Decoding Plains All American Pipeline LP (PAA): A Strategic SWOT Insight

Strategic asset base with a focus on crude oil and NGL infrastructure.

Robust financial strategy aimed at maintaining an investment grade credit profile.

Challenges in the face of economic downturns and fluctuating commodity markets.

Opportunities in emerging energy opportunities and infrastructure development.

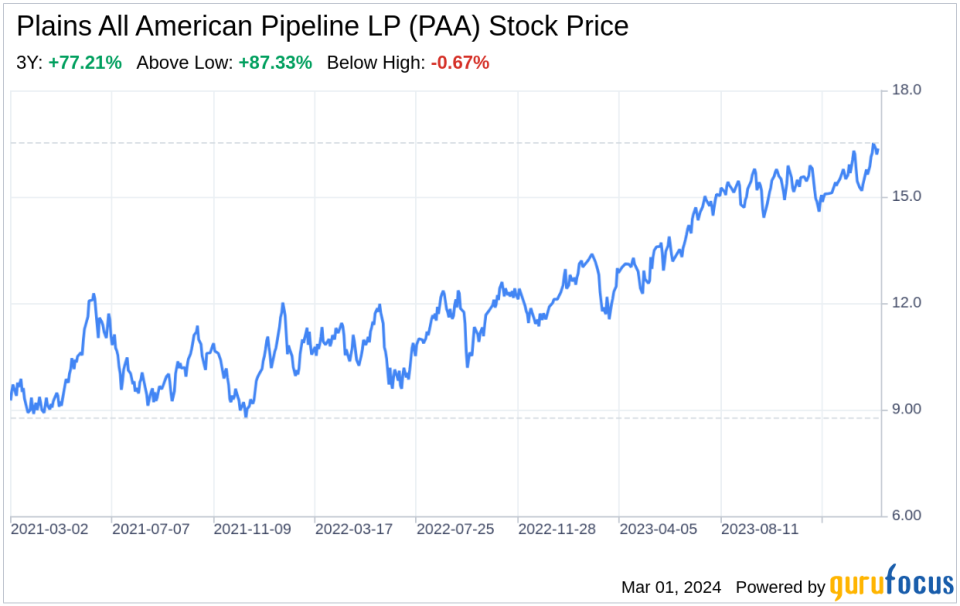

On February 29, 2024, Plains All American Pipeline LP (NASDAQ:PAA), a leading provider of midstream energy infrastructure and logistics services, filed its annual 10-K report with the SEC. The report offers a comprehensive overview of the company's financial performance, strategic positioning, and future outlook. With a focus on crude oil and natural gas liquids (NGL), PAA's extensive network of pipeline transportation, terminalling, storage, and gathering assets spans key producing basins and transportation corridors across the United States and Canada. As of December 31, 2023, the company reported a strong asset base, with a market capitalization of approximately $6.4 billion, reflecting the confidence of investors in its business model and growth prospects.

Strengths

Strategic Asset Base and Integrated Model: PAA's strategic asset base, particularly in the Permian Basin, provides significant operational flexibility and commercial optionality. The company's integrated business model, which combines supply aggregation with midstream infrastructure, attracts a diverse and high-quality customer base. This model supports sustainable fee-based cash flow generation, as evidenced by the company's long-term contracts and acreage dedication agreements.

Financial and Commercial Expertise: PAA's financial strategy is focused on generating free cash flow and improving shareholder returns. The company has a history of disciplined capital allocation, accretive investments, and maintaining an investment grade credit profile. Additionally, PAA's specialized market knowledge and merchant activities allow for incremental margin generation, showcasing the company's strategic and technical acumen.

Weaknesses

Exposure to Market Volatility: PAA's operations are subject to fluctuations in crude oil demand and prices, which can impact the volume of oil and NGL shipped. The company's financial performance is vulnerable to economic downturns, high inflation, and supply chain issues, which could lead to under-utilization of assets and increased costs.

Operational Risks: The company faces risks related to the development and operation of its assets, including natural disasters, equipment failures, and cybersecurity attacks. These risks could disrupt operations and result in financial losses, as well as damage to PAA's reputation.

Opportunities

Emerging Energy Opportunities: PAA is well-positioned to capitalize on emerging energy opportunities, including energy transition initiatives. The company's existing infrastructure is expected to play a critical role in supporting these initiatives, providing a platform for growth and diversification.

Infrastructure Development: The pace of natural gas infrastructure development, particularly in the Permian Basin, presents opportunities for PAA to enhance its asset portfolio. Strategic investments in this area could drive crude oil production growth and expand the company's service offerings.

Threats

Competitive and Regulatory Pressures: PAA operates in a highly competitive industry with risks associated with recontracting and capacity overbuild. Additionally, the company must navigate a complex regulatory environment, including environmental and safety regulations, which could impose additional costs and constraints on its operations.

Societal and Political Challenges: Societal and political pressures, including opposition to pipeline development and increased environmental concerns, pose threats to PAA's business model. The company must address these challenges to maintain its social license to operate and pursue growth opportunities.

In conclusion, Plains All American Pipeline LP (NASDAQ:PAA) exhibits a robust strategic asset base and financial acumen that position it well within the midstream energy sector. However, the company must navigate market volatility, operational risks, and competitive and regulatory pressures to sustain its growth trajectory. PAA's ability to leverage emerging energy opportunities and infrastructure development will be critical in shaping its future success. By maintaining a focus on operational excellence and strategic investments, PAA can continue to generate value for its stakeholders and adapt to the evolving energy landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.