Decoding Textron Inc (TXT): A Strategic SWOT Insight

Comprehensive SWOT analysis based on Textron Inc's latest SEC 10-K filing.

Financial overview reveals a 6% revenue increase and a 17% segment profit increase in 2023.

Backlog growth and strategic acquisitions position Textron Inc for future expansion.

Analysis includes detailed examination of Textron Inc's strengths, weaknesses, opportunities, and threats.

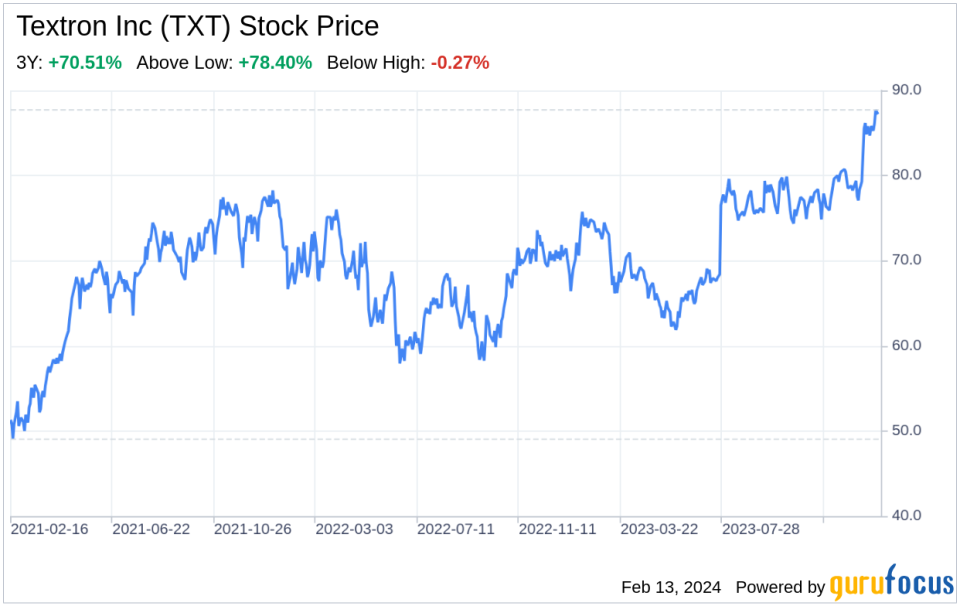

On February 12, 2024, Textron Inc (NYSE:TXT), a leading conglomerate in the design, manufacture, and service of specialty aircraft and related products, filed its annual 10-K report with the SEC. The filing provides a detailed overview of the company's financial performance and strategic direction. In 2023, Textron Inc reported a revenue increase of 6% to $13.7 billion, reflecting higher pricing and improved volume and mix, particularly in the Textron Aviation and Industrial segments. Segment profit saw an impressive 17% rise, largely due to higher pricing net of inflation. The company's backlog also grew by 5% to $13.9 billion, with a notable $782 million increase in the Textron Aviation segment. This financial overview sets the stage for a deeper SWOT analysis, providing investors with a clear picture of Textron Inc's market position and future prospects.

Strengths

Diverse Product Portfolio and Market Leadership: Textron Inc's diverse range of products across multiple segments, including Textron Aviation, Bell, Textron Systems, and Industrial, positions the company as a market leader in general aviation and defense. The company's aviation segment, with its renowned Cessna and Beechcraft aircraft, continues to dominate the business jet and turboprop market. The Bell segment's innovative helicopter and tilt-rotor offerings cater to both commercial and military needs, while Textron Systems' unmanned aircraft and armored vehicles are critical to military operations. The Industrial segment's Kautex business is a frontrunner in plastic fuel tank manufacturing for the automotive industry. This diversity not only mitigates market risks but also allows Textron Inc to leverage cross-segment capabilities for technological advancements and cost efficiencies.

Strong Aftermarket Services and Global Presence: Textron Inc's extensive aftermarket parts and services network, which includes commercial parts sales, maintenance, inspection, and repair services, ensures a steady revenue stream beyond initial product sales. The company's global reach, with service centers in over 35 countries and a network of independent distributors and dealers, enhances its ability to serve customers worldwide and maintain a competitive edge. The presence of 85 independent service centers and four global parts distribution centers exemplifies Textron Inc's commitment to customer service and positions it as a reliable partner for ongoing maintenance and support.

Weaknesses

Dependence on U.S. Government Contracts: Textron Inc's significant revenue reliance on U.S. Government contracts, which accounted for approximately 21% of its 2023 revenues, exposes the company to the volatility of defense spending and political shifts. Changes in government priorities, budget constraints, or shifts in military strategy could lead to funding delays or reductions, impacting Textron Inc's financial performance. The cyclical nature of defense contracts also introduces uncertainty in revenue projections and may necessitate a strategic pivot to mitigate potential downturns.

Supply Chain and Labor Shortages: The global supply chain disruptions and labor shortages experienced in 2023 have highlighted vulnerabilities in Textron Inc's operational efficiency. While the company has managed these challenges to deliver products to customers, continued shortages or delays could hinder production capacity, increase costs, and impact the timely fulfillment of orders. These weaknesses underscore the need for Textron Inc to strengthen its supply chain resilience and workforce management to maintain its competitive advantage.

Opportunities

Expansion into Electric Aviation: Textron Inc's eAviation segment, including the acquisition of Pipistrel, a manufacturer of light aircraft with electric and combustion engines, presents significant growth opportunities. As the aviation industry shifts towards sustainable solutions, Textron Inc's focus on developing electric and hybrid-electric aircraft for urban air mobility and general aviation positions it at the forefront of this emerging market. The company's investments in sustainable aviation technologies could lead to new product lines, partnerships, and market expansion, aligning with global environmental goals and consumer demand for greener transportation options.

Innovation in Defense and Aerospace Technologies: Textron Inc's ongoing research and development efforts in defense and aerospace technologies, such as unmanned systems and advanced marine craft, offer opportunities to capture new contracts and expand its customer base. The company's ability to innovate and integrate cutting-edge products and services for military, government, and commercial customers can drive future growth. By staying ahead of technological trends and customer requirements, Textron Inc can secure its position as a key player in the defense and aerospace industries.

Threats

Competitive Pressures and Technological Advancements: Textron Inc operates in highly competitive markets where rapid technological advancements can quickly alter the competitive landscape. The company must continuously invest in research and development to keep pace with competitors who may introduce new products and upgrades with features desired by customers. Failure to innovate or to meet market demands for advanced technologies could result in lost market share and reduced profitability.

Regulatory and Compliance Risks: Textron Inc's operations are subject to numerous laws and regulations, including environmental, health, safety, and government contracting requirements. Changes in regulations or the adoption of new ones could necessitate additional compliance measures, leading to increased costs and reduced profitability. Moreover, the company's role as a government contractor exposes it to audits, reviews, and potential legal proceedings, which could impact its reputation and financial position.

In conclusion, Textron Inc (NYSE:TXT) exhibits a robust market presence with its diverse product portfolio, strong aftermarket

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.