Decoding International Flavors & Fragrances Inc (IFF): A Strategic SWOT Insight

International Flavors & Fragrances Inc (NYSE:IFF) stands as a global leader in the creation and manufacturing of a diverse range of consumer product ingredients.

IFF's strategic divestitures and focus on innovation highlight its commitment to adapting to market demands and enhancing its competitive edge.

The company's extensive patent portfolio and global presence underscore its strengths in research, development, and market reach.

IFF's comprehensive approach to environmental, social, and governance (ESG) initiatives reflects its dedication to sustainable and responsible business practices.

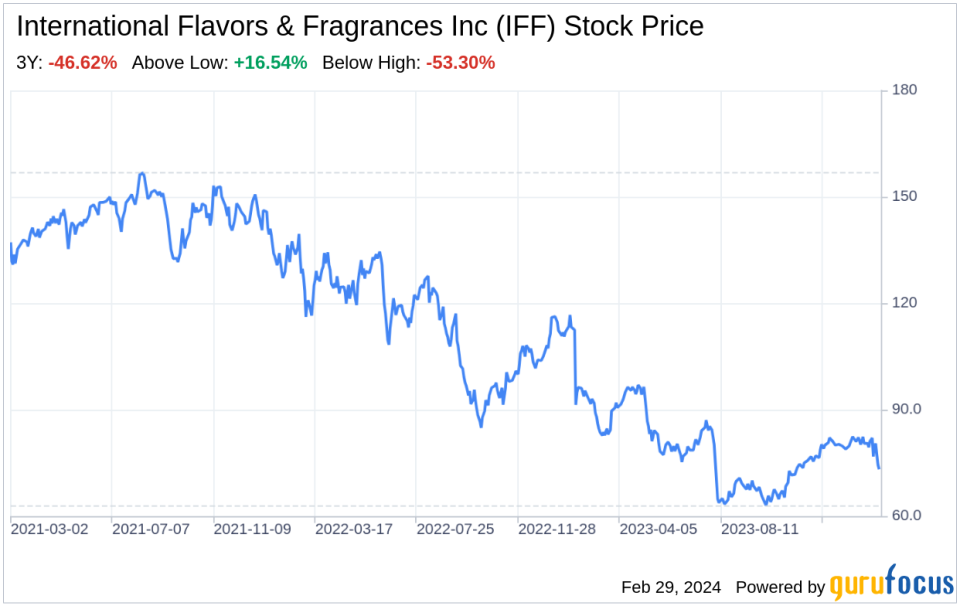

On February 28, 2024, International Flavors & Fragrances Inc (NYSE:IFF) filed its annual 10-K report, revealing a financial landscape that investors and stakeholders keenly anticipate. With sales reaching approximately $11.479 billion in 2023, IFF demonstrates a robust financial performance, underpinned by a diverse and global customer base. The company's strategic initiatives, including the divestiture of its Flavor Specialty Ingredients business and the anticipated sale of its Cosmetic Ingredients business, reflect a focused approach to optimizing its product portfolio. As we delve into a SWOT analysis of IFF, we will explore the strengths, weaknesses, opportunities, and threats that shape the company's strategic direction and market position.

Strengths

Global Market Leadership and Diverse Portfolio: International Flavors & Fragrances Inc (NYSE:IFF) has cemented its status as a global leader in the flavors and fragrances industry. With a sales footprint that spans across various consumer product categories and a customer base that includes both global consumer products companies and small to mid-sized enterprises, IFF's diverse portfolio is a testament to its strength. The company's leadership in key categories such as Tastes, Textures, Scents, Nutrition, Enzymes, Cultures, Soy Proteins, Pharmaceutical Excipients, and Probiotics positions it at the forefront of innovation and customer preference. This diversity not only mitigates the risk associated with reliance on a single market segment but also provides multiple avenues for growth and expansion.

Innovation and Intellectual Property: IFF's commitment to research and development is a cornerstone of its competitive advantage. With 880 granted U.S. patents and 431 pending applications, the company's investment in innovation has yielded a rich pipeline of unique molecules and delivery systems. These proprietary advancements enable IFF to offer differentiated products that are crucial for maintaining and expanding its market share. The company's global network of research and development centers fosters a culture of creativity and scientific excellence, ensuring that IFF remains at the cutting edge of the industry.

Weaknesses

Integration Challenges Post-Acquisitions: The integration of Frutarom and the N&B Transaction has significantly expanded IFF's customer base and product offerings. However, this expansion brings integration challenges that could potentially divert management's focus from core financial and operational goals. The need to adjust product development, manufacturing, distribution, and sales strategies to cater to a more diverse customer base requires significant effort and resources. If not managed effectively, these integration challenges could impact IFF's ability to maintain its competitive position and realize the full potential of its acquisitions.

Competitive Market Pressures: The flavors and fragrances market is characterized by intense competition from multinational and specialized companies. IFF faces the risk of aggressive price competition and the need to continuously innovate to stay ahead. The company's ability to protect its intellectual property and retain key employees is critical in this competitive landscape. Any failure to effectively compete could lead to reduced margins, loss of market share, and an adverse impact on profitability.

Opportunities

Strategic Divestitures and Market Focus: IFF's strategic decision to divest certain businesses, such as its Flavor Specialty Ingredients and Cosmetic Ingredients divisions, allows the company to streamline its operations and concentrate on areas with higher growth potential. This strategic realignment presents an opportunity for IFF to invest more heavily in its core competencies, potentially leading to increased innovation, efficiency, and market penetration in its key segments.

ESG Initiatives and Sustainable Solutions: IFF's comprehensive ESG roadmap, the 'Do More Good Plan,' aligns with the growing trend of sustainable business practices. The company's commitment to environmental stewardship, social equity, and governance transparency not only enhances its corporate reputation but also opens doors to new markets and customer segments that prioritize sustainability. By focusing on sustainable solutions, IFF can capitalize on the increasing demand for eco-friendly and socially responsible products.

Threats

Supply Chain Disruptions and Geopolitical Risks: IFF's reliance on a vast network of suppliers for raw materials exposes it to risks associated with supply chain disruptions and geopolitical developments. Events such as the Russia-Ukraine war and climate-change events could adversely affect the availability and cost of raw materials, impacting IFF's business operations and financial results. The company must navigate these risks carefully to ensure consistent product quality and delivery to its customers.

Regulatory Changes and Compliance Costs: As a global entity operating in various jurisdictions, IFF is subject to stringent regulatory standards. Changes in food, beverage, pharmaceutical, and environmental regulations could lead to increased compliance costs and capital expenditures. While IFF has successfully managed these challenges thus far, any future regulatory changes could have a material impact on the company's operations and financial performance.

In conclusion, International Flavors & Fragrances Inc (NYSE:IFF) exhibits a strong market presence, bolstered by its commitment to innovation and a diverse product portfolio. However, the company must navigate integration challenges and competitive pressures to maintain its leadership position. Opportunities for growth lie in strategic divestitures and a focus on sustainable solutions, while threats from supply chain disruptions and regulatory changes loom on the horizon. As IFF continues

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.