Decoding UnitedHealth Group Inc (UNH): A Strategic SWOT Insight

UnitedHealth Group Inc (NYSE:UNH) showcases robust financial performance with significant market capitalization.

Optum and UnitedHealthcare segments drive diversified revenue streams, reinforcing the company's market position.

Strategic investments in healthcare services and technology position UNH for future growth.

Regulatory challenges and competitive pressures remain key threats to UNH's operational landscape.

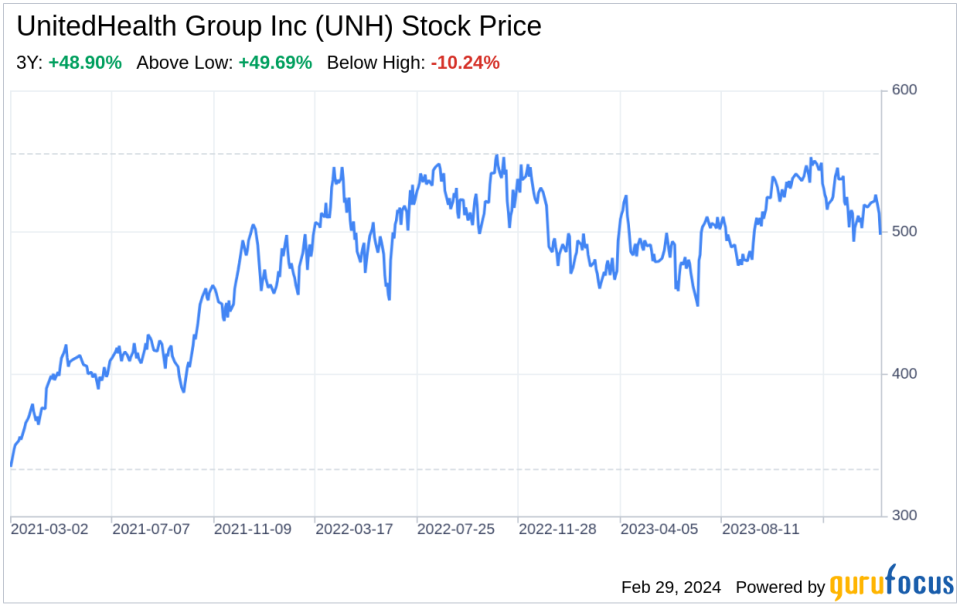

On February 28, 2024, UnitedHealth Group Inc (NYSE:UNH), a leading entity in the healthcare and well-being sector, filed its annual 10-K report, revealing a comprehensive overview of its financial and operational performance. As a health care and well-being company with a mission to help people live healthier lives, UnitedHealth Group operates through two distinct yet complementary businesses: Optum and UnitedHealthcare. These segments work synergistically to improve access, affordability, outcomes, and experiences within the health system. With a significant market capitalization of $444.6 billion as of mid-2023, UnitedHealth Group serves approximately 53 million members globally, demonstrating its expansive reach and influence in the healthcare industry. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the latest SEC filing, providing investors with a nuanced understanding of the company's strategic positioning and potential future trajectory.

Strengths

Financial Robustness and Market Leadership: UnitedHealth Group Inc (NYSE:UNH) has cemented its position as a market leader in the healthcare insurance sector, with a substantial market capitalization reflecting investor confidence and a strong financial foundation. The company's diversified revenue streams, driven by its UnitedHealthcare and Optum segments, contribute to a stable financial outlook. This financial strength enables strategic investments in healthcare services and technology, further solidifying UNH's competitive edge.

Innovative Healthcare Solutions: Innovation is at the core of UNH's strengths, with the company's continued investments in Optum franchises creating a healthcare services colossus. This spans medical and pharmaceutical benefits, outpatient care, and analytics, serving both affiliated and third-party customers. The integration of advanced analytics and technology in healthcare delivery positions UNH as a forward-thinking leader in the industry.

Weaknesses

Regulatory Compliance and Litigation Risks: UnitedHealth Group Inc (NYSE:UNH) operates in a highly regulated industry, which necessitates stringent compliance with healthcare laws and regulations. The complexity of these regulations poses a challenge, with potential for increased liability and litigation risks. These factors could impact the company's financials and reputation if not managed effectively.

Dependency on Government Healthcare Programs: A significant portion of UNH's revenue is derived from government healthcare programs such as Medicare and Medicaid. Changes in government funding or policy can directly affect the company's profitability and growth prospects. This dependency on government programs exposes UNH to political and fiscal uncertainties that could disrupt its operations.

Opportunities

Expansion into Global Markets: UnitedHealth Group Inc (NYSE:UNH) has the opportunity to further expand its international presence, leveraging its expertise in managed care and healthcare services. With a footprint in over 5 million members outside the U.S., UNH can capitalize on emerging markets to drive growth and diversify its revenue base.

Technological Advancements and Data Analytics: The company's ability to analyze complex data and apply deep healthcare insights presents significant opportunities for growth. By harnessing technological advancements and data analytics, UNH can enhance patient outcomes, streamline operations, and develop innovative healthcare solutions that meet evolving consumer needs.

Threats

Competitive Pressures: The healthcare industry is characterized by intense competition, with numerous players vying for market share. UnitedHealth Group Inc (NYSE:UNH) faces the challenge of maintaining its leadership position amid rising competition from both traditional health insurers and new entrants leveraging technology to disrupt the industry.

Healthcare Reform and Policy Changes: Legislative and policy changes, particularly those related to healthcare reform, pose a threat to UNH's business model. The uncertainty surrounding healthcare policies can lead to market volatility and necessitate adjustments in the company's strategy to comply with new regulations.

In conclusion, UnitedHealth Group Inc (NYSE:UNH) exhibits a strong financial foundation and market leadership, bolstered by its innovative healthcare solutions and strategic investments. However, the company must navigate regulatory complexities and dependence on government programs, which could pose risks to its operational stability. Opportunities for global expansion and technological innovation present pathways for growth, while competitive pressures and healthcare reform remain significant threats. As UNH continues to adapt to the dynamic healthcare landscape, its strategic focus on improving access, affordability, and outcomes will be crucial in maintaining its competitive advantage and driving long-term success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.