Decoding Invitation Homes Inc (INVH): A Strategic SWOT Insight

Invitation Homes Inc. (NYSE:INVH) showcases a robust market presence with a portfolio of nearly 83,000 single-family rental homes.

Strategic focus on high-growth markets with a significant presence in the Western U.S. and Florida.

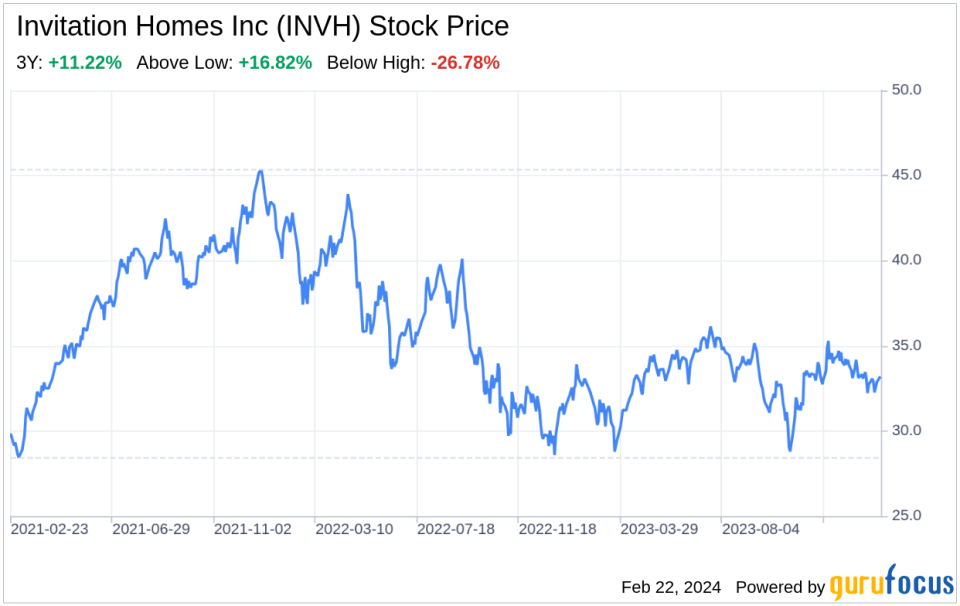

INVH's financial health is underscored by an aggregate market value of common stock held by non-affiliates at approximately $21.1 billion.

Challenges include market concentration risks, regulatory pressures, and the need for continuous innovation in property management.

Invitation Homes Inc. (NYSE:INVH), a leading player in the single-family rental homes market, filed its 10-K on February 21, 2024, revealing a comprehensive overview of its financial health and operational strategies. With a portfolio that spans across 16 target markets, INVH has established a strong foothold in the starter and move-up segments of the housing market. As of June 30, 2023, the aggregate market value of INVH's common stock held by non-affiliates was approximately $21.1 billion, reflecting the company's substantial market capitalization. The company's financial tables indicate a robust balance sheet, with 611.96 million shares of common stock outstanding, signaling investor confidence and a solid equity base. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as disclosed in INVH's latest SEC filing, providing investors with a data-driven perspective to inform their investment decisions.

Strengths

Market Presence and Brand Equity: INVH's expansive portfolio of nearly 83,000 single-family rental homes is a testament to its significant market presence. The company's focus on high-growth markets, particularly in the Western U.S. and Florida, positions it well to capitalize on regional economic and household formation growth. INVH's brand is synonymous with quality and reliability, appealing to a resident base that values stability and community. This brand equity is further reinforced by the company's commitment to high-touch customer service and sustainable practices, which resonate with consumers and enhance loyalty.

Financial Robustness: With an aggregate market value of common stock held by non-affiliates at approximately $21.1 billion, INVH demonstrates financial robustness that underpins its operational capabilities. The company's strong balance sheet, as evidenced by the number of shares outstanding, provides it with the financial flexibility to pursue growth opportunities, manage debt effectively, and navigate economic fluctuations. This financial health is a cornerstone of INVH's strength, enabling it to maintain a competitive edge in the market.

Vertically Integrated Platform: INVH's vertically integrated, scalable platform allows for greater control over the resident experience and operational costs. The company's resident-centric focus, local presence, and expertise, coupled with a scalable, centralized infrastructure, enable it to drive rent growth, occupancy, and low turnover rates. This integration fosters significant brand equity over the long term and positions INVH as a leader in the single-family rental market.

Weaknesses

Market Concentration Risks: INVH's investment concentration in certain markets and the single-family properties sector exposes it to seasonal fluctuations in rental demand and downturns in specific markets or the sector as a whole. This concentration could limit the company's ability to diversify risks and may lead to volatility in earnings, particularly if one or more of its core markets experience an economic downturn.

Regulatory and Legal Challenges: INVH operates in an industry that is subject to extensive governmental laws, regulations, and covenants. The expanding tenant rights laws, restrictions on evictions and collections, and rent control laws present a complex regulatory landscape that INVH must navigate. Compliance with these regulations may negatively impact rental income and profitability, and any legal or regulatory proceedings could result in significant litigation expenses and reputational harm.

Operational Inefficiencies: While INVH's vertically integrated platform offers many advantages, it also presents challenges in maintaining consistency and efficiency across its operations. The reliance on third-party services for key operations could lead to disruptions if these parties fail to perform. Additionally, the company's business model, with a limited track record, may pose difficulties in evaluating its long-term viability and scalability.

Opportunities

Strategic Acquisitions and Partnerships: INVH has the opportunity to further expand its portfolio through strategic acquisitions and partnerships, particularly with homebuilders. These relationships enable INVH to commission the construction of homes in high-demand areas, catering to the needs and preferences of its target customer base. By leveraging its proprietary database and local market expertise, INVH can identify and capitalize on acquisition opportunities that align with its investment strategy.

Technological Advancements: Investing in technology to enhance operational efficiency and the resident experience presents a significant opportunity for INVH. The adoption of smart home technologies, property management software, and data analytics can streamline processes, reduce costs, and improve service delivery. This technological edge could differentiate INVH from competitors and drive long-term growth.

ESG Initiatives: INVH's commitment to environmental, social, and governance (ESG) initiatives offers an opportunity to strengthen its brand and appeal to a growing segment of socially conscious consumers and investors. By integrating sustainability efforts into its business strategy, INVH can drive positive change and create value for stakeholders, while potentially benefiting from incentives and favorable financing terms linked to ESG performance.

Threats

Economic and Market Volatility: INVH's operations are susceptible to unfavorable global and U.S. economic conditions, financial market uncertainty, and geopolitical tensions. These external factors can lead to fluctuations in rental rates, declining real estate valuations, and impairment charges, adversely affecting INVH's financial condition and

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.