Decoding NXP Semiconductors NV (NXPI): A Strategic SWOT Insight

Strengths: Robust market share in the automotive sector and diversified product offerings.

Weaknesses: Exposure to cyclical semiconductor industry and geopolitical risks.

Opportunities: Expansion in IoT and mobile markets, and strategic partnerships.

Threats: Intense competition and evolving cybersecurity threats.

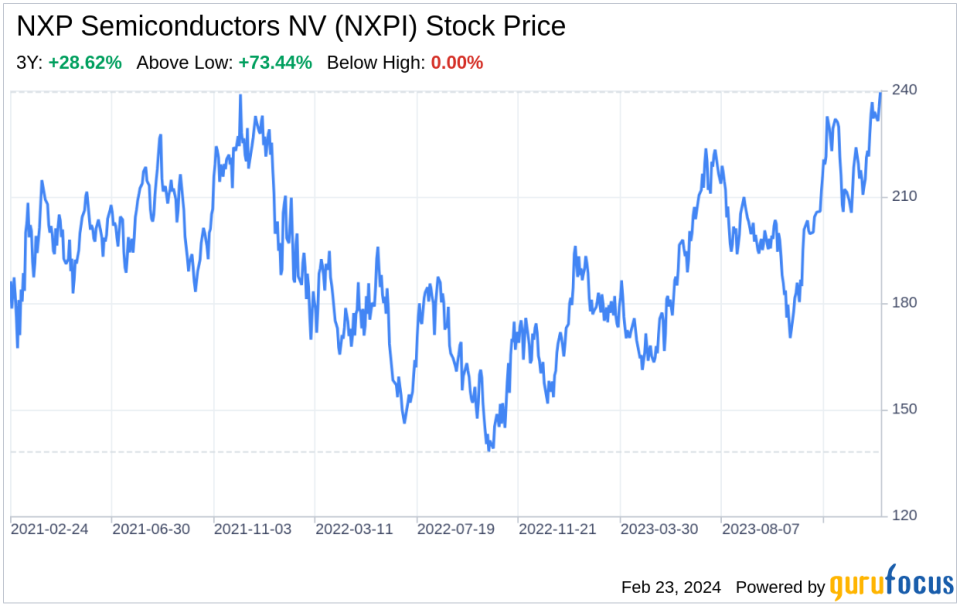

On February 22, 2024, NXP Semiconductors NV (NASDAQ:NXPI) filed its annual 10-K report, revealing a slight increase in revenue from $13,205 million in 2022 to $13,276 million in 2023. This marginal growth underscores the company's resilience in a highly competitive and cyclical semiconductor industry. NXP Semiconductors, with its comprehensive portfolio and deep application knowledge, continues to be a formidable player in the automotive, industrial & IoT, mobile, and communication infrastructure markets. The company's strategic acquisitions, such as Freescale Semiconductor, have bolstered its market share, particularly in the automotive sector, where it is a leading supplier of microcontrollers and analog chips. As we delve into the SWOT analysis, we will explore how NXPI leverages its strengths, addresses its weaknesses, capitalizes on opportunities, and mitigates threats in the dynamic semiconductor landscape.

Strengths

Market Leadership in Automotive: NXP Semiconductors NV (NASDAQ:NXPI) has cemented its position as a leader in the automotive semiconductor market. The acquisition of Freescale Semiconductor has expanded its product range and reinforced its market presence. NXPI's microcontrollers and analog chips are integral to automotive clusters, powertrains, infotainment systems, and radars, which are critical for modern vehicles. The company's deep application knowledge and intellectual property portfolio enable it to innovate and meet the evolving needs of the automotive industry. This strength is not only a testament to NXPI's strategic vision but also provides a stable revenue stream and a platform for future growth.

Diversified Product Portfolio: NXPI's diversified product offerings across various end markets, including industrial & IoT, mobile, and communication infrastructure, reduce its dependence on any single market segment. The company's expertise in cryptography-security, RF, mixed A/D, power management, and digital signal processing allows it to cater to a broad customer base. This diversification mitigates risks associated with market volatility and positions NXPI as a comprehensive solutions provider in the semiconductor space.

Weaknesses

Cyclical Nature of Semiconductor Industry: The semiconductor industry is known for its cyclicality, with alternating periods of high demand and oversupply. NXP Semiconductors NV (NASDAQ:NXPI) is not immune to these market dynamics, which can lead to fluctuations in revenue and profitability. While NXPI has managed to maintain a steady revenue stream, the inherent volatility of the industry poses a challenge to long-term financial planning and stability. The company must continue to innovate and manage production capacity efficiently to navigate these cycles effectively.

Geopolitical Risks and Supply Chain Disruptions: NXPI's global operations expose it to various geopolitical risks, including trade disputes and regional instabilities, such as the Russia-Ukraine conflict. These issues can disrupt supply chains and affect the demand for NXPI's products. Additionally, the company's reliance on third-party outsourcing partners for production adds another layer of risk, as any adverse events affecting these partners could impact NXPI's ability to deliver products to its customers.

Opportunities

Growth in IoT and Mobile Markets: The expanding Internet of Things (IoT) and mobile markets present significant growth opportunities for NXP Semiconductors NV (NASDAQ:NXPI). As devices become increasingly connected, the demand for NXPI's high-performance mixed-signal products is expected to rise. The company's expertise in security and connectivity positions it well to capitalize on this trend and drive revenue growth in these burgeoning sectors.

Strategic Partnerships and Alliances: NXPI's ability to form strategic partnerships and joint ventures is a critical opportunity for expansion and innovation. Collaborating with other industry leaders can lead to the development of new technologies and products, opening up additional markets and strengthening NXPI's competitive edge. These alliances also provide avenues for sharing research and development costs, which can improve the company's financial efficiency.

Threats

Intense Competition: NXP Semiconductors NV (NASDAQ:NXPI) operates in a highly competitive industry, with numerous players vying for market share. Competitors such as Qualcomm Inc., Broadcom Inc., and Texas Instruments Inc. invest heavily in research and development, which can lead to rapid technological advancements and pricing pressures. NXPI must continuously innovate and differentiate its product offerings to maintain its market position and profitability.

Cybersecurity Threats: As a technology company, NXPI faces increasing and evolving cybersecurity threats. A breach or significant cyberattack could compromise sensitive data, disrupt operations, and damage the company's reputation. NXPI's proactive approach to cybersecurity, including its certification to ISO 27001 and the establishment of a Security Operating Center (SOC), is crucial in mitigating these risks. However, the threat landscape is constantly changing, requiring ongoing vigilance and investment in security measures.

In conclusion, NXP Semiconductors NV (NASDAQ:NXPI) exhibits a robust SWOT profile with strong market leadership, particularly in the automotive sector, and a diversified product portfolio. While the company must navigate the cyclical nature of the semiconductor industry and geopolitical risks, it is well-positioned to capitalize on growth opportunities in IoT and mobile markets through strategic partnerships. NXPI's ability to manage intense competition and cybersecurity threats will be pivotal in maintaining its market position and driving future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.