Decoding Illinois Tool Works Inc (ITW): A Strategic SWOT Insight

Illinois Tool Works Inc exhibits a robust financial performance with a diverse portfolio across seven segments.

The company's decentralized, entrepreneurial culture fosters rapid adaptation to market dynamics.

ITW's 80/20 operating process and customer-back innovation drive operational excellence and organic growth.

Strategic divestitures and acquisitions align with ITW's focus on high-quality, differentiated markets.

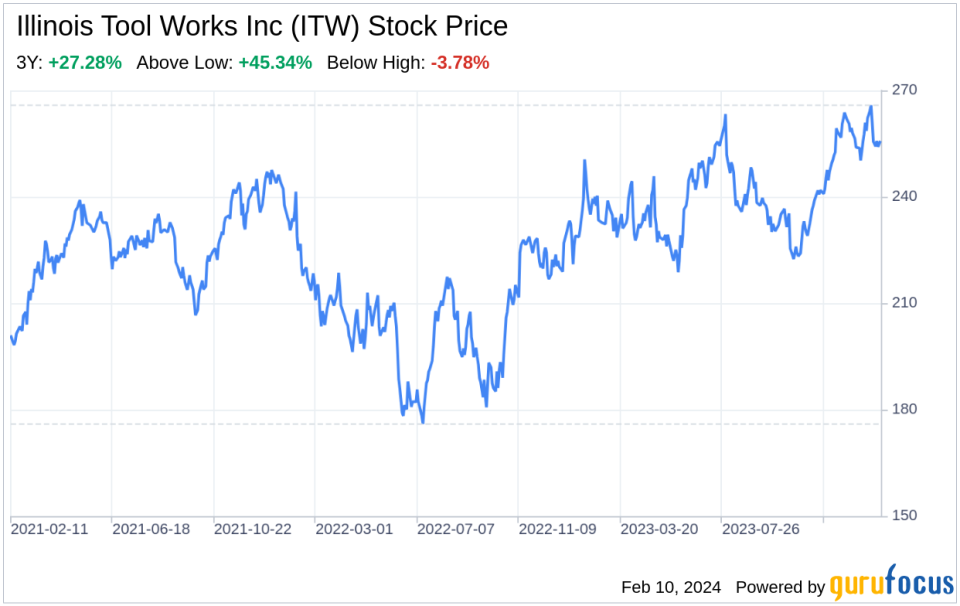

On February 9, 2024, Illinois Tool Works Inc (NYSE:ITW) filed its annual 10-K report, revealing a comprehensive overview of its financial health and strategic direction. As a diversified global manufacturer with a presence in 51 countries and a workforce of approximately 45,000, ITW operates through seven segments, including Automotive OEM, Food Equipment, and Welding, among others. The company's decentralized approach and 80/20 operating process, modeled on the Pareto principle, have been instrumental in driving its financial and operational success. With a market capitalization of $75.1 billion as of June 30, 2023, and a strong balance sheet, ITW is well-positioned to leverage its strengths and navigate through potential challenges. This SWOT analysis delves into the intricacies of ITW's strategic and financial nuances, as disclosed in its latest SEC filing, to provide investors with a clear understanding of the company's competitive standing and future prospects.

Strengths

Financial Robustness and Diversified Portfolio: ITW's financial strength is a testament to its diversified business model and effective management. The company's operations span across seven segments, each contributing to a balanced revenue stream that mitigates sector-specific risks. ITW's market capitalization of approximately $75.1 billion reflects investor confidence and a solid financial foundation. The company's ability to generate consistent revenue from its diverse portfolio, coupled with a disciplined approach to cost management, has resulted in strong financial performance, positioning ITW favorably against its competitors.

Decentralized, Entrepreneurial Culture and 80/20 Operating Process: ITW's decentralized structure and 80/20 operating process are central to its operational excellence. This approach allows individual divisions to focus on their most profitable products and customers, driving efficiency and innovation. The company's entrepreneurial culture empowers its workforce to act swiftly to market changes and customer needs, fostering a competitive edge in product development and customer service. ITW's commitment to this business model has consistently yielded high-quality organic growth and operational capabilities.

Weaknesses

Dependence on North American Markets: Despite ITW's global presence, approximately half of its revenue is derived from North America. This reliance on a single geographic market could expose the company to regional economic fluctuations and trade policies that may adversely affect its financial stability. Diversifying its revenue streams across more international markets could help ITW reduce this dependency and tap into emerging market growth opportunities.

Challenges in Innovation and Market Adaptation: While ITW prides itself on customer-back innovation, the pace of technological change and evolving market demands require continuous investment in research and development. ITW must ensure that its innovation pipeline remains robust and aligned with market trends to maintain its competitive advantage. Any lag in this area could result in lost opportunities and allow competitors to gain market share.

Opportunities

Expansion into Emerging Markets: ITW's strong financial position and operational model provide a platform for expansion into emerging markets. By leveraging its expertise and adapting its product offerings to local needs, ITW can tap into new customer segments and drive growth. The company's decentralized approach allows for flexibility in tailoring strategies to specific markets, potentially leading to increased market share and revenue diversification.

Strategic Acquisitions and Divestitures: ITW's strategic focus on high-quality businesses and its willingness to refine its portfolio through divestitures and acquisitions offer pathways to bolster its market position. The recent divestitures and the acquisition of the MTS Test & Simulation business demonstrate ITW's commitment to enhancing its long-term growth potential. These strategic moves enable ITW to concentrate on areas with significant competitive advantage and long-term value creation.

Threats

Competitive Pressure and Market Fragmentation: ITW operates in highly competitive and fragmented markets, facing challenges from both large multinational corporations and specialized regional players. The company must continuously innovate and differentiate its product offerings to maintain its market position. Failure to do so could result in pricing pressures, reduced market share, and profitability.

Regulatory and Environmental Risks: ITW's global operations are subject to various government regulations, including environmental, trade, and labor laws. Changes in these regulations could impose additional compliance costs or operational restrictions, impacting ITW's financial performance. Moreover, the physical risks associated with climate change could affect the availability and cost of raw materials, potentially disrupting the supply chain and increasing operating costs.

In conclusion, Illinois Tool Works Inc (NYSE:ITW) presents a strong financial profile with a diversified portfolio and a proven business model that emphasizes operational efficiency and customer-focused innovation. The company's decentralized structure and 80/20 process have been instrumental in driving its success. However, ITW must navigate challenges such as its reliance on North American markets and the need for continuous innovation to stay ahead of the competition. Opportunities for growth lie in strategic market expansion and acquisitions, while threats include competitive pressures and regulatory risks. ITW's forward-looking strategies, including its focus on high-quality organic growth and portfolio discipline, position it well to leverage its strengths and mitigate potential weaknesses and threats.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.