Decoding Tandem Diabetes Care Inc (TNDM)'s Performance Potential: A Deep Dive into Key Metrics

Long-established in the Medical Devices & Instruments industry, Tandem Diabetes Care Inc (NASDAQ:TNDM) has enjoyed a stellar reputation. It has recently witnessed a daily gain of 4.97%, juxtaposed with a three-month change of -22.17%. However, fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Tandem Diabetes Care Inc.

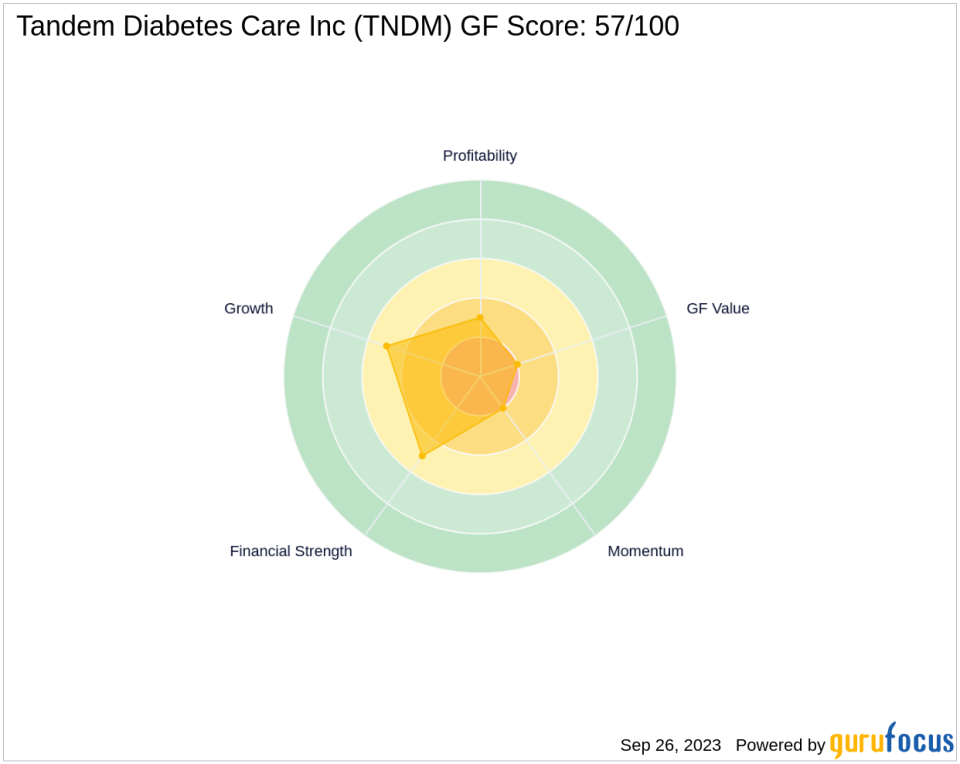

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Financial strength rank: 5/10

Profitability rank: 3/10

Growth rank: 5/10

GF Value rank: 2/10

Momentum rank: 2/10

Based on the above method, GuruFocus assigned Tandem Diabetes Care Inc the GF Score of 57 out of 100, which signals poor future outperformance potential.

Snapshot of Tandem Diabetes Care Inc's Business

Tandem Diabetes Care Inc, with a market cap of $1.32 billion, designs, manufactures, and markets durable insulin pumps for diabetes patients. The firm first entered this market in 2012 and has since introduced multiple generations of pumps leading to its current t:slim X2 device. Nearly three quarters of total revenue is derived from the U.S., with the remainder primarily from other developed nations. The pumps themselves generate just over half of total sales, and another one third is from disposable infusion sets that need to be changed over every 2 to 3 days.

Financial Strength Breakdown

Tandem Diabetes Care Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company has an interest coverage ratio of 0, which positions it worse than 0% of 424 companies in the Medical Devices & Instruments industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. It's worth noting that the esteemed investor Benjamin Graham typically favored companies with an interest coverage ratio of at least five.

The company's Altman Z-Scoreis just 0.75, which is below the distress zone of 1.81. This suggests that the company may face financial distress over the next few years.

Profitability Breakdown

Tandem Diabetes Care Inc's low Profitability rank can also raise warning signals. The company's operating margin stands at -29.34%, indicating that it is currently unprofitable. This could be a potential red flag for investors looking for profitable investments.

Conclusion

Considering Tandem Diabetes Care Inc's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While the company has a strong reputation in the Medical Devices & Instruments industry, its current financial indicators suggest that it may struggle to maintain its historical performance. Therefore, investors should exercise caution when considering this stock.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.