Decoding Genuine Parts Co (GPC): A Strategic SWOT Insight

GPC's robust global presence and brand strength underscore its market-leading positions.

Strategic financial objectives focused on revenue growth, operating margins, and strong cash flow.

Competitive differentiation through extensive supply chain and advanced technology solutions.

Challenges include intense competition, geopolitical risks, and supply chain disruptions.

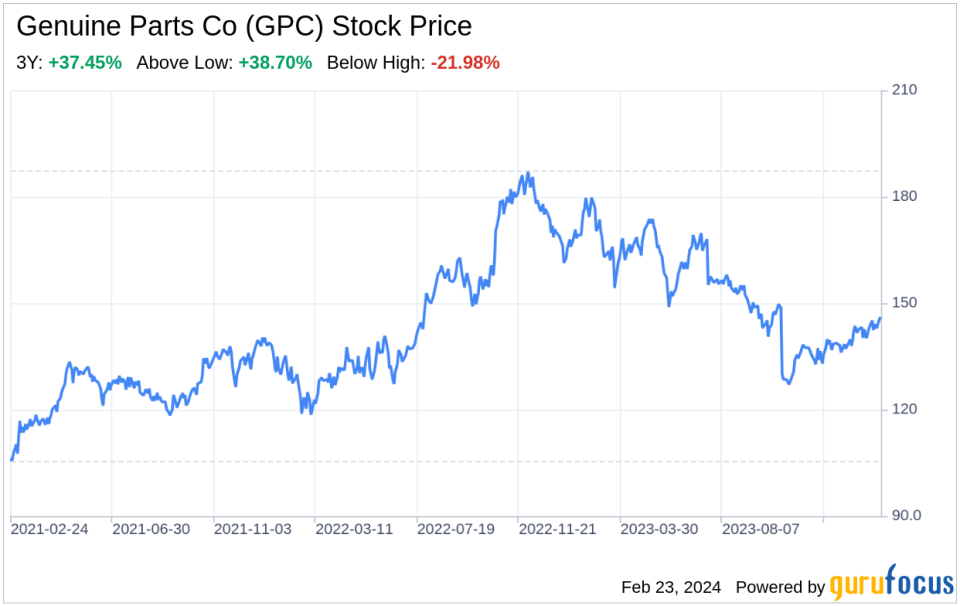

On February 22, 2024, Genuine Parts Co (NYSE:GPC) filed its annual 10-K report, providing a comprehensive overview of its financial health and strategic direction. As a global distributor of automotive and industrial replacement parts, GPC operates from over 10,700 locations, with a significant presence in North America, Europe, and Australasia. The company's financial tables reveal a strong balance sheet, with a focus on revenue growth exceeding market growth, improving operating margins, and maintaining robust cash flows. GPC's strategic financial objectives are designed to drive value for stakeholders and position the company for long-term profitable growth. With a market capitalization of approximately $19.3 billion as of June 30, 2023, and a history of 67 consecutive years of dividend increases, GPC demonstrates financial resilience and a commitment to shareholder returns.

Strengths

Global Presence and Brand Recognition: Genuine Parts Co (NYSE:GPC) boasts a formidable global footprint, with operations spanning North America, Europe, and Australasia. This extensive reach is a testament to the company's robust supply chain and distribution capabilities, which ensure timely delivery of over 800,000 different parts to a diverse customer base. The NAPA brand, in particular, is a significant asset, enhancing GPC's visibility and credibility in the automotive parts market. With a market that exceeds $200 billion, the company's strategic acquisitions and technology advancements position it to capitalize on the fragmented nature of the industry and outmaneuver smaller competitors.

Financial Robustness: GPC's financials reflect a company with a strong balance sheet and cash flows. The strategic financial objectives outlined in the 10-K filing emphasize revenue growth outpacing market growth, improving operating margins, and effective capital allocation. These goals are not just aspirational; they are backed by a history of financial discipline and a track record of delivering shareholder value, as evidenced by the company's consistent dividend growth and market capitalization.

Weaknesses

Intense Competition: The automotive and industrial parts sectors are highly competitive landscapes. GPC faces a myriad of competitors, from international chains to local stores, internet providers, and full-service repair shops. The pressure to maintain competitive pricing and service levels is relentless, and any strategic missteps could lead to a loss of market share. Furthermore, the industry's ongoing consolidation could empower competitors with enhanced financial positions, allowing them to offer more competitive prices and leverage developing technologies more effectively.

Supply Chain Vulnerabilities: Despite its extensive distribution network, GPC is not immune to supply chain disruptions, which have been exacerbated by recent global events such as the COVID-19 pandemic and geopolitical tensions. The 10-K filing acknowledges these challenges, noting that disruptions have not materially impacted the business to date. However, continued or new supply chain issues could pose significant risks to GPC's operations and financial results in the future.

Opportunities

Market Expansion and Diversification: GPC's position in a large and fragmented market presents numerous opportunities for strategic acquisitions and expansion into new regions. The company's focus on both the DIFM and DIY segments, along with its ability to cater to a wide range of vehicle models, including electric and hybrid vehicles, positions it to capitalize on evolving market trends. Additionally, the industrial segment's potential growth due to nearshoring and increased demand for automation and robotics solutions offers a promising avenue for diversification and revenue growth.

Technological Advancements: GPC's commitment to enhanced technology solutions is a significant opportunity to differentiate itself from competitors. By leveraging data analytics, artificial intelligence, and machine learning, GPC can optimize its inventory management, improve customer service, and streamline operations. This technological edge could lead to increased efficiency, cost savings, and an improved customer experience, further solidifying GPC's market position.

Threats

Geopolitical Risks: GPC's international operations expose it to various geopolitical risks, including economic sanctions, trade disputes, and regional conflicts. The 10-K filing highlights concerns such as the Russia-Ukraine conflict and Middle East tensions, which could disrupt global supply chains and impact regional economies. These uncertainties could adversely affect GPC's business, particularly in Europe, and require vigilant risk management and contingency planning.

Technological Disruption: The automotive industry is undergoing significant transformation with the rise of electric vehicles, ride-sharing services, and autonomous driving technology. These shifts could alter the demand for traditional automotive parts and necessitate a strategic pivot for GPC. Staying ahead of these trends and adapting its product offerings will be crucial for GPC to maintain its relevance and competitive edge in a rapidly evolving market.

In conclusion, Genuine Parts Co (NYSE:GPC) presents a compelling case of a company with strong market presence, financial stability, and strategic growth opportunities. However, it must navigate a competitive landscape, supply chain vulnerabilities, and geopolitical risks. GPC's ability to leverage its strengths, address its weaknesses, capitalize on opportunities, and mitigate threats will be critical in shaping its future success and delivering value to its stakeholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.