Decoding Sirius XM Holdings Inc (SIRI): A Strategic SWOT Insight

Strengths: Dominant market presence with a robust subscriber base and innovative content delivery.

Weaknesses: Intense competition and reliance on the automotive industry for subscriber growth.

Opportunities: Expansion into new markets and leveraging technology for enhanced user experience.

Threats: Rapidly changing technology and evolving consumer preferences pose significant challenges.

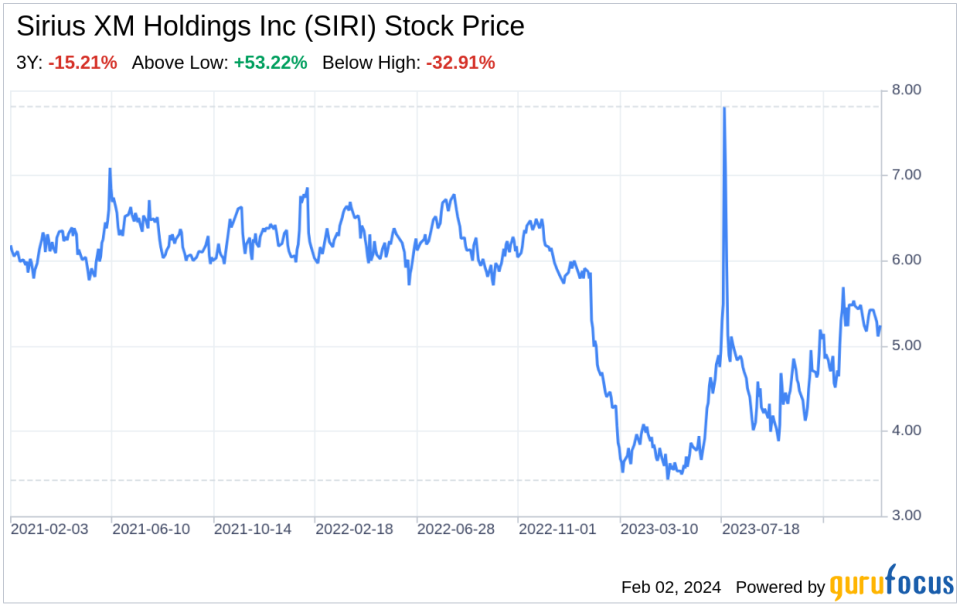

On February 1, 2024, Sirius XM Holdings Inc (NASDAQ:SIRI) filed its annual 10-K report, offering a comprehensive view of its financial health and strategic positioning. As a premier provider of satellite and streaming radio services, Sirius XM Holdings Inc encompasses SiriusXM and Pandora, serving a combined subscriber base of nearly 40 million as of December 31, 2023. The company's financials reveal a strong revenue stream primarily from subscription fees, complemented by advertising sales and ancillary services. With an aggregate market value of $2,812.58 million as of mid-2023, Sirius XM Holdings Inc stands as a formidable player in the audio entertainment industry, backed by Liberty Media's majority ownership.

Strengths

Market Dominance and Subscriber Loyalty: Sirius XM Holdings Inc's strength lies in its commanding presence in the satellite radio industry, with a vast subscriber base of approximately 33.9 million for SiriusXM and 6.0 million for Pandora as of the end of 2023. This loyalty is a testament to the company's diverse and high-quality content offerings, including music, sports, talk shows, and podcasts. The integration of SiriusXM with the innovative 360L in-car user interface further solidifies its market position by enhancing the user experience and retaining subscribers.

Content and Technological Innovation: The company's commitment to content excellence is evident through its curated and exclusive programming, which sets it apart from competitors. Sirius XM Holdings Inc's strategic acquisitions, such as Stitcher, bolster its podcasting segment, tapping into the growing podcast listener base. Additionally, the SiriusXM App's new digital infrastructure, including a commerce platform and billing engine, showcases the company's technological prowess, offering a seamless digital experience to users.

Weaknesses

Dependence on Automotive Sector: A significant portion of Sirius XM Holdings Inc's subscriber growth is tied to the automotive industry, with radios primarily distributed through automakers. This reliance poses a risk, as any downturn in the automotive sector could adversely impact subscriber numbers. Moreover, the company's performance is closely linked to the health of the economy, which influences new car sales and, consequently, the uptake of SiriusXM subscriptions.

Competitive Pressure: The audio entertainment landscape is fiercely competitive, with numerous players vying for listener attention. Sirius XM Holdings Inc faces stiff competition from traditional media, online advertising platforms, and other digital media services. The company must continuously innovate and adapt to maintain its competitive edge and market share in the face of challenges from established giants like Amazon, Facebook, and Google, as well as emerging streaming services.

Opportunities

Expansion into New Markets: Sirius XM Holdings Inc has the opportunity to grow its subscriber base by tapping into new markets and demographics. The company's diverse content offerings and technological capabilities position it well to attract a broader audience, including international markets where satellite and streaming services are gaining popularity.

Technological Advancements: The company's investment in digital infrastructure and connected vehicle services presents significant opportunities for growth. By leveraging advancements in technology, Sirius XM Holdings Inc can enhance its service offerings, such as real-time weather and traffic information, to provide additional value to subscribers and attract new customers in the increasingly connected world.

Threats

Technological Disruption: The rapid pace of technological change poses a threat to Sirius XM Holdings Inc's business model. As consumer preferences evolve and new technologies emerge, the company must stay ahead of the curve to avoid obsolescence. This requires continuous investment in innovation and the ability to quickly adapt to changing market dynamics.

Regulatory Challenges: Sirius XM Holdings Inc operates in a highly regulated environment, with stringent FCC regulations governing satellite systems and data protection laws affecting consumer privacy. Compliance with these regulations is critical, and any changes in the regulatory landscape could have significant implications for the company's operations and profitability.

In conclusion, Sirius XM Holdings Inc (NASDAQ:SIRI) exhibits a strong market presence and subscriber loyalty, bolstered by its innovative content and technological capabilities. However, the company must navigate the challenges of dependence on the automotive sector, competitive pressures, technological disruptions, and regulatory hurdles. By capitalizing on opportunities for expansion and technological advancements, Sirius XM Holdings Inc can continue to thrive in the dynamic audio entertainment industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.