Decoding Ownership and Performance: Hecla Mining Co(HL)

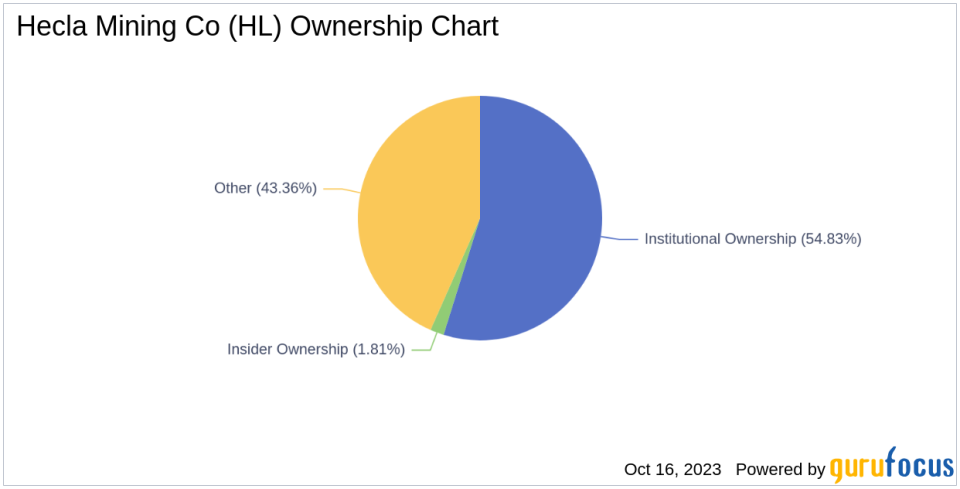

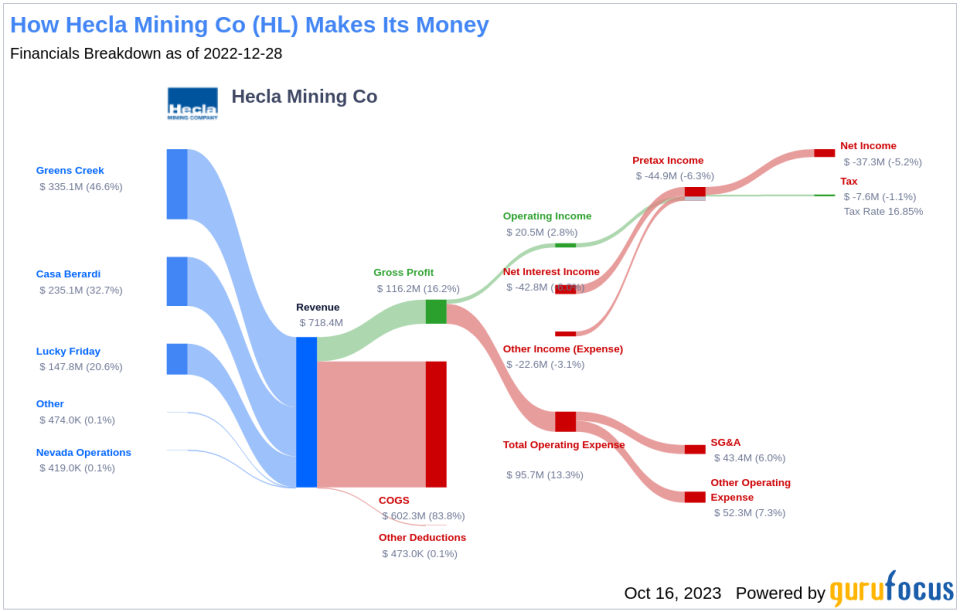

Hecla Mining Co (NYSE:HL), a prominent producer and explorer of silver, gold, lead, and zinc, operates through several business segments, including Greens Creek, Lucky Friday, Keno Hill, Casa Berardi, and Nevada Operations. The majority of its revenue is derived from Canada. With an outstanding share count of 617.34 million, institutional ownership accounts for 338.49 million shares or 54.83% of the total shares, while insiders hold 11.19 million shares, equating to 1.81% of the total share count.

Recent Performance and Market Sentiment

Over the past week, Hecla Mining Co (NYSE:HL) experienced a decline of about 10.92% in its stock value. However, as of Oct 16, 2023, the stock rose by 1.45%, contrasting with its three-month return of -28.7%. This volatility, especially in its market cap, which dropped to $3.12 billion in the most recent quarter from $3.81 billion in the preceding one, has sparked keen interest in the company's ownership trends.

Institutional Ownership and Key Players

Hecla Mining Co's institutional ownership history reveals the levels of trust and confidence that major players have in the company's future. As of 2023-09-30, Hecla Mining Co's institutional ownership level is 54.83%, down from 56.36% as of 2023-06-30 and 68.49% from a year ago. The top fund managers owning significant chunks of Hecla Mining Co's stock are First Eagle Investment (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Arnold Van Den Berg (Trades, Portfolio), with 0.15%, 0.01%, and 0% of shares outstanding respectively.

Delving into Earnings: Past and Future

Over the past three years, Hecla Mining Co's Ebitda growth averaged -1.4% per year, which is worse than 62.25% of 1849 companies in the Metals & Mining industry. Looking forward, the estimated earnings growth for Hecla Mining Co is 0% per year, lower than the earnings growth of 28.3% during the past three years.

Insider Ownership and Activities

Insider ownership of Hecla Mining Co is approximately 1.81% as of 2023-08-31, compared to 1.92% from a year ago. This suggests a decreased faith of those intimately familiar with the company's operations. In the past three months, Hecla Mining Co had one insider buy transaction: George R Johnson, Director, bought 8,500 shares on 2023-08-22.

Next Steps

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. Hecla Mining Co's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.