Decoding Liberty SiriusXM Group's (LSXMA) Ownership: A Deep Dive into Institutional and Insider ...

Liberty SiriusXM Group (NASDAQ:LSXMA) operates as a subsidiary providing subscription-based satellite radio services. With an impressive portfolio of music, sports, entertainment, comedy, talk, news, traffic, and weather channels, the firm has carved out a significant presence in the US and Canada. As of the latest data, the company has an outstanding share count of 326.58 million, with institutional ownership at 27.51 million shares (8.42%) and insider ownership at 17.32 million shares (5.3%).

Recent Performance

Liberty SiriusXM Group (NASDAQ:LSXMA) has seen a decline of approximately 12.24% in its stock value over the past week. As of Oct 02, 2023, the stock fell by 0.75%, contrasting with its three-month return of 5.38%. The company's market cap has also seen significant fluctuations, rising to $7.87 billion in the most recent quarter from $6.74 billion in the preceding one.

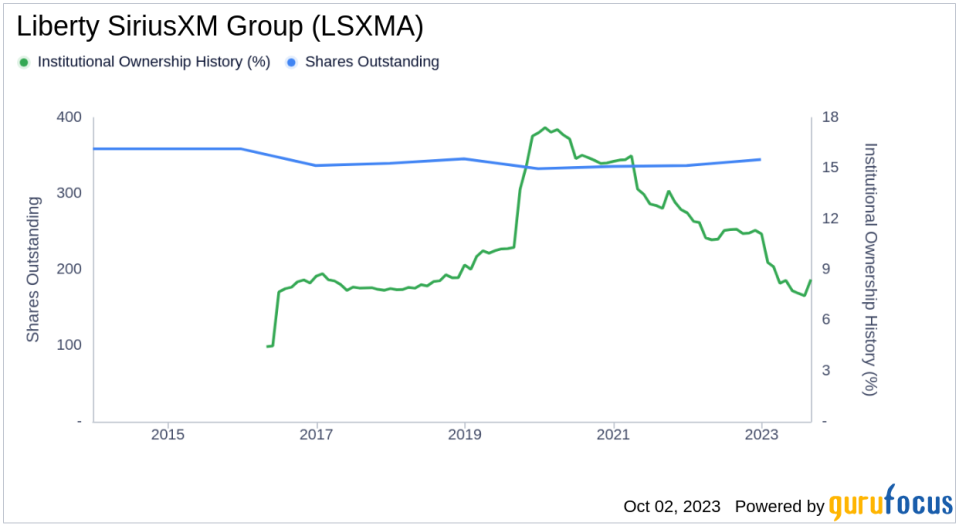

Institutional Ownership and Key Players

Liberty SiriusXM Group's institutional ownership history offers a glimpse into the confidence of major players in the company's future. As of August 31, 2023, the institutional ownership level stands at 8.42%, up from 7.76% as of May 31, 2023, but down from 11.14% a year ago. Among the most significant stakeholders, Warren Buffett (Trades, Portfolio), Seth Klarman (Trades, Portfolio), and Tom Gayner (Trades, Portfolio) hold 6.19%, 2.5%, and 0.13% of shares outstanding, respectively.

Financial Performance and Future Prospects

Over the past three years, Liberty SiriusXM Group's Ebitda growth averaged 24.2% per year, outperforming 75.3% of 761 companies in the Media - Diversified industry. However, the estimated earnings growth for the company is 0% per year, lower than the earnings growth of 35.2% during the past three years.

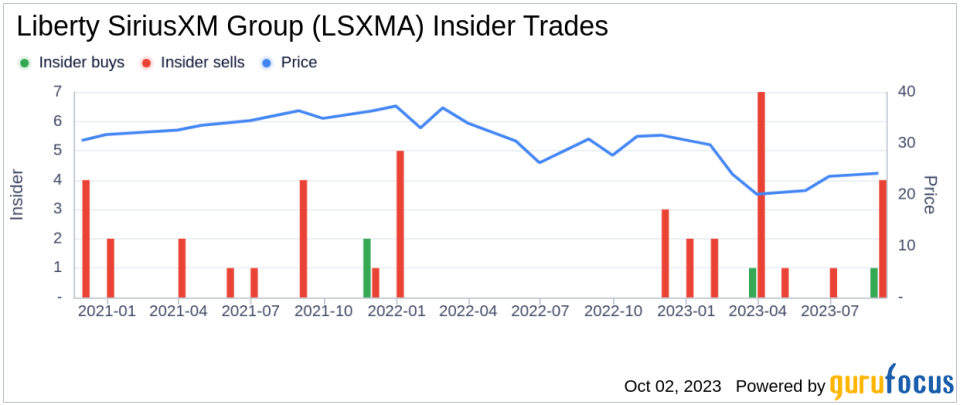

Insider Ownership and Activities

Insider ownership at Liberty SiriusXM Group is approximately 5.3% as of August 31, 2023, unchanged from a year ago. This reflects the unwavering faith of the company's board directors and C-level employees. Recent insider trades provide a nuanced view of this sentiment. Over the past three months, the company had 4 insider sell transactions and 1 insider buy transaction.

Conclusion

In the dynamic world of stocks, understanding the nuances of ownership and earnings is crucial. Liberty SiriusXM Group's recent dip offers a case study in how major players react to market shifts, providing valuable insights for potential investors. As always, a holistic view combining past performance and future projections remains key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article first appeared on GuruFocus.