Decoding Keurig Dr Pepper Inc (KDP): A Strategic SWOT Insight

Keurig Dr Pepper Inc (NASDAQ:KDP) showcases a robust portfolio of over 125 owned, licensed, and partner brands.

Strong e-commerce presence and direct-to-consumer platform bolster KDP's market position.

Strategic partnerships and licensing arrangements provide growth opportunities and diversification.

Market volatility and competition from multinational corporations pose significant threats.

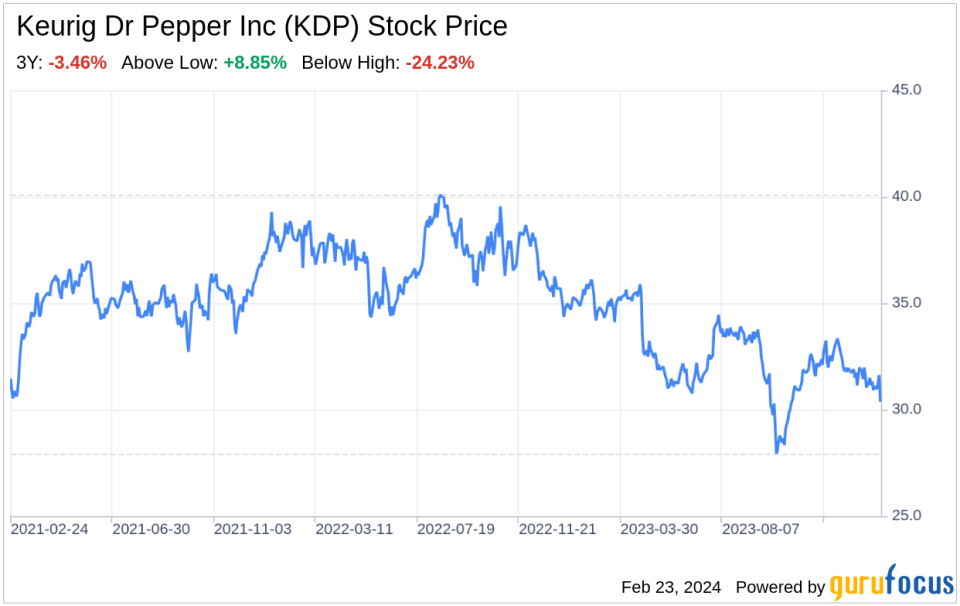

On February 22, 2024, Keurig Dr Pepper Inc (NASDAQ:KDP) filed its annual 10-K report, revealing a year of strategic maneuvers and financial performance that solidify its position as a leading beverage company in North America. With a merger that combines the strengths of Keurig Green Mountain Coffee and Dr Pepper Snapple, KDP has crafted a diverse portfolio that spans across coffee systems, flavored sparkling soft drinks, and a variety of other beverages. The company's financial health, as indicated by the filing, reflects a strong balance sheet and a market capitalization of approximately $31.3 billion as of June 30, 2023. With 95% of revenues generated from the U.S. and Canada, KDP's financial tables point to a company that is both resilient and poised for continued growth.

Strengths

Brand Portfolio and Consumer Loyalty: KDP's strength lies in its expansive and diverse portfolio of over 125 owned, licensed, and partner brands, including Dr Pepper, Canada Dry, and Green Mountain Coffee Roasters. This variety ensures a wide market presence and caters to a broad consumer base with varying preferences. The company's brands are not only well-recognized but also boast high levels of consumer awareness and loyalty, which are critical assets in the competitive beverage market.

Innovation and Market Expansion: KDP's commitment to innovation is evident in its robust program designed to meet changing consumer tastes and expand market share. The company's strategic partnerships and acquisitions have allowed it to fill gaps in its product offerings and enter fast-growing segments efficiently. For instance, partnerships with brands like C4 energy drinks and Peet's RTD coffee have enabled KDP to tap into new consumer trends without the need for extensive capital investment.

Operational Efficiency and E-commerce Strength: KDP's operational model is highly efficient, driving significant cash flow that allows for reinvestment and growth. The company's e-commerce platform, Keurig.com, is a leading direct-to-consumer channel that provides valuable insights into consumer behavior and preferences. This online presence has been leveraged to grow the cold beverage business, demonstrating KDP's ability to adapt to the evolving retail landscape.

Weaknesses

Supply Chain Vulnerabilities: Despite a strong operational framework, KDP faces potential vulnerabilities in its supply chain. The company relies on a limited number of suppliers for certain raw materials, which could lead to disruptions if suppliers face challenges such as civil unrest, political instability, or adverse weather conditions. These risks are exacerbated by the fact that some materials are sourced from countries with unstable economic conditions.

Dependency on Seasonality and Market Fluctuations: KDP's business is subject to seasonal variations, with cold beverage sales peaking during warmer months and hot beverage sales during cooler months. This seasonality can lead to fluctuations in revenue and may require careful inventory management. Additionally, the company's costs are impacted by changes in commodity prices, which can affect operating margins and overall cost structure.

Limited International Presence: While KDP has a strong foothold in North America, its international presence is limited. With only a small percentage of revenues coming from Mexico and other markets, the company may be missing out on growth opportunities in emerging economies and global markets, which could be crucial for long-term expansion and diversification.

Opportunities

Expansion into New Markets: KDP has the opportunity to expand its international footprint, particularly in emerging markets where the demand for beverages is growing. By leveraging its existing brand strength and distribution capabilities, KDP can enter new geographies and tap into additional revenue streams.

Product Diversification and Health Trends: The increasing consumer focus on health and wellness presents an opportunity for KDP to diversify its product portfolio further. By developing and marketing beverages with reduced sugar content, organic ingredients, or functional benefits, KDP can attract health-conscious consumers and respond to changing market trends.

Technological Advancements: KDP's strong e-commerce platform and expertise in direct-to-consumer sales provide a foundation for leveraging technology to enhance customer engagement and operational efficiency. Investing in data analytics, artificial intelligence, and machine learning can lead to better decision-making and a more personalized consumer experience.

Threats

Intense Competition: The beverage industry is highly competitive, with KDP facing competition from multinational corporations like Coca-Cola, PepsiCo, and Starbucks. These competitors have significant financial resources and established market positions, which could challenge KDP's ability to maintain and grow its market share.

Regulatory Changes and Environmental Concerns: KDP operates in an industry that is increasingly subject to regulatory scrutiny, particularly concerning health, safety, and environmental impact. Changes in regulations or consumer sentiment regarding packaging waste, sugar content, or other health-related issues could lead to increased costs or necessitate changes in product formulations and packaging.

Economic Volatility and Supply Chain Risks: KDP's reliance on raw materials that are subject to price volatility, such as green coffee and aluminum, poses a threat to its cost structure. Additionally, disruptions in the supply chain due to geopolitical tensions or natural disasters could impact the availability of key ingredients and materials, affecting production and distribution.

In conclusion, Keurig Dr Pepper Inc (NASDAQ:KDP) presents a compelling case of a company with a strong brand portfolio, innovative capabilities, and operational efficiency. However, it must navigate supply chain vulnerabilities, intense competition

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.