Decoding Marathon Petroleum Corp (MPC): A Strategic SWOT Insight

Marathon Petroleum Corp (NYSE:MPC) showcases a robust refining capacity and a diversified midstream asset network.

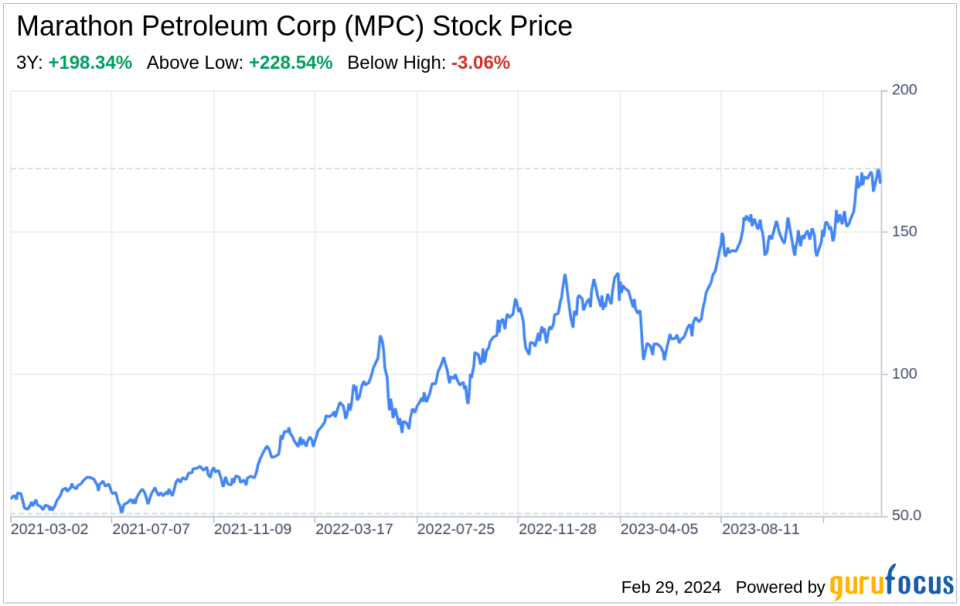

Despite market volatility, MPC maintains a strong market presence and competitive edge.

Strategic investments and divestitures reflect MPC's adaptability and focus on long-term growth.

Regulatory and market risks remain a concern for MPC's operational and financial performance.

On February 28, 2024, Marathon Petroleum Corp (NYSE:MPC) filed its annual 10-K report, revealing the financial and operational status of the company for the fiscal year ended December 31, 2023. As a leading independent refiner, MPC operates a vast refining system with a capacity of approximately 3.0 million barrels per day, making it one of the largest wholesale suppliers of gasoline and distillates in the United States. The company's midstream assets, managed through MPLX, connect producers to domestic and international markets. The financial tables from the filing indicate that MPC has navigated the volatile energy market with resilience, maintaining a strong balance sheet and cash flow position. The aggregate market value of common stock held by non-affiliates as of June 30, 2023, was approximately $47.2 billion, reflecting investor confidence in the company's strategy and execution.

Strengths

Robust Refining Capacity and Diversified Product Portfolio: MPC's substantial refining capacity of 3.0 million barrels per day positions it as a dominant player in the energy sector. The company's ability to process a wide variety of crude oils and produce a diverse range of products, including transportation fuels and petrochemicals, provides a competitive advantage. This strength is further bolstered by the strategic acquisition of Andeavor in 2018, which expanded MPC's geographic reach and scale of operations.

Strategic Midstream Assets: MPC's ownership of MPLX, a large-cap master limited partnership, enhances its midstream capabilities. MPLX's network of pipelines, terminals, and storage facilities ensures efficient transportation and distribution of crude oil, natural gas, and refined products. This integration of midstream operations allows MPC to optimize its asset portfolio and capture value across the supply chain.

Weaknesses

Exposure to Market Volatility: The cyclical nature of the oil and gas industry subjects MPC to fluctuations in commodity prices and refining margins. While the company has mechanisms to manage these risks, such as hedging strategies, the inherent volatility can impact financial performance and operational planning. The 10-K filing acknowledges the potential effects of market conditions, including disruptions in credit markets and changes in commodity prices.

Regulatory Risks: MPC operates in a highly regulated environment, with laws and regulations impacting various aspects of its business, from environmental compliance to taxation. The complexity and evolving nature of these regulations pose challenges to MPC's operations and can lead to increased costs or operational constraints.

Opportunities

Renewable Energy Initiatives: MPC's investments in renewable diesel production, such as the Dickinson and Martinez facilities, align with the global shift towards cleaner energy sources. These initiatives not only diversify MPC's product offerings but also position the company to capitalize on growing demand for sustainable fuels and potential government incentives.

Strategic Asset Optimization: MPC's history of strategic divestitures, such as the sale of Speedway, demonstrates its ability to adapt to market dynamics and focus on core operations. The company's ongoing evaluation of its asset portfolio presents opportunities for further optimization, potentially unlocking value and enhancing shareholder returns.

Threats

Competitive Pressure: The refining and marketing sectors are highly competitive, with numerous players vying for market share. MPC faces competition from integrated oil companies, independent marketers, and alternative energy providers. Maintaining a competitive edge requires continuous innovation and operational efficiency.

Environmental and Social Governance (ESG) Challenges: As societal and investor focus on ESG factors intensifies, MPC must navigate the increasing expectations for sustainable operations and transparent reporting. Failure to meet these expectations could impact the company's reputation and investor relations.

In conclusion, Marathon Petroleum Corp (NYSE:MPC) exhibits a strong strategic position with its extensive refining capacity and integrated midstream assets. The company's proactive approach to asset management and investment in renewable energy sources are commendable strengths. However, MPC must continue to navigate the challenges of market volatility, regulatory complexity, and competitive pressures. By leveraging its strengths and addressing its weaknesses, MPC can capitalize on opportunities and mitigate threats, positioning itself for sustained success in the dynamic energy landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.