Decoding JB Hunt Transport Services Inc (JBHT): A Strategic SWOT Insight

JBHT's robust intermodal and dedicated services segments drive its competitive edge.

Technological advancements and strategic partnerships offer significant growth opportunities.

Challenges include economic fluctuations and the competitive, fragmented industry landscape.

JBHT's commitment to sustainability and innovation positions it well for future industry shifts.

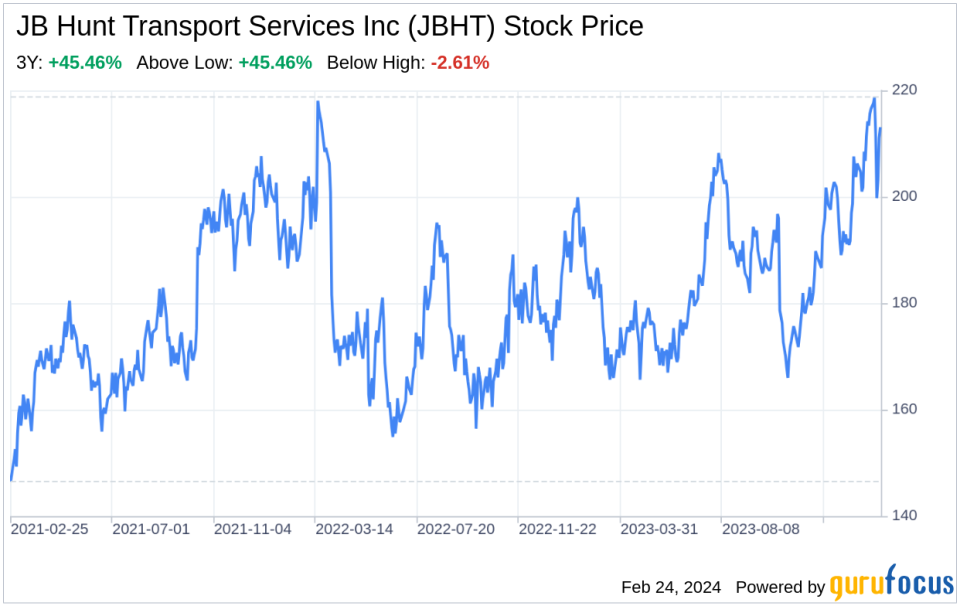

On February 23, 2024, JB Hunt Transport Services Inc (NASDAQ:JBHT), a leading North American surface transportation company, filed its annual 10-K report with the SEC. The company, known for its intermodal delivery and dedicated trucking services, reported a strong financial performance with key segments contributing to a diverse revenue stream. The financial tables within the filing reveal a company that is not only managing its assets efficiently but also maintaining a healthy balance sheet, indicative of strategic growth and operational excellence. This SWOT analysis delves into the company's strengths, weaknesses, opportunities, and threats, providing investors with a comprehensive understanding of JBHT's market position and future prospects.

Strengths

Market Position and Diverse Services: JBHT's dominant market position is bolstered by its comprehensive service offerings, which include intermodal delivery, dedicated trucking, final-mile delivery, and truck brokerage. Its intermodal segment, which accounted for 48% of sales in 2023, leverages partnerships with major North American rail carriers, offering a competitive edge in terms of cost and efficiency. The dedicated services segment, contributing 28% to sales, provides tailored solutions that foster long-term customer relationships. These core segments benefit from JBHT's commitment to technological innovation, such as the J.B. Hunt 360 platform, enhancing supply chain visibility and efficiency.

Financial Health and Investment in Assets: JBHT's financial health is a testament to its prudent management and strategic investments. The company's balance sheet reflects a modern fleet, with an average tractor age of 1.9 years, which not only attracts quality drivers but also reduces maintenance expenses and improves fuel efficiency. This investment in assets, coupled with a diversified revenue stream, positions JBHT to capitalize on market opportunities while mitigating risks associated with economic downturns.

Weaknesses

Dependence on Top Customers: A significant portion of JBHT's revenue is concentrated among its top customers, with one customer alone accounting for approximately 13% of total revenue in 2023. This reliance on a limited number of clients could pose risks if there are changes in their shipping needs or if they decide to shift towards other service providers or expand their private fleets. Diversifying its customer base could help JBHT reduce this dependency and stabilize its revenue streams.

Regulatory Compliance and Environmental Laws: As a transportation and logistics provider, JBHT is subject to stringent regulatory oversight, including DOT and FMCSA regulations, as well as environmental laws. Compliance with these regulations incurs significant costs, and any changes or increased stringency in these regulations could further impact JBHT's operations and profitability. The company's proactive approach to fleet modernization and sustainability initiatives, however, positions it well to adapt to regulatory changes.

Opportunities

Technological Advancements and Efficiency: JBHT's investment in technology, such as the J.B. Hunt 360 platform, presents significant opportunities to enhance operational efficiency and customer satisfaction. By leveraging data analytics and AI, JBHT can optimize routing, reduce empty miles, and improve asset utilization. These technological advancements not only provide a competitive advantage but also open new avenues for service offerings and market expansion.

Environmental Sustainability Initiatives: With increasing focus on environmental sustainability, JBHT's efforts to maintain a modern fleet and explore alternative fuel vehicles align with industry trends and customer demands for greener transportation solutions. These initiatives not only contribute to cost savings through improved fuel efficiency but also offer the potential to capture market share from environmentally conscious customers.

Threats

Economic Fluctuations and Customer Business Cycles: JBHT's operations are sensitive to economic conditions and customer business cycles. A downturn in the economy or in key industries served by JBHT could lead to reduced freight volumes and pressure on rates. The company's diversified service offerings provide some buffer against these fluctuations, but the potential for significant adverse effects on financial performance remains.

Competitive and Fragmented Industry: The transportation and logistics industry is highly competitive and fragmented, with numerous players ranging from small carriers to large conglomerates. JBHT faces competition on price, service quality, and capacity availability. While its size and range of services provide a competitive edge, the company must continuously innovate and enhance its value proposition to maintain and grow its market share.

In conclusion, JB Hunt Transport Services Inc (NASDAQ:JBHT) exhibits a strong market position with a diversified portfolio of transportation and logistics services. Its financial health and strategic investments in technology and assets are commendable strengths. However, reliance on a few major customers and the ever-present regulatory landscape present challenges that require vigilant management. Opportunities in technological advancements and sustainability initiatives are promising, while economic fluctuations and intense competition pose threats that JBHT must navigate. Overall, JBHT's strategic focus on efficiency and customer value, combined with its commitment to innovation and sustainability, positions it well to capitalize on market opportunities and mitigate risks.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.