Decoding Ownership and Performance: The AES Corp(AES)

The AES Corp (NYSE:AES) is a global power conglomerate with a broad generation portfolio of over 32 gigawatts, consisting of renewable energy (46%), gas (32%), coal (20%), and oil (2%). As of year-end 2022, the company owns and operates six electric utilities, distributing power to 2.6 million customers. Despite its diversified operations, the company has experienced a recent decline in its stock value, prompting a closer look at its ownership structure and earnings performance.

Overview of AES Corp's Ownership and Performance

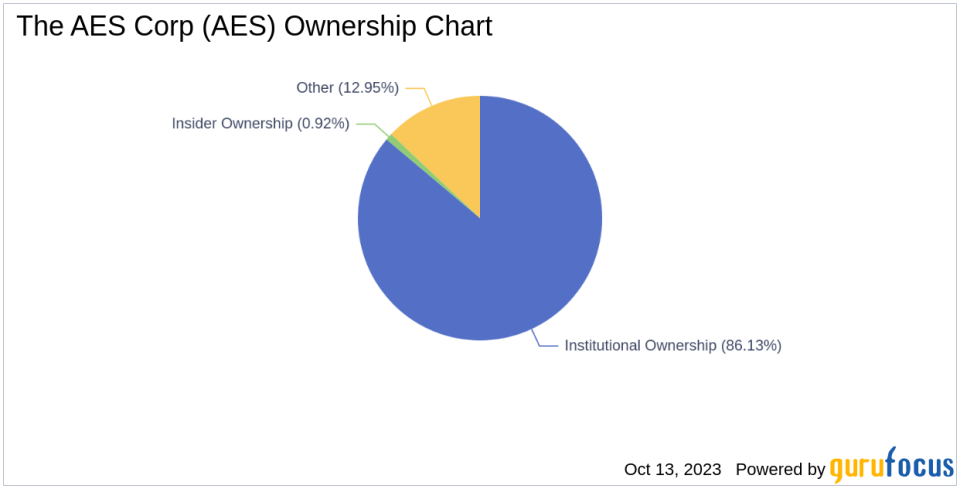

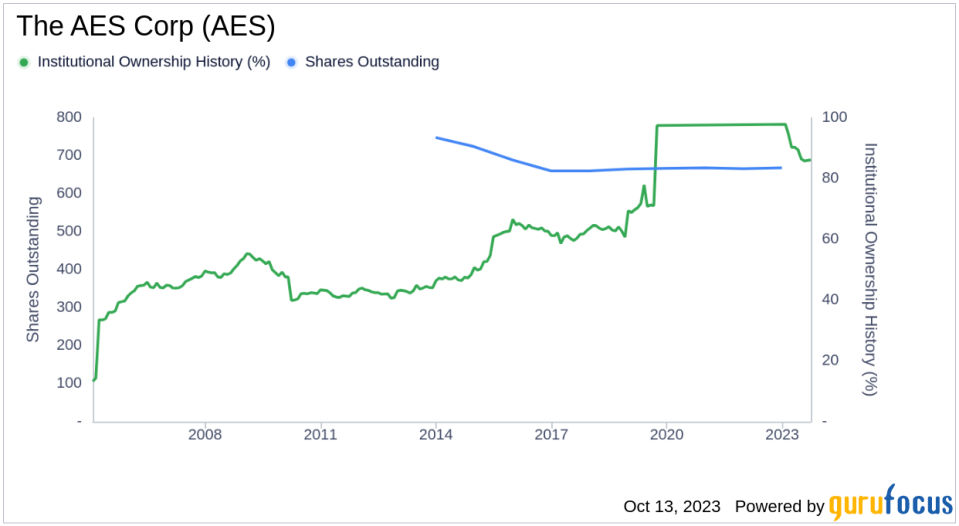

As of the latest data, The AES Corp (NYSE:AES) has an outstanding share count of 669.63 million. Institutional ownership stands at 576.73 million shares, amounting to 86.13% of the total shares. Meanwhile, insiders hold 6.18 million shares, accounting for 0.92% of the total share count.

The AES Corp has witnessed a decline of about 6.59% in its stock value over the past week. As of Oct 13, 2023, the stock rose by 0.92%, contrasting with its three-month return of -38.74%. The company's market cap dropped to $13.88 billion in the most recent quarter from $16.12 billion in the preceding one, sparking interest in the company's ownership trends.

Institutional Ownership and Key Players

The AES Corp's institutional ownership history reveals the trust and confidence that major players have in the company's future. As of September 30, 2023, The AES Corp's institutional ownership level is 86.13%, down from 86.47% as of June 30, 2023, but up from 71.32% a year ago.

Among the most significant stakeholders, the top fund managers owning chunks of The AES Corp's stock are Mario Gabelli (Trades, Portfolio), Jefferies Group (Trades, Portfolio), and Leon Cooperman (Trades, Portfolio), with 0.08%, 0%, and 0% of shares outstanding respectively.

Delving into Earnings: Past and Future

Over the past three years, The AES Corp's Ebitda growth averaged -13.6% per year, which is worse than 89.72% of 457 companies in the Utilities - Regulated industry. Looking forward, the estimated earnings growth for The AES Corp is 7.32% per year, higher than the earnings growth of 0% during the past three years.

Insider Ownership and Activities

Insider ownership provides insights into the convictions of the company's board directors and C-level employees. The AES Corp's insider ownership is approximately 0.92% as of August 31, 2023, compared to 0.86% from a year ago, reflecting the increased faith of those intimately familiar with the company's operations.

During the past three months, The AES Corp had 3 insider buy transactions, further emphasizing the confidence of the board directors and C-level employees in the company's future.

Conclusion

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. The recent dip in AES Corp's stock value is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.