Decoding Keysight Technologies Inc (KEYS): A Strategic SWOT Insight

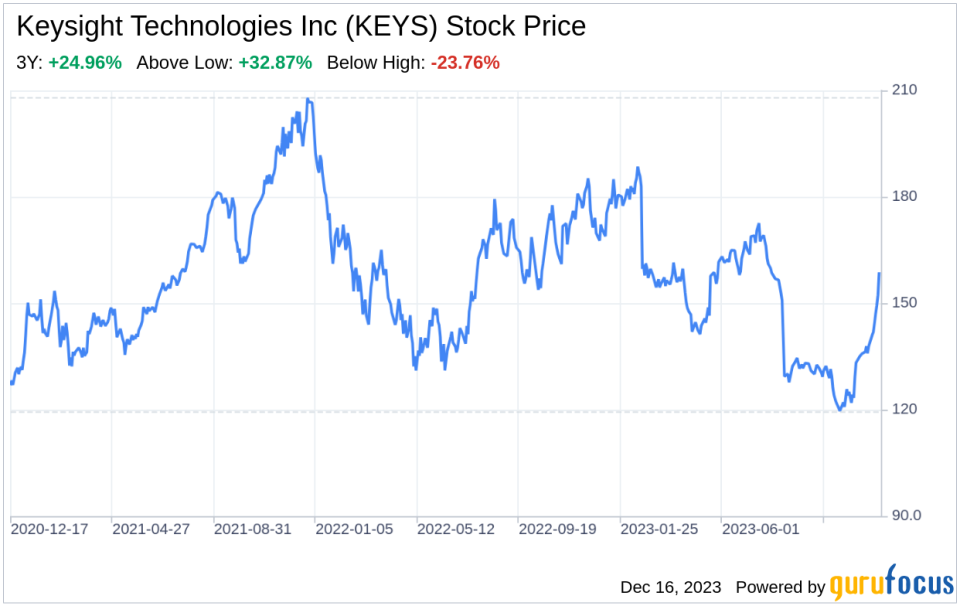

Keysight Technologies Inc (NYSE:KEYS) exhibits a robust financial performance with consistent revenue growth.

The company's R&D investments and strategic acquisitions position it well for capturing emerging market opportunities.

Keysight's comprehensive portfolio and global reach provide a competitive edge, yet market competition remains intense.

Future growth may be influenced by the company's ability to adapt to technological advancements and maintain its innovation leadership.

Keysight Technologies Inc (NYSE:KEYS), a leader in electronic design and test solutions, filed its 10-K on December 15, 2023, revealing a financial landscape marked by steady growth and strategic positioning. With revenues climbing from $4.9 billion in 2021 to $5.5 billion in 2023, the company demonstrates a consistent upward trajectory. Net income, however, saw a slight dip from $1.124 billion in 2022 to $1.057 billion in 2023, potentially reflecting strategic investments and market dynamics. The company's R&D expenditure of $882 million in 2023 underscores its commitment to innovation, crucial for maintaining its competitive edge. With a broad portfolio and presence in over 100 countries, Keysight is well-positioned to capitalize on the accelerating pace of technological innovation and engineering intensity driving demand for its solutions.

Strengths

Brand Power and Market Position: Keysight Technologies Inc (NYSE:KEYS) stands out in the market with its strong brand recognition and a legacy of over 80 years in measurement science. The company's deep, long-term global customer relationships and extensive installed base provide a solid foundation for recurring revenue and upselling opportunities. Keysight's direct sales channel, bolstered by experienced management and technical sales engineers, ensures efficient problem resolution and solution enhancement, fostering customer loyalty and trust.

Technology Leadership and R&D Investment: The company's significant investment in R&D, amounting to $882 million in 2023, reflects its dedication to maintaining technology leadership. Keysight's central R&D team, Keysight Labs, focuses on developing breakthrough hardware and software technologies that are deployed in application-specific contexts by business-specific engineering teams. This commitment to innovation enables Keysight to offer unique technology expertise and capabilities, positioning it at the forefront of the industries it serves.

Diverse and Resilient Business Model: Keysight's operating model exhibits flexibility, allowing it to deliver profitability across various economic and market conditions. The company's variable pay mechanisms, strategic use of contingent staffing, and diversified go-to-market approach contribute to its resilience. Keysight's centralized order fulfillment and extensive network of suppliers and subcontractors provide strategic flexibility and the ability to adapt to changing market conditions.

Weaknesses

Dependence on High R&D Expenditure: While Keysight's commitment to R&D is a strength, it also poses a financial risk. The company's strategy to invest approximately 16% of its revenue annually in R&D could strain financial resources, especially if market conditions deteriorate or if the returns on these investments do not materialize as expected. This high level of expenditure must be carefully managed to ensure sustainable growth.

Market Competition and Consolidation: Keysight faces intense competition in a rapidly evolving industry. The company competes with organizations that offer similar services and solutions, some with substantial sales, marketing, research, and financial capabilities. The entry of new competitors or consolidation among industries or customers could intensify competition further, potentially impacting Keysight's market share and profitability.

Supply Chain Vulnerabilities: Keysight's reliance on a global supply chain and custom-designed parts that are not readily available from alternate suppliers exposes the company to potential disruptions. While the company employs strategies to mitigate these risks, such as qualifying multiple sources of supply, supply chain vulnerabilities remain a weakness that could affect its ability to deliver solutions timely.

Opportunities

Emerging Technologies and Market Expansion: Keysight is well-positioned to capitalize on emerging technologies and expand into attractive adjacencies. The company's strategic acquisitions, such as the recent acquisition of Cliosoft Inc. and a controlling share of ESI Group SA, enhance its software capabilities and support its strategy of moving upstream into earlier stages of customers' design cycles. This proactive approach to capturing opportunities in served addressable markets and expanding in adjacencies presents significant growth potential.

Increasing Software and Services Content: The company's focus on growing recurring revenue through increased software content in its solutions and leveraging its broad services portfolio presents an opportunity for stable and predictable income streams. Keysight's dedicated global enterprise software sales force is poised to drive this priority and maximize cross-selling opportunities across its go-to-market channels.

Global Reach and Industry Diversification: Keysight's global presence and wide range of industry segments served, including communications, aerospace defense, government, automotive, energy, industrial, general electronics, and semiconductor, provide opportunities for geographic and market diversification. This broad reach allows Keysight to tap into various growth markets and reduce dependence on any single industry or region.

Threats

Technological Disruption: The rapid pace of technological change presents a threat to Keysight, as it must continuously innovate to keep up with evolving industry standards and customer requirements. Failure to anticipate or respond to technological shifts could result in obsolescence of its products and solutions, adversely affecting its competitive position.

Economic Uncertainty and Market Volatility: Global economic uncertainty and market volatility can impact customer spending and investment in the industries Keysight serves. Fluctuations in demand for electronic design and test solutions could lead to variability in the company's financial performance and growth prospects.

Regulatory and Compliance Risks: Keysight operates in a highly regulated environment, and changes in regulations or failure to comply with existing ones could result in fines, penalties, or restrictions on its operations. Additionally, the company's global operations expose it to geopolitical risks, trade

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.