Decoding The Interpublic Group of Companies Inc (IPG): A Strategic SWOT Insight

IPG's robust portfolio and strategic investments position it for continued growth in the digital economy.

Acquisitions and talent development underscore IPG's commitment to innovation and market leadership.

Global economic volatility and rapid technological changes present both opportunities and threats to IPG's business model.

Diversity, equity, and inclusion initiatives contribute to IPG's strong corporate culture and industry recognition.

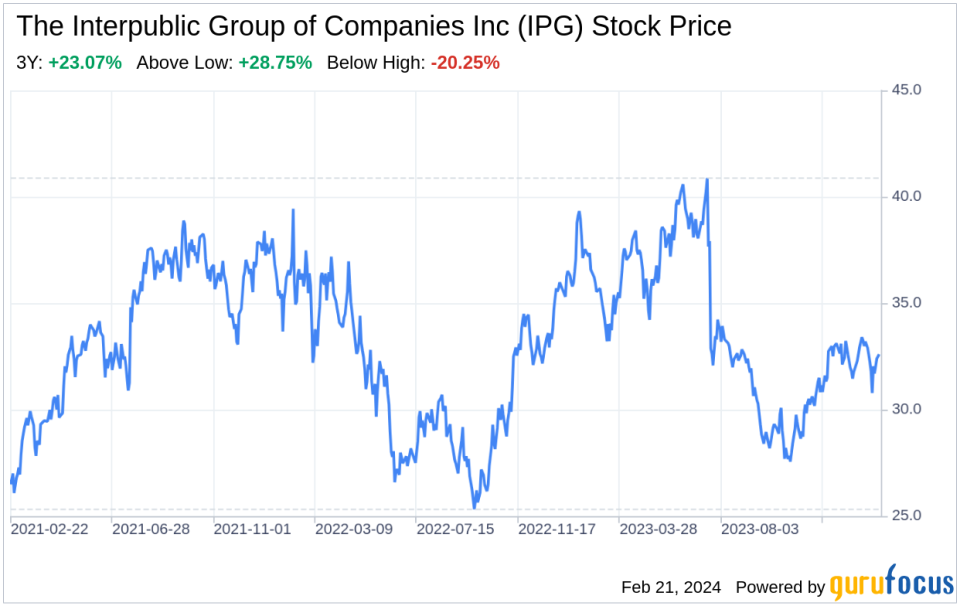

On February 20, 2024, The Interpublic Group of Companies Inc (NYSE:IPG) filed its annual 10-K report, providing a comprehensive overview of its financial performance and strategic direction. As a leading global advertising holding company, IPG has demonstrated resilience and adaptability in a rapidly evolving industry. The company's financial tables reveal a solid foundation, with a diverse client base contributing to a revenue spread that mitigates the risk of client concentration. IPG's strategic investments in digital commerce, artificial intelligence, and data management have positioned it to capitalize on the growing demand for tech-enabled marketing solutions. With a market capitalization of approximately $14.9 billion as of mid-2023, IPG's financial health remains robust, reflecting its ability to navigate the complexities of the global market while delivering value to shareholders.

Strengths

Global Presence and Diverse Services: IPG's expansive global footprint, with operations in over 100 countries, provides a competitive edge in delivering comprehensive marketing solutions. This international presence enables IPG to serve multinational clients with localized strategies, ensuring relevance and impact across diverse markets. The company's broad range of services, from traditional advertising to digital and public relations, allows for cross-selling opportunities and a holistic approach to client needs. The strength of IPG's global network is reflected in its ability to attract and retain large global marketers, contributing to a steady revenue stream and a resilient business model.

Innovation and Strategic Acquisitions: IPG's commitment to innovation is evident in its strategic acquisitions and investments in areas such as digital commerce, artificial intelligence, and data management. The integration of Acxiom in 2018 has bolstered IPG's data capabilities, positioning the company at the forefront of data-driven marketing. IPG's focus on acquiring and developing top talent in strategic, creative, and digital domains has fostered a culture of high performance and creativity. These strategic moves have not only enhanced IPG's service offerings but have also provided a foundation for future growth in the digital economy.

Recognition for Diversity and Inclusion: IPG's dedication to diversity, equity, and inclusion has earned it industry accolades and a reputation as an employer of choice. By linking executive compensation to diversity goals and implementing comprehensive programs, IPG has fostered an inclusive culture that attracts diverse talent. This commitment to diversity not only enriches the company's creative output but also resonates with clients and consumers who value social responsibility, further strengthening IPG's brand equity.

Weaknesses

Dependence on Economic Conditions: Like many in the advertising industry, IPG's performance is susceptible to global economic fluctuations. Economic downturns can lead to reduced client spending on marketing services, impacting IPG's revenue and profitability. While the company has a diversified client base, the potential for short-notice contract terminations adds an element of unpredictability to its revenue streams. IPG must continuously adapt its offerings and manage costs to mitigate the impact of economic volatility on its operations.

Technological Disruption: The rapid pace of technological change presents a challenge for IPG to stay ahead of emerging trends and maintain its competitive edge. The company must invest significantly in research and development to keep its services relevant and effective in a market where digital transformation is accelerating. Failure to anticipate or quickly adapt to technological advancements could result in a loss of market share to more agile competitors.

Regulatory and Legal Risks: IPG operates in a complex regulatory environment, with laws and regulations related to data protection, consumer privacy, and advertising practices varying across regions. Compliance with these evolving standards requires constant vigilance and adaptation, which can be resource-intensive. Non-compliance or a breach of data security could lead to reputational damage, financial penalties, and a loss of client trust, undermining IPG's competitive position.

Opportunities

Expansion in Emerging Markets: IPG's established presence in developed regions presents an opportunity to further penetrate emerging markets, where advertising spend is growing rapidly. By leveraging its global network and expertise, IPG can capture a larger share of these high-growth markets, driving revenue expansion and diversifying its geographic portfolio. Strategic partnerships or acquisitions in these regions could accelerate IPG's market entry and client acquisition efforts.

Advancements in Data and AI: The integration of artificial intelligence and advanced data analytics into IPG's service offerings opens new avenues for growth. By harnessing the power of AI, IPG can offer clients more personalized and effective marketing solutions, enhancing campaign performance and ROI. Continued investment in these areas will enable IPG to differentiate itself as a leader in tech-enabled marketing services.

Digital Commerce and Retail Media: The rise of digital commerce and retail media networks presents a significant opportunity for IPG to expand its capabilities and revenue streams. By developing specialized services that cater to the unique needs of brands in the e-commerce space, IPG can capitalize on the shift towards online shopping and the growing importance of retail media platforms. This focus aligns with consumer trends and positions IPG to benefit from the digital transformation of the retail industry.

Threats

Competitive Landscape: The advertising and marketing industry is highly competitive, with a mix of large holding companies, specialized firms,

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.