Decoding Union Pacific Corp (UNP): A Strategic SWOT Insight

Union Pacific Corp's expansive rail network and diversified business mix position it as a key player in North America's transportation sector.

Despite a slight decrease in earnings per share, the company's commitment to safety, service, and operational excellence drives its long-term growth strategy.

Environmental stewardship and sustainable practices are central to Union Pacific's operations, aligning with global efforts to reduce greenhouse gas emissions.

Competition from other railroads and transportation modes presents ongoing challenges for Union Pacific Corp.

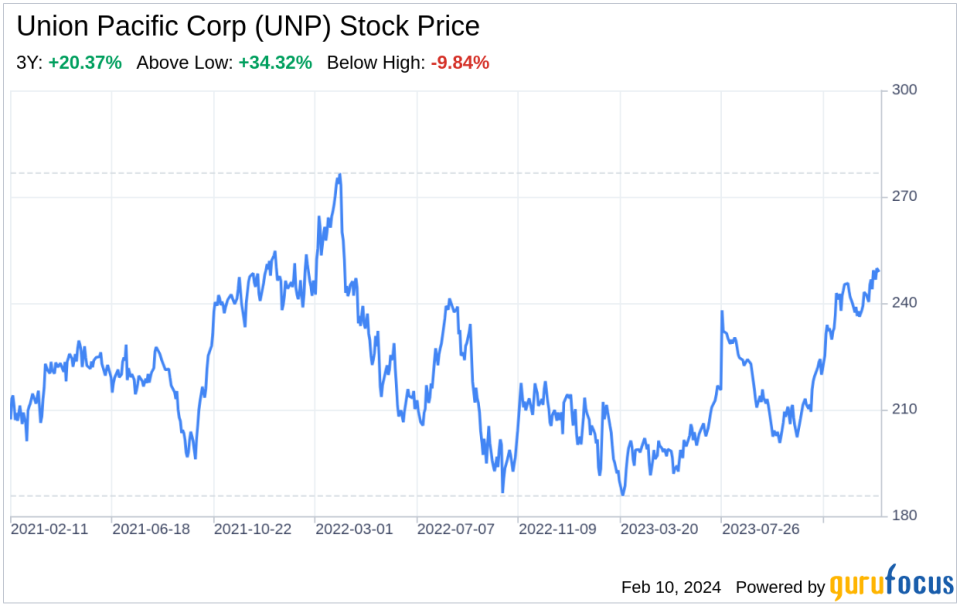

On February 9, 2024, Union Pacific Corp (NYSE:UNP), the largest public railroad in North America, filed its annual 10-K report with the SEC. The Omaha, Nebraska-based company, operating over 30,000 miles of track in the western two-thirds of the U.S., reported $24 billion in revenue for the fiscal year ended December 31, 2023. Despite facing soft consumer markets, inflationary pressures, and new labor agreements, Union Pacific Corp invested $3.7 billion back into its network, demonstrating a commitment to growth and service excellence. With a slight 7% decrease in earnings per diluted share compared to the previous year and a 220 basis point increase in operating ratio, the company navigates a challenging economic landscape while maintaining a strategic focus on safety, service, and operational excellence.

Strengths

Extensive Rail Network and Diversified Business Mix: Union Pacific Corp's vast rail network connects 23 states and serves as a critical link in the global supply chain. With a business mix that includes bulk, industrial, and premium shipments, the company generated 33% of its freight revenues from bulk, 36% from industrial, and 31% from premium shipments in 2023. This diversification allows Union Pacific to tap into various market segments and mitigate the risks associated with demand fluctuations in any single sector.

Commitment to Safety and Operational Excellence: Safety is a cornerstone of Union Pacific's operations, with a culture focused on ensuring that all employees return home safely each day. The company's operational excellence is reflected in its efficient and productive operations, which are designed to be resilient against the inevitable ups and downs of the industry. This focus on safety and operational efficiency not only protects employees but also enhances service reliability for customers.

Strategic Investments in Infrastructure: Union Pacific's significant investment of $3.7 billion in its network infrastructure underscores its commitment to maintaining a robust and reliable service. These investments are critical for supporting the company's service product and facilitating growth, ensuring that Union Pacific remains competitive in the transportation industry.

Weaknesses

Financial Performance Pressures: The company's financial performance in 2023, marked by a decrease in earnings per share and an increase in the operating ratio, reflects the challenges posed by soft consumer markets, inflationary pressures, and new labor agreements. These factors have impacted Union Pacific's profitability and may continue to exert pressure on the company's financial health if not effectively managed.

Workforce and Labor Relations: With approximately 85% of Union Pacific's workforce represented by unions, labor relations are a critical aspect of the company's operations. The upcoming round of negotiations beginning in 2025 poses a potential risk for labor disputes or disruptions, which could affect operational efficiency and service levels.

Dependence on Key Suppliers: Union Pacific's reliance on certain key suppliers for locomotives and rail materials presents a vulnerability. Any disruption in the supply chain or changes in supplier relationships could impact the company's ability to maintain and expand its rail infrastructure, potentially affecting service quality and growth prospects.

Opportunities

Environmental Leadership and Sustainability: As a transportation mode that is inherently more fuel-efficient than trucks, Union Pacific has the opportunity to lead in environmental stewardship and sustainability. The company's efforts to reduce greenhouse gas emissions align with global climate change mitigation strategies, offering a competitive advantage as customers increasingly seek eco-friendly transportation solutions.

Market Expansion and Service Diversification: Union Pacific's strategic focus on safety, service, and operational excellence positions it for growth in both existing and new markets. By leveraging its extensive rail network and diversified service offerings, the company can capture additional market share and expand its customer base.

Technological Advancements: Investment in technology and innovation can enhance Union Pacific's operational efficiency and service quality. The adoption of advanced analytics, automation, and other digital tools can lead to improved decision-making, reduced costs, and enhanced customer experiences.

Threats

Intense Competition: Union Pacific faces stiff competition from other railroads, particularly Burlington Northern Santa Fe LLC (BNSF), as well as from alternative transportation modes such as motor carriers, ships, barges, and pipelines. This competition challenges Union Pacific to continuously improve its service offerings and maintain cost competitiveness.

Regulatory and Environmental Compliance: The company operates under stringent federal and state environmental regulations. Compliance with these regulations requires significant investment and can impact operational flexibility. Any changes in environmental laws or increased regulatory scrutiny could result in additional costs or operational constraints for Union Pacific.

Economic and Industry Risks: Macroeconomic factors such as consumer demand, commodity prices, and trade policies can significantly affect Union Pacific's business. Additionally, industry consolidation or legislative changes could alter the competitive landscape, posing risks to the company's market position and profitability.

In conclusion, Union Pacific Corp (NYSE:UNP) stands as a formidable entity in the transportation sector, bolstered by its extensive rail network, diversified business mix, and strategic focus on safety and operational excellence. However, financial pressures, workforce dynamics,

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.