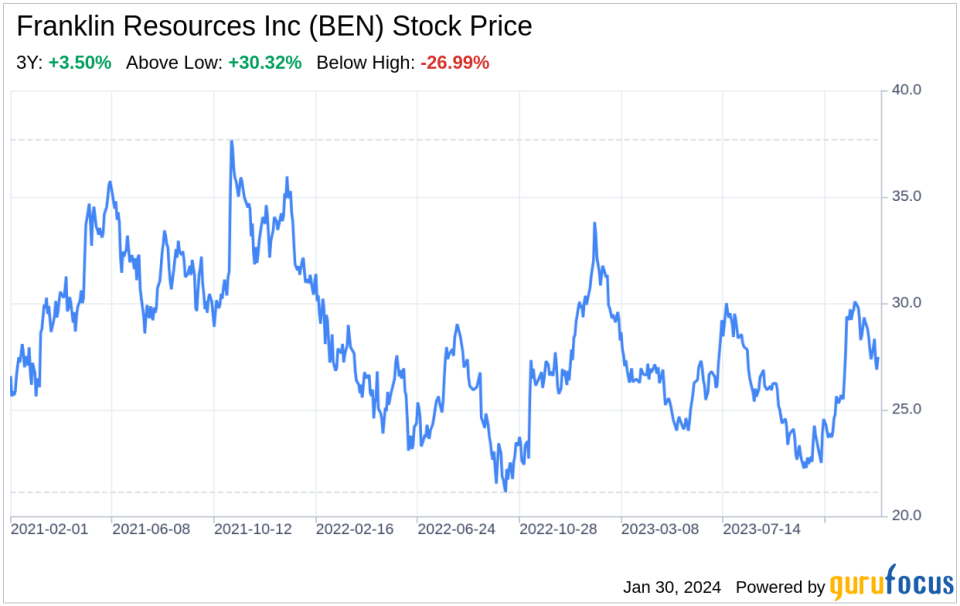

Franklin Resources Inc (NYSE:BEN) showcases robust financial performance with significant year-over-year net income growth.

Global investment management services with a diversified asset and client base strengthen Franklin Resources Inc's market position.

Recent acquisition of Putnam Investments indicates strategic growth, yet poses integration risks.

Market volatility and regulatory changes remain key threats to Franklin Resources Inc's operational landscape.

Franklin Resources Inc (NYSE:BEN), a global investment management organization, has recently filed its 10-Q report on January 29, 2024, revealing a comprehensive financial performance for the quarter ended December 31, 2023. The company has demonstrated a strong financial position with total operating revenues increasing to $1,991.1 million from $1,967.1 million in the previous year. Notably, net income attributable to Franklin Resources Inc surged to $251.3 million, up from $165.6 million, reflecting a robust year-over-year growth. This financial overview sets the stage for a detailed SWOT analysis, providing investors with a deeper understanding of the company's strategic positioning and potential investment opportunities.

Strengths

Financial Performance and Revenue Growth: Franklin Resources Inc has exhibited a solid financial performance with a notable increase in net income, from $165.6 million in 2022 to $251.3 million in 2023. This 51.7% growth in net income is a testament to the company's effective management and strategic initiatives. The increase in operating revenues, particularly investment management fees, which rose from $1,631.8 million to $1,652.2 million, underscores the company's ability to attract and retain assets under management (AUM), despite market fluctuations. The effective investment management fee rate also saw an uptick, contributing to the revenue growth.

Global Presence and Diversified Portfolio: With over a third of its AUM invested in global/international strategies and 29% of managed assets sourced from clients outside the United States, Franklin Resources Inc benefits from a geographically diversified client base and investment portfolio. This global footprint not only mitigates the risk associated with any single market but also allows the company to capitalize on growth opportunities across different regions and asset classes.

Acquisition of Putnam Investments: The strategic acquisition of Putnam Investments, completed on January 1, 2024, positions Franklin Resources Inc for further growth. Putnam brings additional expertise and product offerings to the company's already extensive lineup, potentially leading to increased AUM and revenue streams. This move also reflects Franklin Resources Inc's commitment to expanding its market share and enhancing its competitive edge.

Weaknesses

Operational Costs and Expenses: Despite the increase in revenues, Franklin Resources Inc's operating expenses also rose from $1,773.1 million to $1,784.6 million. The uptick in compensation and benefits, which form a significant portion of the total expenses, indicates the company's investment in human capital. However, this also puts pressure on the company's margins, especially in a competitive industry where cost efficiency can be a differentiator.

Dependence on Market Conditions: The investment management industry is highly sensitive to market conditions. Franklin Resources Inc's performance fees, which decreased due to lower fees earned by Lexington Partners L.P., highlight the company's exposure to market volatility. Such dependence on market performance could pose challenges in sustaining revenue growth during economic downturns or periods of market instability.

Integration Risks from Acquisitions: The recent acquisition of Putnam Investments, while strategically sound, introduces integration risks. The process of integrating operations, cultures, and systems can be complex and costly, with potential to disrupt ongoing business activities. If not managed effectively, these risks could offset the anticipated benefits of the acquisition.

Opportunities

Expansion of Investment Offerings: The acquisition of Putnam Investments opens up opportunities for Franklin Resources Inc to expand its investment offerings and cater to a broader client base. By leveraging Putnam's strengths and integrating them into its existing operations, Franklin Resources Inc can enhance its product mix and potentially increase its AUM.

Technological Advancements: Investing in technology infrastructure is crucial for maintaining a competitive edge. Franklin Resources Inc has the opportunity to harness technological advancements to improve operational efficiency, enhance customer experience, and develop innovative investment products that cater to evolving investor needs.

Emerging Markets Growth: With a significant portion of AUM invested in global strategies, Franklin Resources Inc is well-positioned to capitalize on growth in emerging markets. As these markets mature and wealth increases, the demand for investment management services is likely to grow, providing a lucrative opportunity for expansion.

Threats

Market Volatility: The investment management industry is inherently exposed to market volatility. Fluctuations in equity and bond markets can significantly impact AUM and, consequently, revenue from management fees. Franklin Resources Inc must navigate this uncertainty and adapt its strategies to mitigate the impact of market downturns.

Regulatory Changes: The global financial regulatory landscape is constantly evolving, with potential implications for compliance costs and operational flexibility. Franklin Resources Inc faces the threat of increased regulatory scrutiny, which could lead to higher compliance costs and impact its profitability.

Competitive Pressure: The industry is marked by intense competition, with numerous players vying for market share. Franklin Resources Inc must continuously innovate and differentiate its offerings to retain existing clients and attract new ones, amidst the pressure from both traditional asset managers and fintech disruptors.

In conclusion, Franklin Resources Inc (NYSE:BEN) presents a strong financial profile with significant growth in net

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.