Decoding MetLife Inc (MET): A Strategic SWOT Insight

MetLife Inc demonstrates robust financial fundamentals with a diverse portfolio and strong market presence.

Strategic reorganization and Next Horizon strategy position MetLife for future growth.

Competitive pressures and regulatory changes present ongoing challenges.

MetLife's commitment to risk management and liquidity ensures resilience in volatile markets.

MetLife Inc, one of the world's leading financial services companies, filed its 10-K on February 16, 2024, revealing a comprehensive overview of its operations and financial health. The company, with its diversified business model and strong market positions across the United States, Asia, Latin America, and EMEA, continues to leverage its globally recognized brand and financial expertise to drive growth and enhance shareholder value. The financial tables within the filing indicate a solid liquidity position, with short-term liquidity at $19.2 billion and liquid assets at $182.6 billion as of December 31, 2023. MetLife's strategic focus on its Next Horizon strategy and a recent reorganization into six segments underscore its commitment to adaptability and value creation. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the 10-K filing, providing investors with a nuanced understanding of MetLife's strategic and financial positioning.

Strengths

Global Diversification and Market Leadership: MetLife Inc's extensive global footprint, with leading market positions in the U.S., Japan, Latin America, and other regions, is a testament to its strength. The company's diversified business model not only mitigates risks associated with market volatility but also allows for capitalizing on growth opportunities across different geographies. In the U.S. alone, MetLife holds a commanding presence in the group insurance market, bolstered by long-standing relationships with major employers. This geographical and product diversification is a significant competitive advantage, enabling MetLife to maintain stability and drive consistent revenue streams.

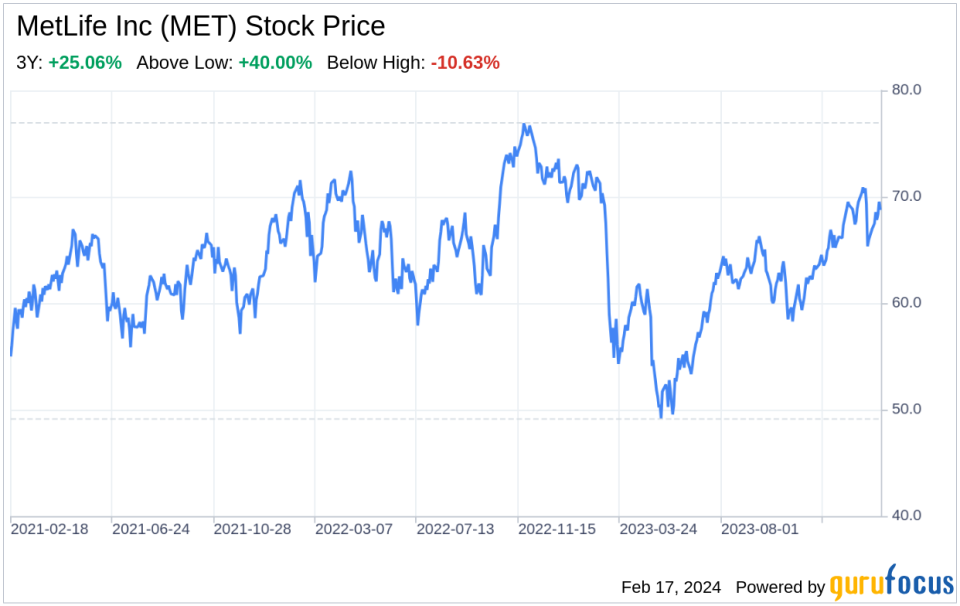

Robust Financial Fundamentals: The company's financial health is underpinned by strong liquidity and a well-managed investment portfolio. With an increase in short-term liquidity from $16.4 billion in 2022 to $19.2 billion in 2023, and a solid base of liquid assets, MetLife is well-equipped to meet its financial obligations and invest in growth initiatives. This financial stability is crucial for maintaining investor confidence and for the company's ability to weather economic downturns.

Weaknesses

Competitive Pressures and Market Saturation: Despite its strong market position, MetLife faces intense competition from a multitude of insurance and financial services companies. Competitors with broader product offerings, more competitive pricing, or higher claims-paying ability ratings could potentially erode MetLife's market share. The company's group insurance products are subject to annual underwriting, which exposes it to the risk of losing customers to competitors offering more favorable terms. This competitive landscape necessitates continuous innovation and strategic marketing to retain and grow its customer base.

Regulatory and Operational Risks: MetLife operates in a heavily regulated industry, where changes in laws and regulations can significantly impact its business operations. The company must navigate a complex web of regulatory requirements across different markets, which can increase compliance costs and limit operational flexibility. Additionally, operational risks such as data breaches or system failures pose a threat to the company's reputation and financial stability.

Opportunities

Technological Advancements and E-Business Capabilities: The insurance industry is increasingly influenced by technology, and MetLife's ability to adapt and invest in e-business capabilities presents a significant opportunity. By harnessing data analytics, artificial intelligence, and digital platforms, MetLife can enhance customer experiences, streamline operations, and create more personalized product offerings. This technological edge can lead to increased efficiency, cost savings, and a stronger competitive position in the market.

Emerging Markets and Product Innovation: MetLife's presence in emerging markets such as Asia and Latin America offers avenues for growth as these regions experience rising incomes and increased demand for insurance products. The company's focus on innovation and customer-centric product development can help capture new segments and drive expansion. Additionally, the growing emphasis on environmental, social, and governance (ESG) factors opens up opportunities for MetLife to differentiate itself by integrating ESG considerations into its business strategy.

Threats

Economic Volatility and Interest Rate Fluctuations: As a global insurer and investor, MetLife is susceptible to financial market volatility and interest rate changes. These factors can affect the company's investment returns, capital positions, and overall profitability. Economic downturns or significant market disruptions could lead to increased claims and reduced demand for insurance products, thereby impacting MetLife's financial performance.

Regulatory Changes and Legal Risks: The insurance industry is subject to stringent and ever-evolving regulatory requirements. Changes in regulation, particularly those affecting the life insurance sector, can impose additional compliance costs and constrain business operations. Moreover, MetLife must contend with legal risks, including potential litigation and regulatory actions, which can result in financial penalties and damage to the company's reputation.

In conclusion, MetLife Inc's SWOT analysis reveals a company with a strong foundation, marked by its global diversification, robust financials, and market leadership. However, it must navigate competitive pressures, regulatory complexities, and economic uncertainties. Opportunities in technological innovation and emerging markets are countered by threats from market volatility and regulatory changes. MetLife's strategic initiatives and risk management practices are crucial in leveraging its strengths and opportunities while addressing its weaknesses and threats to ensure long-term success and shareholder value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.