Decoding Neurocrine Biosciences Inc (NBIX): A Strategic SWOT Insight

Neurocrine Biosciences Inc (NASDAQ:NBIX) showcases a robust financial performance with INGREZZA net product sales totaling $1.8 billion for 2023.

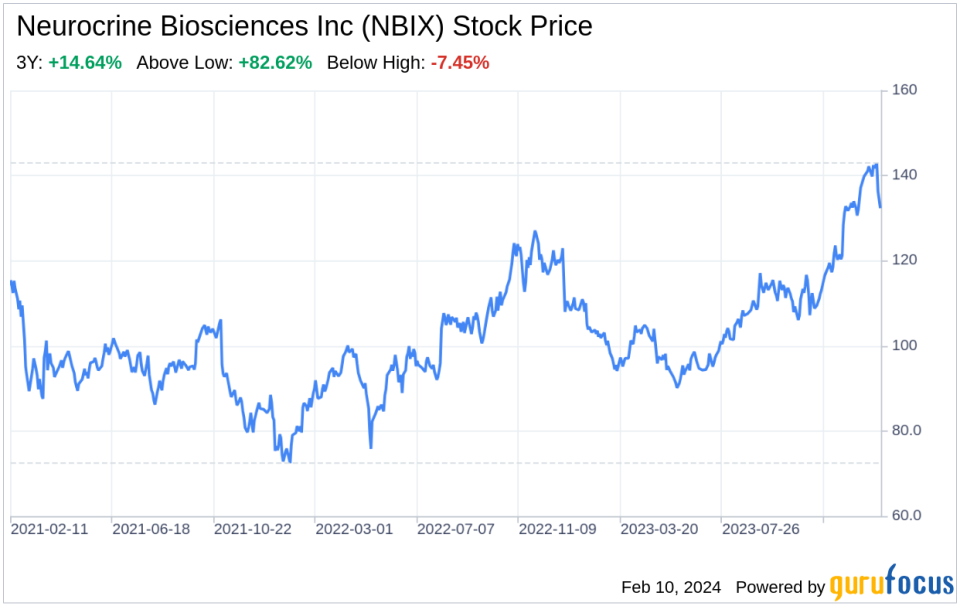

The company's market capitalization stood at $7.9 billion as of June 30, 2023, reflecting investor confidence.

Neurocrine Biosciences Inc (NASDAQ:NBIX) is poised to leverage its strengths and opportunities while addressing its weaknesses and threats in the dynamic biopharmaceutical landscape.

With a focus on neuroscience, the company continues to innovate with FDA approvals and strategic partnerships, setting the stage for future growth.

Neurocrine Biosciences Inc (NASDAQ:NBIX), a neuroscience-focused biopharmaceutical company, filed its 10-K on February 9, 2024, revealing a year of significant progress and robust financial health. The company's dedication to developing treatments for neurological, neuroendocrine, and neuropsychiatric disorders has translated into a strong financial performance, with INGREZZA net product sales reaching $1.8 billion in 2023. This figure accounted for approximately 99% of the company's total net product sales, underscoring the drug's critical role in Neurocrine's portfolio. With a market capitalization of $7.9 billion as of June 30, 2023, and 99.51 million shares of common stock outstanding as of February 5, 2024, Neurocrine Biosciences Inc (NASDAQ:NBIX) demonstrates both investor confidence and a solid foundation for continued growth. This SWOT analysis delves into the company's strengths, weaknesses, opportunities, and threats, providing investors with a comprehensive understanding of NBIX's strategic position in the biopharmaceutical industry.

Strengths

Robust Product Sales and Market Presence: Neurocrine Biosciences Inc (NASDAQ:NBIX) has established a strong market presence with its flagship product, INGREZZA, which is the first FDA-approved treatment for tardive dyskinesia. The drug's success is evident in the substantial net product sales of $1.8 billion in 2023, a 28.6% increase from the previous year. This growth reflects higher prescription demand and effective commercial activities, including a direct-to-consumer advertising campaign and an expanded sales force. The company's ability to successfully commercialize INGREZZA and gain FDA approval for additional indications, such as chorea associated with Huntington's disease, demonstrates its strength in product development and market penetration.

Strategic Collaborations and Pipeline Expansion: Neurocrine Biosciences Inc (NASDAQ:NBIX) has formed strategic partnerships to enhance its research and development capabilities. A notable collaboration with Voyager Therapeutics Inc. to advance gene therapy programs for neurological diseases involved an upfront fee of $175.0 million, showcasing Neurocrine's commitment to expanding its pipeline. The company's diversified portfolio includes FDA-approved treatments and advanced clinical-stage programs, positioning it well for future growth. The Breakthrough Therapy designation received by crinecerfont for the treatment of CAH further highlights the company's potential to bring innovative therapies to market.

Weaknesses

Dependence on Key Product: Neurocrine Biosciences Inc (NASDAQ:NBIX)'s financial performance is heavily reliant on the success of INGREZZA, which accounted for 99% of the company's total net product sales in 2023. This dependence on a single product poses a risk, as any issues related to the drug's efficacy, safety, or market acceptance could significantly impact the company's revenue stream. Diversification of the product portfolio is crucial to mitigate this vulnerability and ensure long-term financial stability.

Operational Challenges in Scaling: As Neurocrine Biosciences Inc (NASDAQ:NBIX) continues to grow, it faces challenges in scaling its operations effectively. The company has increased its workforce by approximately 200 employees in 2023 and plans to continue expanding, particularly in research and development. Managing this growth while maintaining a low employee turnover rate and a strong corporate culture will be critical to sustaining its operational success. Additionally, the reliance on third-party contract manufacturers necessitates robust supply chain management to avoid potential disruptions.

Opportunities

Market Expansion and New Indications: Neurocrine Biosciences Inc (NASDAQ:NBIX) has the opportunity to further expand its market reach with INGREZZA and other products in its pipeline. The recent FDA approval for the treatment of chorea associated with Huntington's disease opens up a new patient population for INGREZZA. Moreover, the company's ongoing clinical trials and the anticipated NDA submission for crinecerfont in the second quarter of 2024 present opportunities to address additional unmet medical needs and drive revenue growth.

Technological Advancements in Gene Therapy: The strategic partnership with Voyager Therapeutics Inc. positions Neurocrine Biosciences Inc (NASDAQ:NBIX) at the forefront of gene therapy research for neurological diseases. The collaboration leverages Voyager's next-generation TRACERTM capsids, which could lead to breakthrough treatments and solidify Neurocrine's reputation as an innovator in the biopharmaceutical industry. The company's investment in cutting-edge technology and its focus on gene therapy programs highlight its potential to capitalize on emerging therapeutic modalities.

Threats

Intense Competition and Generic Threats: Neurocrine Biosciences Inc (NASDAQ:NBIX) operates in a highly competitive industry, with numerous companies developing treatments for similar indications. The launch of a once-daily dosing of AUSTEDO by Teva Pharmaceuticals Industries, a direct competitor to INGREZZA, exemplifies the competitive pressures Neurocrine faces. Additionally, the settlement agreements allowing

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.