Decoding Teva Pharmaceutical Industries Ltd (TEVA): A Strategic SWOT Insight

TEVA's robust generic drug portfolio and innovative CNS, oncology, and respiratory treatments drive its competitive edge.

Strategic "Pivot to Growth" initiative aims to capitalize on growth engines and enhance global commercial and R&D capabilities.

Global market presence and scale offer leverage against local competitors, with a focus on quality and timely market entry.

Macroeconomic and geopolitical challenges necessitate adaptive strategies to mitigate impacts on production and distribution.

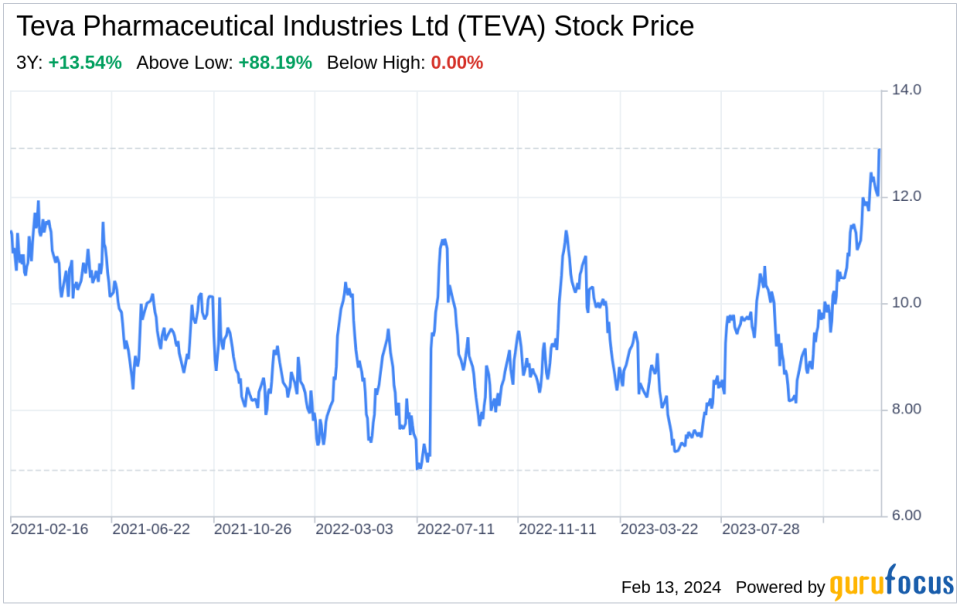

On February 12, 2024, Teva Pharmaceutical Industries Ltd (NYSE:TEVA), a global leader in generic and innovative pharmaceuticals, filed its 10-K report, revealing a comprehensive overview of its financial and strategic positioning. With headquarters in Israel and a significant presence in North America, Europe, and other key markets, TEVA's diverse product portfolio spans across generics, biosimilars, and innovative medicines. The company's financial tables from the filing indicate a solid footing, with a market capitalization of approximately $8.38 billion as of June 30, 2023, and a global workforce of 37,851 employees dedicated to driving its mission forward. This SWOT analysis delves into TEVA's strengths, weaknesses, opportunities, and threats, providing investors with a nuanced understanding of its market dynamics and future prospects.

Strengths

Global Generics Powerhouse: TEVA's position as a leading generic pharmaceutical company is a significant strength. With approximately 500 generic prescription products in the United States alone, TEVA's extensive portfolio covers a wide range of dosage forms and therapeutic areas. This diversity allows TEVA to meet various patient needs and maintain a strong market presence. The company's generics are supported by strategic marketing efforts, including digital programs and partnerships, enhancing consumer awareness and loyalty.

Innovative Medicine Development: TEVA's focused portfolio in central nervous system (CNS), oncology, and respiratory areas is another pillar of strength. Products like AUSTEDO, AJOVY, and COPAXONE have established TEVA as a key player in the innovative medicines space. The recent FDA approval and launch of UZEDY further bolster the company's CNS offerings. TEVA's commitment to innovation is also evident in its "Pivot to Growth" strategy, which emphasizes the development of late-stage pipeline assets and exploration of business development opportunities.

Weaknesses

Intense Competition and Price Pressures: The generic drug market is highly competitive, with increasing FDA approvals leading to margin pressures. TEVA faces competition from both domestic and international manufacturers, as well as brand-name pharmaceutical companies. The European market presents additional challenges with its focus on pricing, quality standards, and customer service. TEVA's ability to maintain its market share and profitability is continually tested by these competitive dynamics.

Patent Litigation Risks: TEVA's involvement in patent litigation, such as the case with GSK's carvedilol tablets, exposes the company to potential financial liabilities. The complexity of patent laws and the risk of infringement claims can lead to significant legal costs and uncertainties. These risks are inherent in the pharmaceutical industry and can impact TEVA's financial stability and growth prospects.

Opportunities

Expansion in Biosimilars: The expiration of intellectual property protections for biological products presents an opportunity for TEVA to expand its biosimilars portfolio. With its biologics knowledge and experience, TEVA is well-positioned to compete in this evolving market. The growing acceptance of biosimilars among physicians and payers could lead to increased uptake and revenue streams for the company.

Geographic and Therapeutic Diversification: TEVA's global infrastructure and scale provide a platform for geographic and therapeutic diversification. The company's presence in significant markets like Japan and Russia, where governments are promoting generic penetration, offers opportunities for growth. Additionally, TEVA's strategic focus on CNS, oncology, and respiratory treatments aligns with global healthcare trends, allowing for potential expansion in these therapeutic areas.

Threats

Macroeconomic and Geopolitical Instability: Fluctuating foreign exchange rates, inflation, and geopolitical tensions pose threats to TEVA's operations. The recent war in Israel, where TEVA's headquarters and several facilities are located, underscores the potential for disruptions to the company's production and R&D activities. While TEVA has implemented measures to mitigate these risks, the impact of such events on the global supply chain and financial results remains a concern.

Regulatory Challenges: TEVA, like all pharmaceutical companies, is subject to extensive regulation by the FDA, DEA, and other governmental bodies. Compliance with these regulations is critical for maintaining market access and avoiding penalties. Any changes in regulatory policies or noncompliance issues could lead to fines, recalls, or production suspensions, adversely affecting TEVA's business operations and reputation.

In conclusion, TEVA Pharmaceutical Industries Ltd (NYSE:TEVA) exhibits a strong foundation with its extensive generics portfolio and innovative medicine development. However, the company must navigate a competitive landscape, patent litigation risks, and macroeconomic uncertainties. Opportunities in biosimilars and market diversification present avenues for growth, while regulatory vigilance remains imperative. TEVA's strategic initiatives, such as the "Pivot to Growth" strategy, are crucial for leveraging its strengths and addressing potential threats, positioning the company for sustained success in the dynamic pharmaceutical industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.