Decoding Hannon Armstrong Sustainable Infrastructure Capital Inc's (HASI) Performance ...

Long-established in the REITs industry, Hannon Armstrong Sustainable Infrastructure Capital Inc (NYSE:HASI) has enjoyed a stellar reputation. It has recently witnessed a daily gain of 5.41%, juxtaposed with a three-month change of -37.26%. However, fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Hannon Armstrong Sustainable Infrastructure Capital Inc.

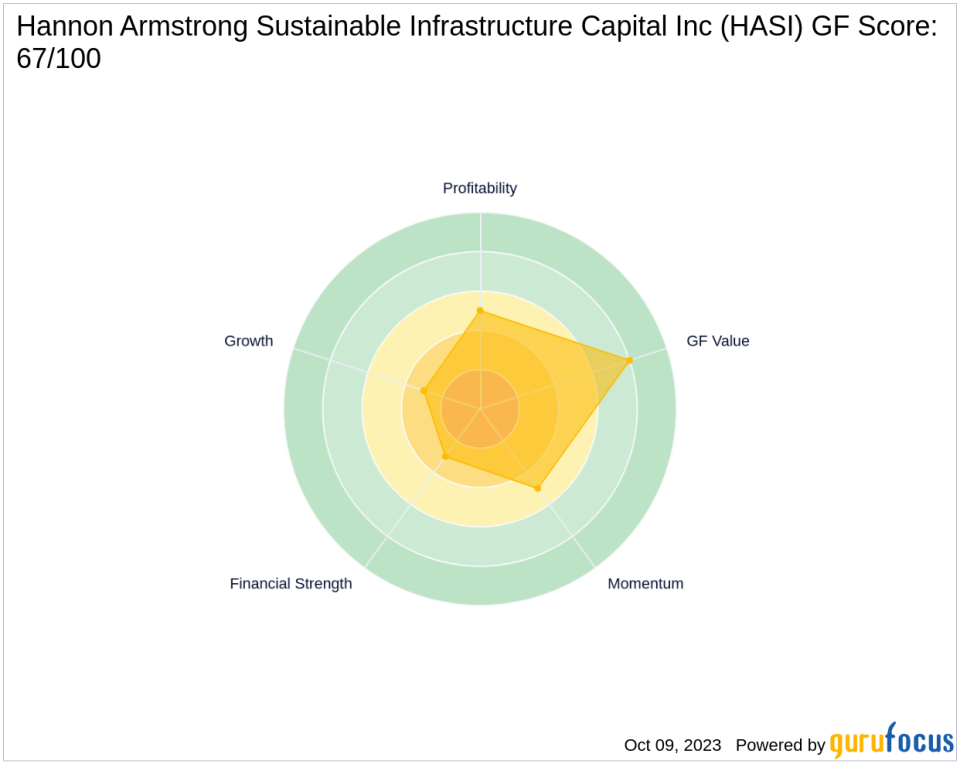

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Financial strength rank: 3/10

Profitability rank: 5/10

Growth rank: 3/10

GF Value rank: 8/10

Momentum rank: 5/10

Based on the above method, GuruFocus assigned Hannon Armstrong Sustainable Infrastructure Capital Inc the GF Score of 67 out of 100, which signals poor future outperformance potential.

Company Snapshot: Hannon Armstrong Sustainable Infrastructure Capital Inc

Hannon Armstrong Sustainable Infrastructure Capital Inc, with a market cap of $1.63 billion, provides debt and equity financing to the energy markets in the United States. The company focuses on investments in two types of projects: energy-efficiency projects and renewable-energy projects. Energy-efficiency projects reduce the energy use and energy cost of a building or facility through the improvement or installation of building components. Renewable-energy projects deploy cleaner energy sources such as solar and wind to generate power production. The company also provides financing solutions for other projects to improve energy efficiency and the environment. Its sales stand at $152.67 million, but it currently has an operating margin of 0.

Financial Strength Analysis

Hannon Armstrong Sustainable Infrastructure Capital Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company's low cash-to-debt ratio at 0.04 indicates a struggle in handling existing debt levels. Additionally, the company's debt-to-Ebitda ratio is 9999, which is above Joel Tillinghast's warning level of 4 and is worse than 0% of 525 companies in the REITs industry. Tillinghast said in his book Big Money Think's Small: Biases, Blind Spots, and Smarter Investing that a high debt-to-Ebitda ratio can be a red flag unless tangible assets cover the debt.

Profitability Analysis

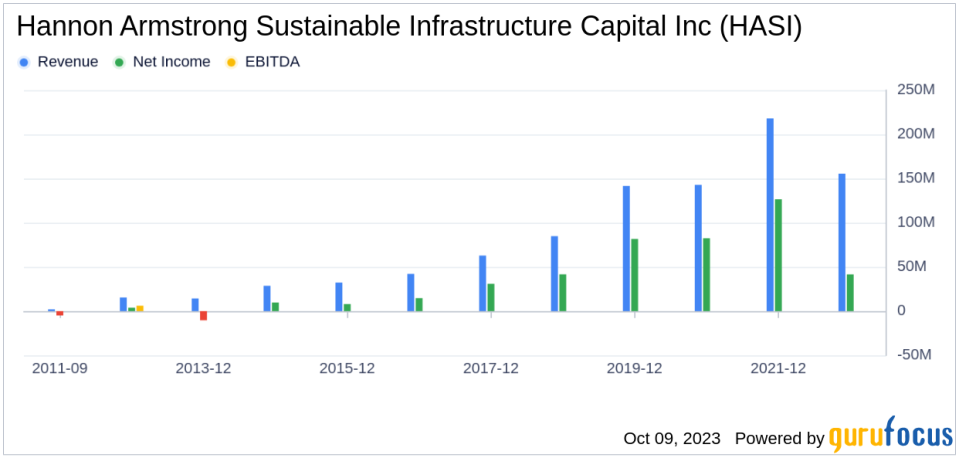

Hannon Armstrong Sustainable Infrastructure Capital Inc's low Profitability rank can also raise warning signals. The company's Net Margin has declined over the past five years (-45.63%), as shown by the following data: 2018: 49.10; 2019: 57.64; 2020: 57.76; 2021: 58.10; 2022: 26.70; .

Growth Prospects

A lack of significant growth is another area where Hannon Armstrong Sustainable Infrastructure Capital Inc seems to falter, as evidenced by the company's low Growth rank. The company's revenue has declined by -7.7 per year over the past three years, which underperforms worse than 82.28% of 632 companies in the REITs industry. Stagnating revenues may pose concerns in a fast-evolving market.

Conclusion

Given Hannon Armstrong Sustainable Infrastructure Capital Inc's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While the company has a commendable history in the REITs industry, its current financial health and growth prospects may not support sustained outperformance. Therefore, investors should exercise caution and conduct thorough research before making investment decisions.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.