Decoding Micron Technology Inc (MU): A Strategic SWOT Insight

Strengths: Micron Technology Inc (NASDAQ:MU) showcases robust revenue growth and a solid product portfolio in the dynamic semiconductor industry.

Weaknesses: Despite its strengths, MU faces challenges in operational efficiency and competitive pressures.

Opportunities: The company is well-positioned to capitalize on the growing demand for memory and storage solutions across various sectors.

Threats: External factors such as geopolitical tensions and intense competition pose risks to MU's market position.

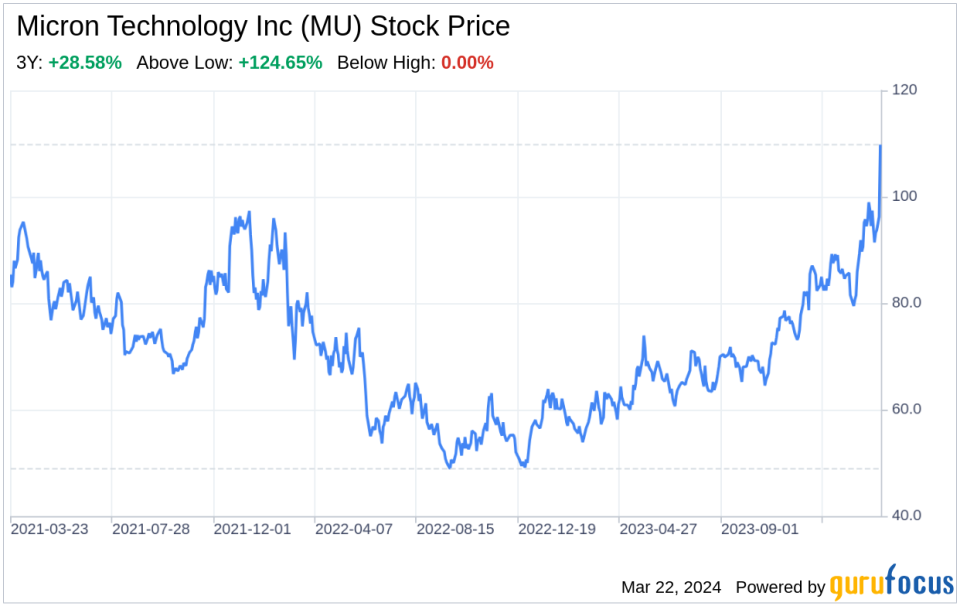

On March 21, 2024, Micron Technology Inc (NASDAQ:MU) filed its 10-Q report, revealing a significant turnaround in its financial performance. The company reported a net income of $793 million for the quarter ended February 29, 2024, a stark contrast to the net loss of $2,312 million in the same period the previous year. This remarkable recovery is reflected in the earnings per share (EPS), which improved from a loss of $2.12 to a gain of $0.72. The revenue also saw a substantial increase, rising from $3,693 million to $5,824 million. These figures underscore Micron's financial resilience and set the stage for a detailed SWOT analysis to inform investors about the company's strategic positioning.

Strengths

Revenue Growth and Market Position: Micron Technology Inc (NASDAQ:MU) has demonstrated impressive revenue growth, with a significant increase from $3,693 million to $5,824 million for the quarter ended February 29, 2024. This growth is a testament to MU's strong market position and its ability to capitalize on the increasing demand for memory and storage solutions. The company's diverse product portfolio, which includes high-performance DRAM, NAND, and NOR memory and storage products, caters to a wide range of applications, from data centers to mobile devices. This versatility not only enhances Micron's brand reputation but also provides a stable revenue stream across various market segments.

Technological Leadership and Innovation: Micron Technology Inc (NASDAQ:MU) is recognized for its technological leadership and commitment to innovation. The company's relentless focus on R&D has led to the development of advanced memory technologies that are critical for the data economy. Micron's ability to introduce new generations of products with improved performance characteristics, such as higher data transfer rates and lower power consumption, positions it as a leader in the semiconductor industry. This strength is crucial for maintaining a competitive edge and driving future growth.

Weaknesses

Operational Efficiency: While Micron Technology Inc (NASDAQ:MU) has shown strong revenue growth, the company's operational efficiency could be improved. The cost of goods sold (COGS) remains high at $4,745 million for the quarter, indicating potential areas for cost reduction and margin improvement. Addressing these operational challenges is essential for MU to enhance its profitability and ensure long-term financial stability. Streamlining manufacturing processes and optimizing supply chain management could lead to significant cost savings and a stronger bottom line.

Competitive Pressures: Micron Technology Inc (NASDAQ:MU) operates in a highly competitive industry, facing rivals such as Samsung Electronics Co., Ltd. and SK hynix Inc. This competitive landscape requires continuous investment in technology and innovation to stay ahead. MU's ability to maintain its market share and profitability is contingent upon its success in developing new products and technologies that meet evolving customer needs. The company must navigate these competitive pressures effectively to sustain its growth trajectory.

Opportunities

Expansion in Emerging Markets: Micron Technology Inc (NASDAQ:MU) has the opportunity to expand its presence in emerging markets, where the demand for memory and storage solutions is growing rapidly. By leveraging its technological expertise and product portfolio, MU can tap into new customer segments and increase its global footprint. Strategic partnerships and investments in these regions could provide a significant boost to the company's revenue and market share.

Advancements in AI and 5G: The advancements in artificial intelligence (AI) and 5G technology present lucrative opportunities for Micron Technology Inc (NASDAQ:MU). As these technologies become more prevalent, the need for high-performance memory solutions will escalate. MU's product innovations are well-aligned with this trend, positioning the company to benefit from the increased adoption of AI and 5G applications across various industries, from the data center to the intelligent edge.

Threats

Geopolitical Tensions: Micron Technology Inc (NASDAQ:MU) faces threats from geopolitical tensions, particularly in key markets such as China and Taiwan. These tensions can lead to trade restrictions, supply chain disruptions, and changes in government policies that could adversely affect MU's operations and financial performance. The company must closely monitor these developments and adapt its strategies accordingly to mitigate potential risks.

Intense Industry Competition: The semiconductor industry is characterized by rapid technological advancements and intense competition. Micron Technology Inc (NASDAQ:MU) must continually innovate and reduce costs to maintain its competitive position. Failure to keep pace with industry trends and competitors' actions could result in loss of market share and revenue. MU must prioritize R&D and strategic investments to address this threat and secure its future success.

In conclusion, Micron Technology Inc (NASDAQ:MU) exhibits strong financial performance and strategic advantages in the semiconductor industry. The company's strengths in revenue growth, technological leadership, and innovation are balanced by challenges in operational efficiency and competitive pressures. However, opportunities for expansion in emerging markets and advancements in AI and 5G technologies present avenues for growth. MU must remain vigilant of threats such as geopolitical tensions and industry competition to sustain its market position. Overall, Micron Technology Inc (NASDAQ:MU) is well-equipped to navigate the complexities of the semiconductor landscape and capitalize on its strategic strengths.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.